What is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement, is a financial document that provides a snapshot of a company’s financial performance over a specific period. It is a crucial tool for assessing how effectively a business generates revenue and manages expenses.

The primary purpose of a profit and loss statement is to show whether a company is making a profit or incurring a loss. By analyzing this statement, business owners and stakeholders can gain valuable insights into the company’s financial health and make informed decisions for the future.

Why are Profit and Loss Statements Important?

Profit and loss statements are essential for several reasons, including:

– Financial Health: Profit and loss statements provide a clear picture of a company’s financial health by showing whether it is making a profit or experiencing a loss.

– Decision-Making: By analyzing profit and loss statements, business owners can identify areas of strength and weakness in their operations and make informed decisions to improve profitability.

– Accountability: Profit and loss statements hold businesses accountable for their financial performance and provide stakeholders with an overview of the company’s success and viability.

– Planning and Forecasting: These statements are crucial for creating budgets, setting financial goals, and forecasting future performance based on past trends and data.

– Investor Confidence: Investors and lenders often rely on profit and loss statements to assess a company’s financial stability and make informed decisions about providing funding.

– Tax Reporting: Profit and loss statements are essential for accurately reporting income and expenses to tax authorities, ensuring compliance with financial regulations and tax laws.

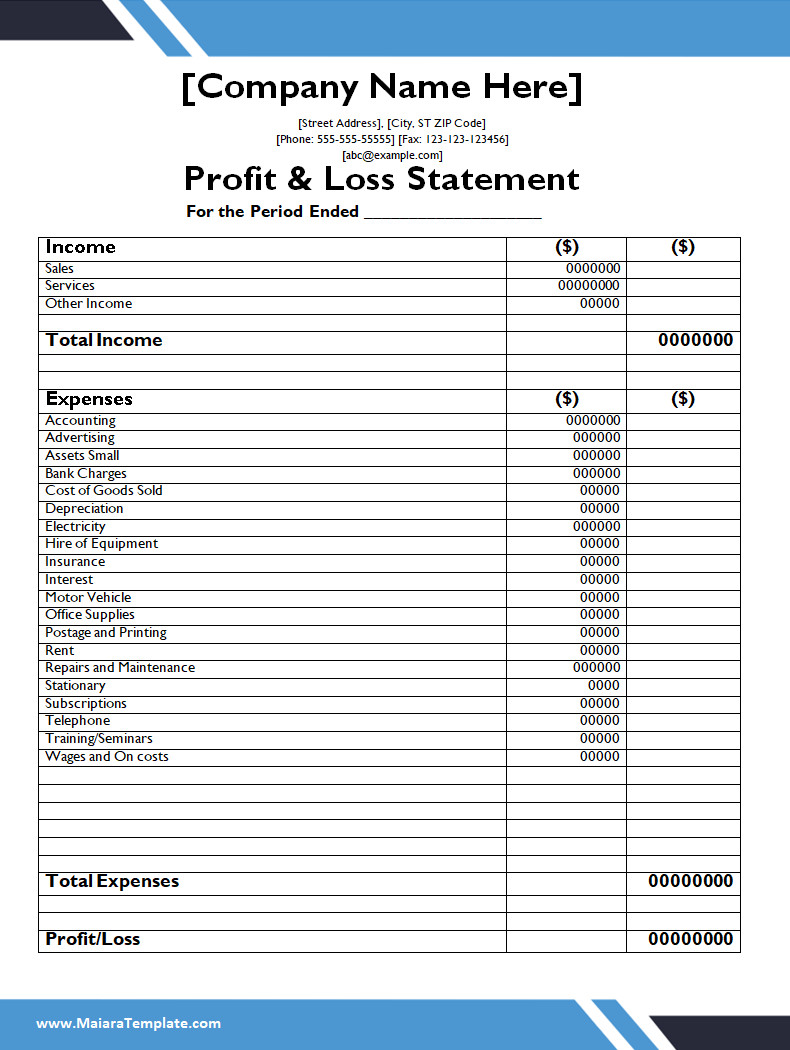

What to Include in a Profit and Loss Statement?

When preparing a profit and loss statement, it is important to include the following components:

– Revenue: Total sales or income generated by the business, including sales of products or services.

– Cost of Goods Sold (COGS): Direct expenses related to producing goods or services, such as materials, labor, and overhead costs.

– Gross Profit: Revenue minus COGS, representing the profit made from selling goods or services before deducting operating expenses.

– Operating Expenses: Costs incurred in the day-to-day operations of the business, including rent, utilities, salaries, marketing expenses, and other overhead costs.

– Net Profit (or Loss): The final result after subtracting all expenses from revenue, indicating the overall profitability or loss of the company.

Including these components in a profit and loss statement provides a comprehensive overview of a company’s financial performance and helps in making informed decisions for the future.

How to Prepare a Profit and Loss Statement

Preparing a profit and loss statement involves several steps to ensure accuracy and completeness. Here is a detailed guide on how to prepare a profit and loss statement for your business:

1. Gather Financial Data: Start by collecting all relevant financial data for the period you are analyzing. This includes sales records, expense receipts, invoices, and other financial documents.

2. Calculate Revenue: Total all sources of revenue, including sales of products or services, interest income, and other sources of income earned by the business.

3. Determine COGS: Calculate the direct costs associated with producing goods or services sold during the period. This includes costs such as raw materials, labor, and other production-related expenses.

4. Calculate Gross Profit: Subtract COGS from total revenue to determine the gross profit. This figure represents the profit made from selling goods or services before deducting operating expenses.

5. Identify Operating Expenses: List all operating expenses incurred during the period, including rent, utilities, salaries, marketing costs, and other overhead expenses.

6. Calculate Net Profit: Subtract total operating expenses from gross profit to calculate the net profit or loss for the period. This figure indicates the overall profitability of the business after all expenses have been accounted for.

7. Review and Analyze: Once you have prepared the profit and loss statement, review the final figures carefully. Analyze the results to identify trends, areas for improvement, and opportunities for growth in your business.

By following these steps and ensuring accuracy in your calculations, you can prepare a comprehensive profit and loss statement that provides valuable insights into your company’s financial performance.

Tips for Optimizing Your Profit and Loss Statement

To make the most of your profit and loss statement and leverage it as a strategic tool for your business, consider the following tips:

– Regular Review: Review your profit and loss statement regularly, whether monthly, quarterly, or annually, to track your financial progress and identify any emerging trends or issues that need attention.

– Comparison: Compare your current profit and loss statement with previous periods to identify trends and deviations in your financial performance. This can help you identify areas where you have improved or where you may need to make adjustments.

– Accuracy: Ensure all numbers in your profit and loss statement are accurate and up-to-date. Inaccurate data can lead to incorrect conclusions and decisions, so it is crucial to double-check your calculations and data entry.

– Expense Management: Monitor and control your operating expenses to improve profitability and maximize your net profit. Look for opportunities to reduce costs without sacrificing the quality of your products or services.

– Seek Professional Help: If you are unsure about preparing a profit and loss statement or interpreting the results, consider seeking the assistance of a financial professional. An accountant or financial advisor can help you ensure accuracy and compliance with financial regulations.

By implementing these tips and best practices, you can optimize your profit and loss statement to effectively track your financial performance, make informed decisions, and drive the success of your business.

Basic Profit And Loss Statement Template – WORD

- Home Purchase Agreement Template - January 28, 2026

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026