When managing your finances, maintaining a good credit score is crucial for your financial well-being. Your credit score plays a significant role in determining your ability to secure loans, credit cards, and even rent an apartment.

However, life is unpredictable, and unexpected challenges can sometimes lead to late payments or other negative items on your credit report. In such situations, a letter of goodwill can be a powerful tool to request the removal of a negative item from your credit report.

What is a Letter of Goodwill?

A letter of goodwill is a formal communication sent to a creditor with the intention of requesting the removal of a negative item, such as a late payment, from your credit report.

The primary goal of a goodwill letter is to appeal to the creditor’s sense of understanding and empathy, seeking their willingness to overlook a past mistake and improve your credit standing as a gesture of goodwill.

Why Do You Need a Goodwill Letter?

There are various reasons why you may need to consider sending a goodwill letter to a creditor:

One-Time Mistake

If you have a history of responsible financial behavior but made a one-time mistake that resulted in a negative item on your credit report, a goodwill letter can help rectify the situation. By acknowledging the error and seeking forgiveness, you show creditors that you are committed to maintaining a positive credit history.

Financial Hardship

In cases where a late payment or other negative item was the result of financial hardship, explaining your circumstances in a goodwill letter can make a compelling case for removal. By demonstrating the impact of the hardship on your ability to make timely payments, you appeal to the creditor’s sense of understanding.

Strong Relationship with Creditor

If you have a long-standing relationship with the creditor and a history of on-time payments, highlighting this in your goodwill letter can work in your favor. Emphasizing your positive payment history and loyalty to the creditor can demonstrate your commitment to responsible financial behavior.

Opportunity for Redemption

A goodwill letter provides an opportunity for redemption and a fresh start in your financial journey. By taking responsibility for past mistakes, offering a sincere apology, and requesting the removal of a negative item, you show creditors that you are willing to learn from errors and improve your credit standing.

When Do You Need This Letter?

A letter of goodwill can be beneficial in various scenarios, including:

Isolated Incident

If the negative item on your credit report was an isolated incident among an otherwise positive payment history, a goodwill letter can help convey that the mistake was not reflective of your overall financial behavior. By addressing the issue proactively, you demonstrate your commitment to maintaining a positive credit profile.

Extenuating Circumstances

In situations where a late payment or other negative item was the result of extenuating circumstances, such as a medical emergency or job loss, explaining these circumstances in a goodwill letter can provide context for the creditor. By illustrating the factors that led to the financial difficulty, you seek understanding and empathy from the creditor.

Desire for Credit Improvement

If you are focused on improving your credit standing and wish to remove negative items that may be hindering your progress, a goodwill letter can be a proactive step towards achieving your financial goals. By taking the initiative to address past mistakes, you show creditors that you are dedicated to enhancing your creditworthiness.

Potential for Financial Opportunities

Removing negative items from your credit report through a goodwill letter can open up a range of financial opportunities. A cleaner credit report can lead to better terms on loans, credit cards, and other financial products, ultimately saving you money in the long run. By improving your credit standing, you position yourself for greater financial success.

Pros And Cons of a Goodwill Letter

Like any financial strategy, sending a goodwill letter to a creditor has its advantages and disadvantages:

Pros

- Improves Credit Score: Removing a negative item from your credit report can positively impact your credit score, making you more attractive to lenders.

- Demonstrates Responsibility: Sending a goodwill letter shows creditors that you are willing to take responsibility for past mistakes and make amends, which can enhance your reputation as a borrower.

- Potential for Forgiveness: Creditors may be willing to overlook a one-time error or extenuating circumstances if presented with a compelling goodwill letter, giving you a chance for redemption.

- Opens Financial Opportunities: A cleaner credit report can lead to better terms on loans and credit cards, providing you with more favorable financial opportunities.

Cons

- No Guarantee of Success: Creditors are not obligated to remove negative items from your credit report, and there is no guarantee that a goodwill letter will be successful in every case.

- Time and Effort Required: Crafting a compelling goodwill letter takes time and effort, as you must carefully explain the circumstances of the negative item and make a persuasive case for its removal.

- Emotional Labor: Writing a goodwill letter can be emotionally challenging, as you must acknowledge your mistake, offer a sincere apology, and request forgiveness from the creditor.

- Potential Impact on Credit Score: In some cases, attempting to remove a negative item through a goodwill letter may not have a significant impact on your credit score, especially if there are multiple negative items present.

What To Include In a Letter of Goodwill?

When composing a goodwill letter, it is essential to include specific elements to maximize its effectiveness:

Clear Explanation

Begin your letter by clearly explaining the circumstances that led to the negative item on your credit report. Whether it was a one-time mistake, financial hardship, or extenuating circumstances, provide context for the creditor to understand the situation.

Genuine Apology

Offer a sincere apology for the late payment or mistake that resulted in the negative item on your credit report. Express remorse for the error and take full responsibility for the oversight, demonstrating your commitment to rectifying the situation.

Request for Removal

Promptly request the removal of the negative item from your credit report as a gesture of goodwill. Clearly state your desire for a clean credit history and explain how the removal of the negative item can benefit both you and the creditor.

Positive Payment History

If you have a history of on-time payments with the creditor, emphasize this positive payment history in your letter. Highlighting your reliability as a borrower can strengthen your case for the removal of the negative item and demonstrate your creditworthiness.

Commitment to Financial Responsibility

Express your commitment to maintaining a positive credit history and practicing responsible financial behavior in the future. Assure the creditor that the negative item was an exception to your typical payment behavior and that you are dedicated to improving your credit standing.

How to Write a Goodwill Letter for a Late Payment

Composing a goodwill letter for a late payment requires careful attention to detail and a strategic approach. Here are some tips to help you craft an effective letter:

Review Your Credit Report

Before drafting your goodwill letter, thoroughly review your credit report to identify the specific negative item you wish to address. Understanding the details of the late payment, including the date it occurred and the creditor involved, will help you provide accurate information in your letter.

Personalize Your Letter

Address your goodwill letter to the specific individual or department at the creditor’s office responsible for handling credit disputes. By personalizing the letter and addressing it to the appropriate party, you demonstrate professionalism and attention to detail.

Explain the Situation

In your letter, clearly explain the circumstances surrounding the late payment that led to the negative item on your credit report. Whether it was a temporary financial setback, a misunderstanding, or an oversight, provide a concise but detailed explanation to give context to the creditor.

Apologize Sincerely

Show genuine remorse for the late payment in your goodwill letter. Offer a heartfelt apology for the oversight and take full responsibility for the mistake without making excuses. A sincere apology can convey your commitment to rectifying the situation and improving your credit standing.

Request Removal of Negative Item

Promptly request the removal of the negative item from your credit report politely and respectfully. Clearly state that you are seeking this action as a gesture of goodwill and to improve your credit history. Express your desire for a clean credit report moving forward.

Highlight Your Positive History

If you have a history of on-time payments and responsible financial behavior with the creditor, emphasize this positive track record in your goodwill letter. Pointing out your consistent payment history can reinforce your credibility as a reliable borrower and strengthen your case for the removal of the negative item.

Follow Up

After sending your goodwill letter, follow up with the creditor if you do not receive a response within a reasonable timeframe. Following up demonstrates your commitment to resolving the issue and can prompt the creditor to review your request. Be persistent yet professional in your communication to ensure your letter is given proper consideration.

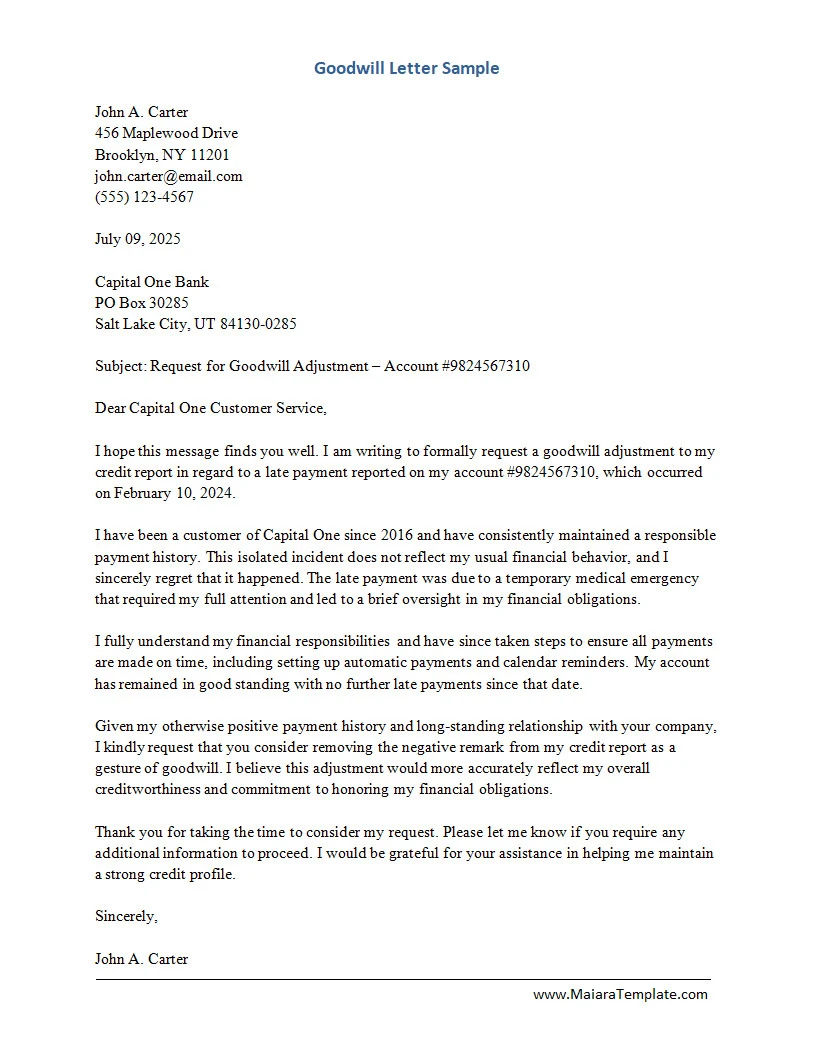

Letter of Goodwill Template

A Letter of Goodwill is a powerful way to request leniency, show sincerity, and maintain a positive relationship with a creditor or institution. It helps explain circumstances clearly while demonstrating responsibility and commitment to resolving past issues. A well-written letter can make a significant difference in repairing your credit or restoring goodwill.

Download the Letter of Goodwill Template today to create a clear, professional request that helps you move forward with confidence.

Letter of Goodwill Template – DOWNLOAD

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026