What is a General Ledger?

A general ledger is the central hub of a company’s financial records, containing a detailed account of all financial transactions. It serves as a comprehensive database that consolidates all financial activities, including sales, purchases, expenses, and revenues.

The general ledger is structured in a way that each account represents a different financial aspect of the business, such as assets, liabilities, equity, income, and expenses. By recording and organizing all transactions, the general ledger provides a clear overview of the company’s financial health and performance.

Why is the General Ledger Important?

The general ledger is a critical component of financial management for several reasons.

Financial Health Assessment

One of the key reasons why the general ledger is important is its role in evaluating the financial health of a business. By maintaining a detailed record of all financial transactions, the general ledger provides insights into the company’s financial performance, liquidity, and solvency. It allows businesses to track their revenues, expenses, assets, and liabilities, facilitating a comprehensive assessment of their financial position. This information is crucial for identifying areas of strength and weakness and making strategic financial decisions.

Support for Decision-Making

Another reason why the general ledger is important is its role in supporting decision-making. The data recorded in the general ledger serves as a valuable resource for management to analyze financial trends, identify opportunities for cost savings or revenue growth, and assess the impact of business decisions on the company’s financial performance. By having access to accurate and timely financial information, decision-makers can make informed choices that align with the company’s goals and objectives, ultimately leading to improved financial outcomes.

Ensuring Legal Compliance

Legal compliance is a critical aspect of financial management, and the general ledger plays a key role in ensuring that businesses meet regulatory requirements. Maintaining accurate and transparent financial records is essential for demonstrating compliance with accounting standards, tax regulations, and other legal obligations. The general ledger provides a detailed account of all financial transactions, making it easier for businesses to prepare financial reports, file taxes, and respond to audit inquiries. By keeping a well-documented and up-to-date general ledger, businesses can avoid legal issues and penalties associated with non-compliance.

Key Elements of a General Ledger

The general ledger consists of several key elements that are essential for effective financial management. Understanding these elements is crucial for maintaining accurate and reliable financial records. Here are some key elements of a general ledger:

Chart of Accounts

The chart of accounts is a fundamental component of the general ledger, as it defines the categories used to classify financial transactions. Each account in the chart of accounts represents a specific financial aspect of the business, such as assets, liabilities, equity, revenue, and expenses. By organizing financial data into different accounts, businesses can track and analyze their financial activities more effectively.

Journal Entries

Journal entries are the individual transactions recorded in the general ledger. Each journal entry contains details such as the date of the transaction, the account name, a description of the transaction, and the amount involved. Journal entries provide a chronological record of all financial activities, allowing businesses to track the flow of money and resources within the organization.

Account Balances

Each account in the general ledger has a balance that reflects the total amount of transactions recorded in that account. Account balances are essential for monitoring the financial status of the business and preparing financial statements. By regularly reconciling account balances and reviewing transaction details, businesses can ensure the accuracy and reliability of their financial records.

Adjusting Entries

Adjusting entries are made at the end of an accounting period to update account balances and ensure the accuracy of financial reports. These entries are necessary to reflect changes in account balances due to accruals, deferrals, depreciation, or other adjustments. Adjusting entries help businesses align their financial records with the actual financial activities that occurred during the accounting period.

How to Maintain a General Ledger

Maintaining a general ledger requires attention to detail, consistency, and adherence to accounting standards. Effective general ledger maintenance involves several steps that ensure the accuracy and reliability of financial records. Here are some key practices for maintaining a general ledger:

Record Transactions Accurately

Accurate recording of financial transactions is essential for maintaining a reliable general ledger. Each transaction should be recorded promptly, with the correct account codes, descriptions, and amounts. Accuracy in recording transactions ensures that the general ledger reflects the true financial position of the business and facilitates the preparation of accurate financial statements.

Reconcile Accounts Regularly

Regular reconciliation of accounts is crucial for ensuring the accuracy of the general ledger. Reconciliation involves comparing the balances in the general ledger to the actual financial transactions recorded in supporting documents, such as bank statements, invoices, and receipts. Any discrepancies should be investigated and corrected promptly to maintain data integrity.

Review and Analyze Financial Data

Regular review and analysis of financial data in the general ledger helps businesses identify trends, patterns, and anomalies in their financial performance. By analyzing key performance indicators, variances, and ratios, businesses can gain valuable insights into their financial health and make informed decisions. Reviewing financial data also enables businesses to detect errors or irregularities and take corrective action as needed.

Generate Financial Statements

The information recorded in the general ledger is used to prepare key financial statements, such as the balance sheet, income statement, and cash flow statement. These financial statements provide a snapshot of the company’s financial position, performance, and cash flow. By generating financial statements regularly, businesses can assess their financial health, track progress toward goals, and communicate financial information to stakeholders.

Tips for Successful General Ledger Management

Effective management of the general ledger is essential for maintaining accurate financial records and supporting sound financial decision-making. Here are some tips for successful general ledger management:

Use Accounting Software

Utilizing accounting software can streamline the process of recording and tracking financial transactions in the general ledger. Accounting software automates data entry, reduces manual errors, and provides real-time access to financial information. By leveraging accounting software, businesses can improve efficiency, accuracy, and compliance in general ledger management.

Train Staff

Providing training to staff members responsible for maintaining the general ledger is crucial for ensuring consistency and accuracy in recording transactions. Training should cover accounting principles, system usage, data entry procedures, and reconciliation processes. Well-trained staff are better equipped to handle complex transactions, identify errors, and maintain data integrity in the general ledger.

Regular Audits

Conducting regular audits of the general ledger helps businesses identify discrepancies, errors, and inefficiencies in their financial records. Audits involve reviewing transaction details, account balances, and supporting documentation to ensure compliance with accounting standards and regulatory requirements. By auditing the general ledger periodically, businesses can detect and rectify issues before they escalate into larger problems.

Document Procedures

Documenting procedures for maintaining the general ledger is essential for promoting consistency and standardization in recording financial transactions. Standard operating procedures should outline the steps for recording transactions, reconciling accounts, generating reports, and resolving discrepancies. By documenting procedures, businesses can ensure that all staff members follow best practices and adhere to accounting guidelines.

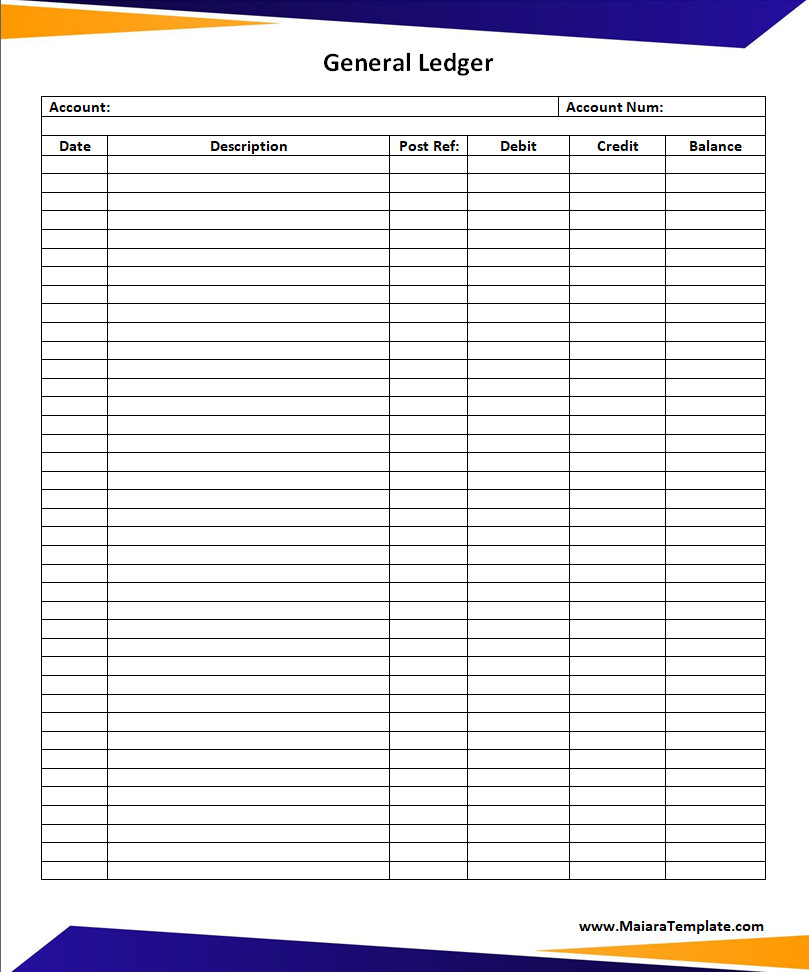

Free General Ledger Template

A general ledger is an essential accounting tool used to record and organize all financial transactions in one place. It helps track income, expenses, assets, and liabilities, giving you a clear overview of your business’s financial health. Ideal for businesses of all sizes, this template simplifies bookkeeping and ensures accurate financial reporting.

Download and use our general ledger template today to manage your finances efficiently, maintain accurate records, and make informed financial decisions.

General Ledger Template – DOWNLOAD

- Free Notary Acknowledgement Form Template - February 27, 2026

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026