What is a Financial Budget?

A financial budget is a detailed plan that outlines an individual’s or a business’s income and expenses over a specific period. It serves as a tool for managing finances, enabling individuals and businesses to make informed decisions about their money.

By creating a budget, you can track your spending, identify areas of overspending, save money for future needs, manage debt effectively, and improve your overall financial well-being.

Why is Creating a Financial Budget Important?

Creating a financial budget is essential for several reasons:

- Providing Financial Control. A budget allows you to take control of your finances by tracking where your money is going.

- Guiding Resource Allocation. By setting priorities in your budget, you can allocate resources to meet your most important needs and goals.

- Helping Achieve Goals. A budget helps you stay on track with your financial goals by ensuring you have the funds to reach them.

- Tracking Income vs. Expenses. With a budget, you can monitor your income and expenses to ensure you are living within your means.

- Identifying Overspending. Budgeting helps you identify areas where you may be overspending and make necessary adjustments.

- Enabling Savings. By including savings in your budget, you can set aside money for emergencies, retirement, or other future needs.

- Managing Debt. A budget allows you to manage your debt by allocating funds towards paying off loans and credit card balances.

- Improving Future Financial Decisions. With a budget, you can make informed financial decisions that will benefit your future financial stability.

What to Include in a Financial Budget?

When creating a financial budget, it’s important to include the following elements:

Income

Income is the foundation of any budget and includes all sources of earnings, such as wages, salary, bonuses, commissions, and investments. When creating a budget, it’s essential to accurately calculate your total income to determine how much money you have available for expenses, savings, and debt repayments.

Expenses

Expenses encompass all the costs that you incur regularly, including fixed expenses like rent or mortgage payments, utilities, insurance premiums, and loan repayments. Variable expenses such as groceries, transportation, entertainment, and clothing should also be included in your budget to provide a comprehensive overview of your spending habits.

Savings

Savings are a critical component of a financial budget as they enable you to set aside money for future needs, emergencies, or long-term goals. When budgeting for savings, it’s important to allocate a specific percentage of your income towards savings each month to ensure that you are building a financial cushion for the future.

Debt Payments

Debt payments refer to any outstanding loans, credit card balances, or other financial obligations that require regular repayment. Including debt payments in your budget ensures that you allocate funds towards reducing your debt burden and avoiding excessive interest charges. By prioritizing debt payments in your budget, you can work towards becoming debt-free over time.

Financial Goals

Setting financial goals is an integral part of creating a budget, as it gives you a sense of purpose and direction in your financial planning. Whether your goals include saving for a down payment on a house, starting a business, or retiring comfortably, incorporating them into your budget allows you to allocate funds towards achieving these objectives systematically.

How to Create a Financial Budget

Follow these steps to create an effective financial budget:

1. Calculate Your Income

Start by calculating your total monthly income from all sources, including wages, salary, bonuses, investments, or any other earnings. Having a clear understanding of your income is essential for determining how much money you have available for expenses, savings, and debt repayments.

2. List Your Expenses

Next, list all your monthly expenses, categorizing them into fixed expenses (such as rent, utilities, and insurance) and variable expenses (such as groceries, transportation, and entertainment). Be thorough in documenting your expenses to ensure that you capture all your spending habits accurately.

3. Set Savings Goals

Determine how much you want to save each month and establish specific savings goals that align with your financial objectives. Whether you are saving for emergencies, retirement, or a major purchase, setting aside funds for savings in your budget is crucial for building financial security.

4. Allocate Funds for Debt Payments

If you have outstanding debt, allocate a portion of your budget towards debt payments to reduce your debt burden systematically. Prioritize paying off high-interest debts first to minimize interest charges and accelerate your journey towards becoming debt-free.

5. Monitor and Adjust

Regularly monitor your budget to track your spending, savings progress, and debt repayment efforts. Make adjustments as needed to stay on track with your financial goals and address any unexpected changes in your income or expenses. By staying proactive and flexible with your budget, you can ensure its effectiveness in helping you achieve financial success.

Tips for Successful Financial Budgeting

Follow these tips to ensure successful budgeting:

Track Your Spending

Keep a detailed record of all your expenses to understand where your money is going and identify areas where you can cut back or make adjustments. Use budgeting tools or apps to streamline the tracking process and gain insights into your spending habits.

Be Realistic

Set achievable financial goals and budget realistically based on your income and expenses. Avoid setting overly ambitious targets that may be difficult to sustain in the long run. By being realistic with your budgeting approach, you increase the likelihood of sticking to your financial plan.

Review Regularly

Regularly review your budget to assess your progress towards your financial goals and make any necessary adjustments. Revisiting your budget on a monthly or quarterly basis allows you to stay accountable, identify areas for improvement, and celebrate milestones achieved along the way.

Avoid Impulse Spending

Avoid impulse spending by sticking to your budget and refraining from making unplanned purchases. Before making a non-essential purchase, consider whether it aligns with your financial goals and priorities. Implement strategies such as creating a shopping list, waiting 24 hours before making a purchase, or setting spending limits to curb impulse buying.

Seek Professional Help

Consider seeking the guidance of a financial advisor or planner to help you create and manage your budget effectively. A financial professional can provide personalized advice, recommend strategies for optimizing your budget, and offer insights on investment opportunities or debt management. Working with an expert can enhance your financial literacy and empower you to make informed decisions about your money.

Involve Family Members

If you have a family or share financial responsibilities with a partner, involve them in the budgeting process. Collaborating on budgeting decisions fosters transparency, accountability, and shared financial goals within the household. Encourage open communication about money matters, set joint priorities, and work together towards achieving financial stability as a family unit.

Automate Your Finances

Simplify the budgeting process by automating your finances where possible. Set up automatic transfers for savings, bill payments, and debt repayments to ensure that your financial obligations are met on time. Automating your finances minimizes the risk of missing payments, reduces the temptation to overspend, and streamlines your budget management for greater efficiency.

Practice Flexibility

While it’s important to adhere to your budget, allow for some flexibility to accommodate unexpected expenses or changes in your financial circumstances. Be prepared to adjust your budget as needed in response to unforeseen events, such as medical emergencies, job loss, or fluctuating income. Flexibility in budgeting allows you to adapt to changing situations without derailing your overall financial plan.

Celebrate Milestones

Recognize and celebrate the milestones you achieve through budgeting, such as reaching a savings goal, paying off a debt, or sticking to your budget for a consecutive period. Celebrating these accomplishments reinforces positive financial behaviors, boosts motivation, and encourages continued progress towards your financial objectives. Reward yourself for your financial discipline while staying focused on long-term financial success.

Invest in Financial Education

Invest in your financial education by increasing your knowledge of personal finance, budgeting strategies, investment options, and money management techniques. Attend workshops, read books, listen to podcasts, or enroll in online courses to enhance your financial literacy and empower yourself to make informed financial decisions. The more you understand about money and finances, the better equipped you’ll be to navigate complex financial situations and achieve your goals.

Stay Committed

Above all, stay committed to your budgeting journey and remain dedicated to your financial goals. Budgeting is a long-term process that requires consistency, discipline, and perseverance. Embrace the mindset of financial stewardship, prioritize your financial well-being, and stay focused on the positive impact that effective budgeting can have on your life and future financial security.

Cultivate a Growth Mindset

Approach budgeting with a growth mindset that embraces challenges, learns from setbacks, and sees financial obstacles as opportunities for growth. View budgeting as a tool for personal and financial development, one that empowers you to take control of your money, overcome financial hurdles, and achieve greater financial freedom. By cultivating a growth mindset, you can transform budgeting from a chore into a rewarding journey towards financial empowerment and success.

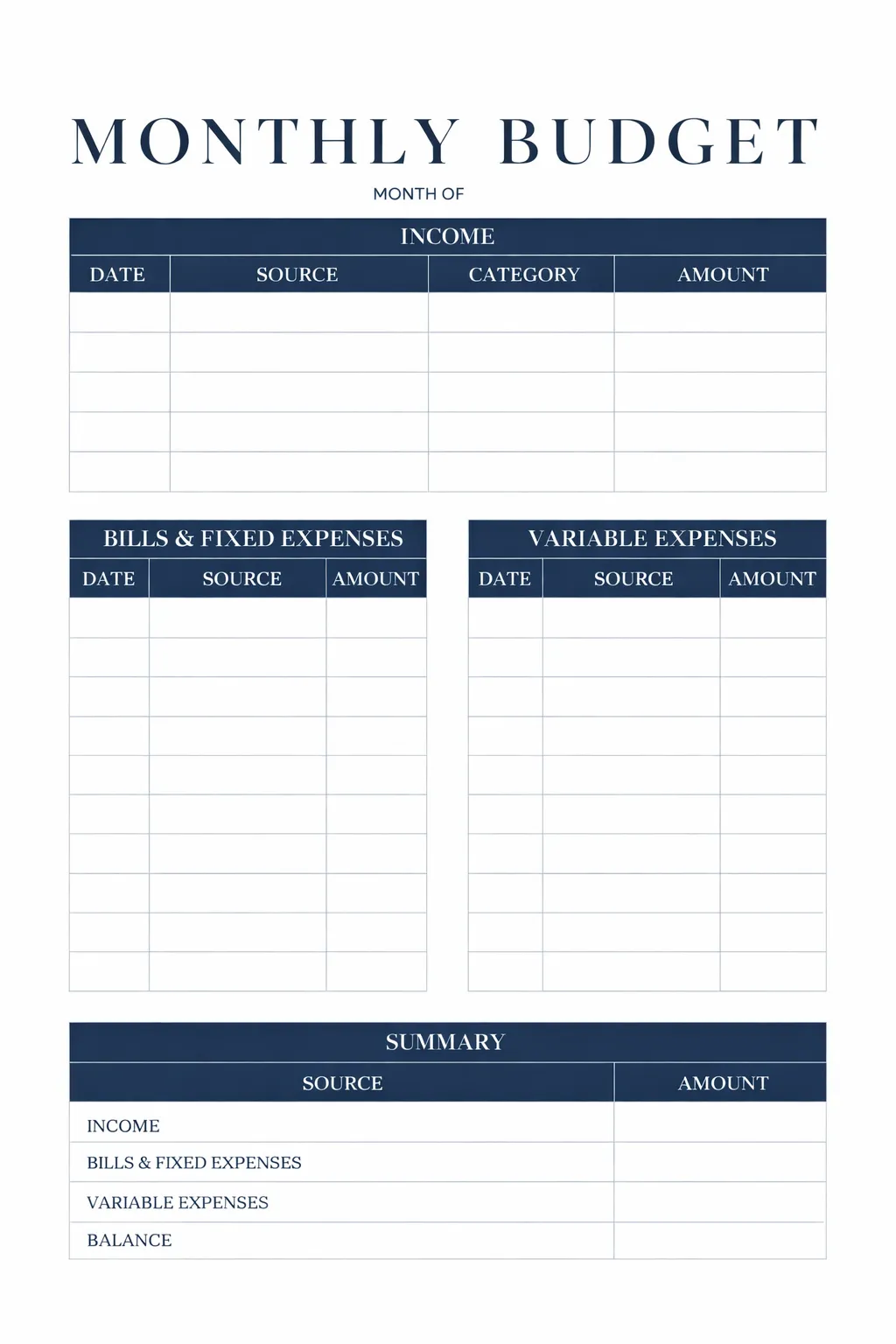

Financial Budget Template

A Financial Budget helps you organize income, track expenses, and plan savings in a clear and structured way. It provides a comprehensive overview of your financial activity, making it easier to manage cash flow, set goals, and make informed decisions. With a well-designed template, you can stay on top of your finances, reduce uncertainty, and work toward long-term financial stability.

Download our Financial Budget Template today to take control of your finances and plan with confidence.

Financial Budget Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026