What is a Gift Letter for Mortgage?

A gift letter for a mortgage is a legal document provided by the donor of the gift funds to the borrower and the mortgage lender. It serves as a formal declaration that the funds being used for the down payment on a home are a gift and not a loan.

This letter is crucial for providing transparency and clarity about the source of the funds.

Why is a Gift Letter Important for Mortgage Approval?

A gift letter is an essential component of the mortgage approval process for several reasons. Understanding the significance of this document can help borrowers navigate the home-buying journey more effectively.

Verification of Funds Source

One of the primary reasons a gift letter is required for mortgage approval is to verify the source of the funds being used for the down payment. Lenders need to ensure that the funds are a gift and not a loan that could affect the borrower’s debt-to-income ratio.

Prevention of Undisclosed Debts

Without a gift letter, there is a risk that the borrower could have undisclosed debts to the donor, which could impact their ability to repay the mortgage. The gift letter helps prevent this scenario by confirming that the funds do not need to be repaid.

Regulatory Compliance

Gift letters are often required to ensure compliance with mortgage lending regulations. Lenders are mandated to verify the source of funds for the down payment to prevent money laundering, fraud, and other illicit activities in the real estate transaction.

Assessment of Borrower’s Financial Situation

By requesting a gift letter, lenders can gain insights into the borrower’s financial stability and overall creditworthiness. This assessment is crucial for determining the borrower’s ability to repay the loan and managing the lender’s risk exposure.

Transparency and Integrity

A gift letter promotes transparency and integrity in the home-buying process. It demonstrates the borrower’s commitment to honesty and openness in their financial dealings, fostering trust between all parties involved.

Documenting the Gift

Documenting the gift through a formal letter provides a clear record of the funds’ origin and purpose. This documentation can be invaluable in case of any future disputes or questions regarding the nature of the down payment.

Evidence of Financial Support

For borrowers receiving a gift for the down payment, a gift letter serves as evidence of financial support from a family member, friend, or other benefactor. This documentation can strengthen the borrower’s case for loan approval.

Risk Mitigation for Lenders

From the lender’s perspective, a gift letter helps mitigate the risk associated with providing a mortgage loan. By verifying the source of the down payment funds, lenders can make more informed decisions about loan approval and reduce the likelihood of default.

Preventing Mortgage Fraud

Mortgage fraud is a significant concern in the real estate industry. Gift letters play a role in preventing fraud by ensuring that the funds used for the down payment are legitimate and do not involve any undisclosed agreements between the borrower and the donor.

Facilitating Loan Approval

Ultimately, a gift letter can facilitate the loan approval process by providing lenders with the necessary documentation to support the borrower’s financial position. This documentation can help expedite the underwriting process and increase the chances of loan approval.

Key Elements of a Gift Letter

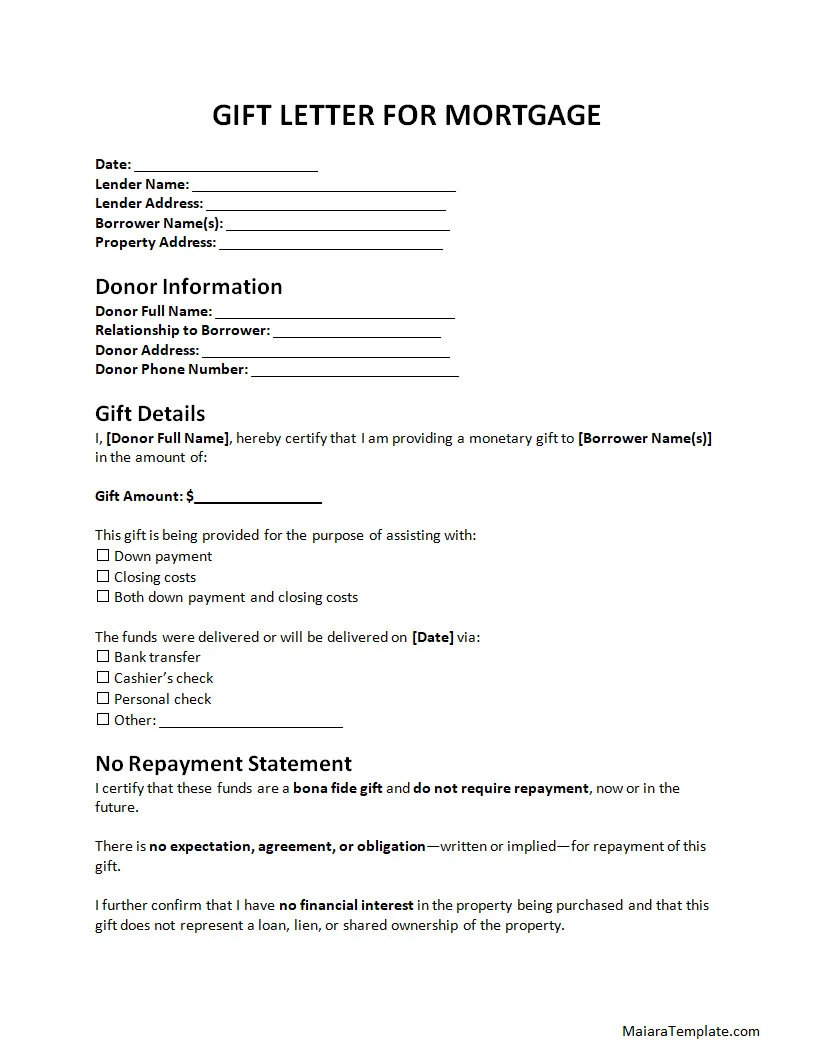

When drafting a gift letter for a mortgage, several key elements must be included to ensure its effectiveness and compliance with lender requirements. Understanding these key elements can help borrowers and donors prepare a thorough gift letter.

Donor Information

The gift letter should include detailed information about the donor, including their full name, address, phone number, and relationship to the borrower. Providing this information helps lenders verify the donor’s identity and relationship to the borrower.

Borrower Information

Similarly, the gift letter should contain detailed information about the borrower, including their full name, address, phone number, and the property address for which the gift is intended. This information helps establish the borrower’s identity and connection to the property.

Gift Amount and Purpose

The gift letter should clearly state the exact amount of the gift and its purpose, specifically for the down payment on the property. Including the gift amount in the letter helps lenders verify the funds’ source and ensure compliance with loan requirements.

Statement of Gift Intent

A crucial element of the gift letter is a clear statement from the donor confirming that the funds are a gift and not a loan. This statement is essential for clarifying the nature of the funds and ensuring that they do not constitute a new debt for the borrower.

Date of Gift

The gift letter should include the date on which the gift was given to the borrower. Including the date of the gift helps establish a timeline for when the funds were provided and ensures that the gift was given before the loan application process began.

Signatures of Donor and Borrower

Both the donor and the borrower should sign and date the gift letter to acknowledge their agreement to the terms outlined in the letter. Signatures from both parties help make the gift letter legally binding and provide a record of their consent to the gift arrangement.

Witness Signatures (Optional)

While not always required, having a witness sign the gift letter can provide an additional layer of verification and authenticity. A witness signature can corroborate the donor and borrower’s agreement to the gift terms and add credibility to the document.

Notarization (Optional)

Some lenders may require the gift letter to be notarized to further authenticate the document. Notarization involves having a notary public witness the signing of the gift letter and verify the identities of the parties involved, adding an extra level of assurance for all parties.

Additional Supporting Documentation

In some cases, lenders may request additional supporting documentation to accompany the gift letter, such as bank statements showing the transfer of funds from the donor to the borrower. Providing these documents can further validate the gift and ensure compliance with lender requirements.

How to Write a Gift Letter for Mortgage Approval

Writing a gift letter for a mortgage requires careful attention to detail and adherence to lender guidelines. By following these steps, borrowers and donors can create a clear and comprehensive gift letter that meets all requirements.

Step 1: Use a Template

Start by using a template or sample gift letter provided by your lender or real estate agent. Templates can help ensure that you include all the necessary information and format the letter correctly for submission.

Step 2: Gather Required Information

Collect all required information, including donor and borrower details, the gift amount, and the purpose of the gift. Having this information on hand will make it easier to complete the gift letter accurately.

Step 3: Draft the Letter

Begin drafting the gift letter by following a formal business letter format. Start with a salutation addressing the lender or loan officer by name, if known. Clearly state the purpose of the letter, which is to confirm that the funds provided by the donor are a gift and not a loan.

Step 4: Include Key Details

Include all key details in the gift letter, such as the donor’s information, the borrower’s information, the gift amount, the purpose of the gift, and a statement confirming that the funds are a gift. Be specific and concise in your wording to ensure clarity.

Step 5: Be Transparent

Transparency is key when writing a gift letter. Clearly explain the relationship between the donor and the borrower, the reason for the gift, and any other relevant details that will help the lender understand the nature of the gift.

Step 6: Review and Edit

Once you have drafted the gift letter, take the time to review and edit it for accuracy, grammar, and clarity. Ensure that all information is correct and that the letter conveys the intended message effectively.

Step 7: Sign and Date

Both the donor and the borrower should sign and date the gift letter to acknowledge their agreement to the terms. Make sure to use ink for the signatures and include the date on which the letter is signed.

Step 8: Submit the Letter

Submit the gift letter to your lender or loan officer along with any additional documentation they may require. Keep a copy of the letter for your records and be prepared to provide any further information or clarification if needed.

Tips for Successful Gift Letters

When preparing a gift letter for a mortgage, consider the following tips to ensure a successful and smooth approval process:

Provide Documentation

Include bank statements or other proof of the gift funds to support the letter. Lenders may require documentation to verify the transfer of funds and ensure compliance with their guidelines.

Communicate with Your Lender

Keep your lender informed throughout the process and provide any additional information they request promptly. Open communication can help address any concerns or questions that may arise during the approval process.

Follow Guidelines

Make sure to follow the lender’s specific requirements for gift letters to avoid any delays in the approval process. Familiarize yourself with the lender’s policies and procedures regarding gift funds to ensure compliance.

Keep Copies

Keep copies of the gift letter and any accompanying documentation for your records. Having a record of the gift letter and related paperwork can be helpful in case of any future inquiries or audits.

Seek Professional Advice

If you have any questions or concerns about drafting a gift letter, consider seeking advice from a real estate attorney or financial advisor. Professional guidance can ensure that your gift letter meets all legal and regulatory requirements.

Plan Ahead

Start the gift letter process early to allow sufficient time for drafting, review, and submission. Planning can help prevent delays in the mortgage approval process and ensure a smooth transaction.

Be Honest and Accurate

Provide truthful and accurate information in the gift letter to avoid any misunderstandings or complications. Honesty and transparency are essential when documenting gift funds for a mortgage.

Stay Organized

Keep all relevant documents, including the gift letter, bank statements, and receipts, organized and easily accessible. Being organized can streamline the approval process and make it easier to provide the requested information to the lender.

Clarify Terms and Conditions

Clearly outline the terms and conditions of the gift in the letter to prevent any confusion or misinterpretation. Specify that the funds are a gift and not a loan, and include any relevant details about the gift amount and purpose.

Follow Up as Needed

If the lender requests additional information or documentation related to the gift funds, be proactive in providing the requested items promptly. Following up with the lender can help expedite the approval process and address any outstanding issues.

Overall, a gift letter for a mortgage is a critical document that serves to protect both the borrower and the lender in the home-buying process. By understanding the importance of a gift letter, knowing the key elements to include, and following best practices for drafting and submitting the letter, borrowers can navigate the mortgage approval process more effectively and increase their chances of securing their dream home.

Gift Letter Template for Mortgage – DOWNLOAD

- Gift Voucher Template - January 8, 2026

- Printable Gift Thank-You Note Template - January 8, 2026

- Free Printable Gift Tag Template - January 7, 2026