Income statements are a crucial component of understanding the financial health of a business.

In this guide, we will delve into the intricacies of income statements, why they are important, what to include in them, how to analyze them, and tips for successfully interpreting the information they provide.

What is an Income Statement?

An income statement, also known as a profit and loss statement, is a financial document that provides a summary of a company’s revenues, expenses, and profits over a specific period of time. It is one of the key financial statements used by businesses to assess their performance and profitability. The income statement shows whether a company is making a profit or incurring losses during the period covered by the statement.

Income statements are typically prepared on a quarterly or annual basis and are essential for investors, creditors, and other stakeholders to evaluate a company’s financial performance. By analyzing the information presented in an income statement, stakeholders can gain insight into how efficiently a company is generating revenue and managing its expenses.

Why are Income Statements Important?

Income statements play a crucial role in helping businesses track their financial performance and make informed decisions. They provide valuable insights into a company’s profitability, growth trends, and financial health. By examining the revenues and expenses reported in an income statement, businesses can identify areas of strength and weakness in their operations, allowing them to take corrective actions if necessary.

Investors and creditors also rely on income statements to assess the financial stability and profitability of a company before making investment or lending decisions. A well-prepared income statement can help build trust and confidence in a company’s financial management, leading to increased investor interest and improved access to capital.

What to Include in an Income Statement

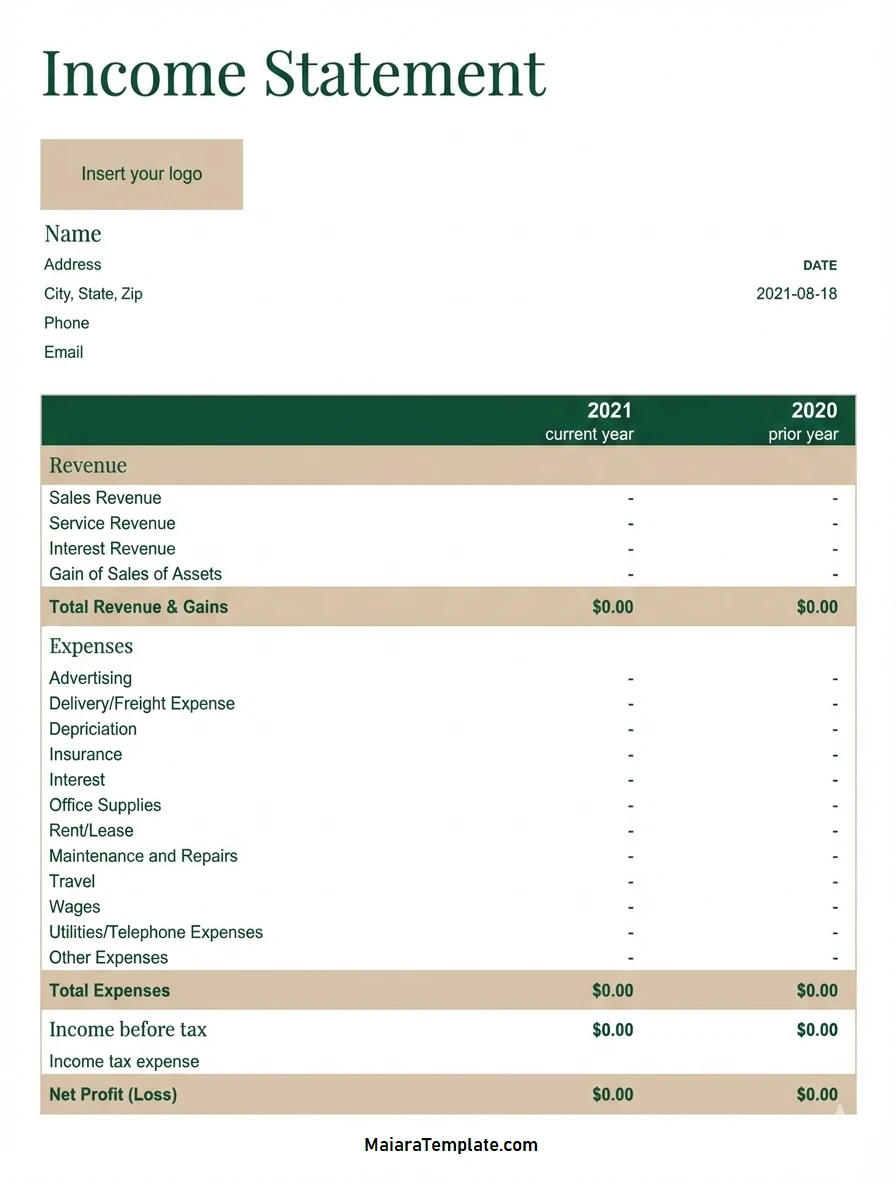

An income statement typically includes the following components:

- Revenue: This is the total amount of money earned from sales of goods or services during the period.

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing the goods or services sold by the company.

- Gross Profit: This is calculated by subtracting the COGS from the revenue and represents the company’s profitability before accounting for other expenses.

- Operating Expenses: These are the costs incurred in the day-to-day operations of the business, such as rent, salaries, and utilities.

- Net Income: This is the final profit or loss after deducting all expenses from the gross profit.

- Earnings Per Share (EPS): This metric is calculated by dividing the net income by the number of outstanding shares and indicates the profitability on a per-share basis.

How to Analyze an Income Statement

Analyzing an income statement involves comparing key financial metrics to assess a company’s performance over time. Some important aspects to consider when analyzing an income statement include:

- Gross Profit Margin: This ratio indicates the percentage of revenue that exceeds the cost of goods sold and reflects the efficiency of a company’s production process.

- Operating Margin: This ratio shows the percentage of revenue that remains after deducting operating expenses and is a measure of operational efficiency.

- Net Profit Margin: This ratio reveals the percentage of revenue that represents the company’s bottom-line profit after all expenses are deducted.

- Revenue Growth: By comparing revenue figures from different periods, businesses can assess their growth trajectory and identify trends.

Tips for Successful Interpretation

Interpreting an income statement can be complex, but there are some key tips to keep in mind for a successful analysis:

- Compare with Previous Periods: Analyze how the current income statement compares to previous periods to identify trends and patterns.

- Consider Industry Benchmarks: Compare the financial ratios and metrics in the income statement with industry benchmarks to evaluate performance relative to competitors.

- Focus on Key Drivers: Identify the main revenue and expense drivers impacting the profitability of the business to pinpoint areas for improvement.

- Look Beyond the Numbers: Consider the context in which the income statement was prepared, including economic conditions, industry trends, and company-specific factors.

In conclusion, income statements are a vital tool for businesses and stakeholders to assess financial performance and make informed decisions. By understanding how to read and analyze income statements effectively, individuals can gain valuable insights into a company’s profitability and financial health.

Income Statement Template – DOWNLOAD

- Free Printable Incident Report Template - February 15, 2026

- Independent Contractor Agreement Template - February 15, 2026

- Free Editable Income Statement Template - February 15, 2026