Financial planning is a crucial tool that enables individuals to maximize their financial resources and achieve their long-term financial objectives. Whether you are looking to make investments, send your children to college, buy a bigger home, leave a legacy, or enjoy a comfortable retirement, financial planning can provide you with the roadmap you need to reach your objectives.

In this article, we will explore the what, why, and how of financial planning, as well as provide some tips for successful financial planning.

What is Financial Planning?

Financial planning is the process of setting goals, assessing your current financial situation, and creating a plan to help you achieve those goals. It involves analyzing your income, expenses, assets, and liabilities to develop a strategy that will help you maximize your financial resources and build wealth over time.

By creating a financial plan, you can make informed decisions about how to allocate your money, invest in opportunities that align with your goals, and protect yourself and your loved ones from financial risks.

Why is Financial Planning Important?

Financial planning is important for several reasons.

Setting Financial Goals

One of the key reasons why financial planning is important is that it allows you to set clear, achievable goals for your financial future. Without specific goals in place, it can be challenging to make meaningful progress towards building wealth and achieving financial security. By defining your goals, you can create a roadmap for success and stay motivated to take the necessary steps to reach them.

Assessing Financial Risk

Another important aspect of financial planning is managing financial risk. Life is full of uncertainties, and unexpected events can have a significant impact on your financial well-being. By incorporating risk management strategies into your financial plan, such as insurance coverage and emergency savings, you can protect yourself and your loved ones from potential financial setbacks and ensure that you are prepared for whatever the future may hold.

Building Wealth Over Time

Financial planning is also crucial for accumulating wealth over time and achieving long-term financial stability. By creating a plan that includes saving, investing, and budgeting strategies, you can grow your assets and increase your net worth. A well-executed financial plan will help you make the most of your financial resources and maximize your opportunities for building wealth and achieving your financial goals.

Preparing for the Future

Financial planning is not just about the present; it’s also about preparing for the future. Whether you want to retire comfortably, leave a legacy for your loved ones, or achieve other long-term goals, financial planning can help you create a roadmap for success. By planning and making strategic financial decisions, you can ensure that you are prepared for whatever the future may bring and able to enjoy a financially secure and fulfilling life.

What to Include in Your Financial Plan?

When creating a financial plan, there are several key elements that you should include to ensure its effectiveness. These elements can vary depending on your specific goals and circumstances, but some common components of a comprehensive financial plan include:

Financial Goals

One of the most important elements of a financial plan is setting clear, achievable financial goals. Your goals may include saving for retirement, buying a home, funding your children’s education, or starting a business. By defining your goals, you can create a roadmap for your financial future and stay motivated to take the necessary steps to achieve them.

Income and Expenses

An essential component of a financial plan is analyzing your income sources and expenses. Understanding where your money is coming from and where it is going is crucial for creating a budget that aligns with your financial goals. By tracking your income and expenses, you can identify areas where you can cut costs, increase savings, or reallocate resources to better support your financial objectives.

Assets and Liabilities

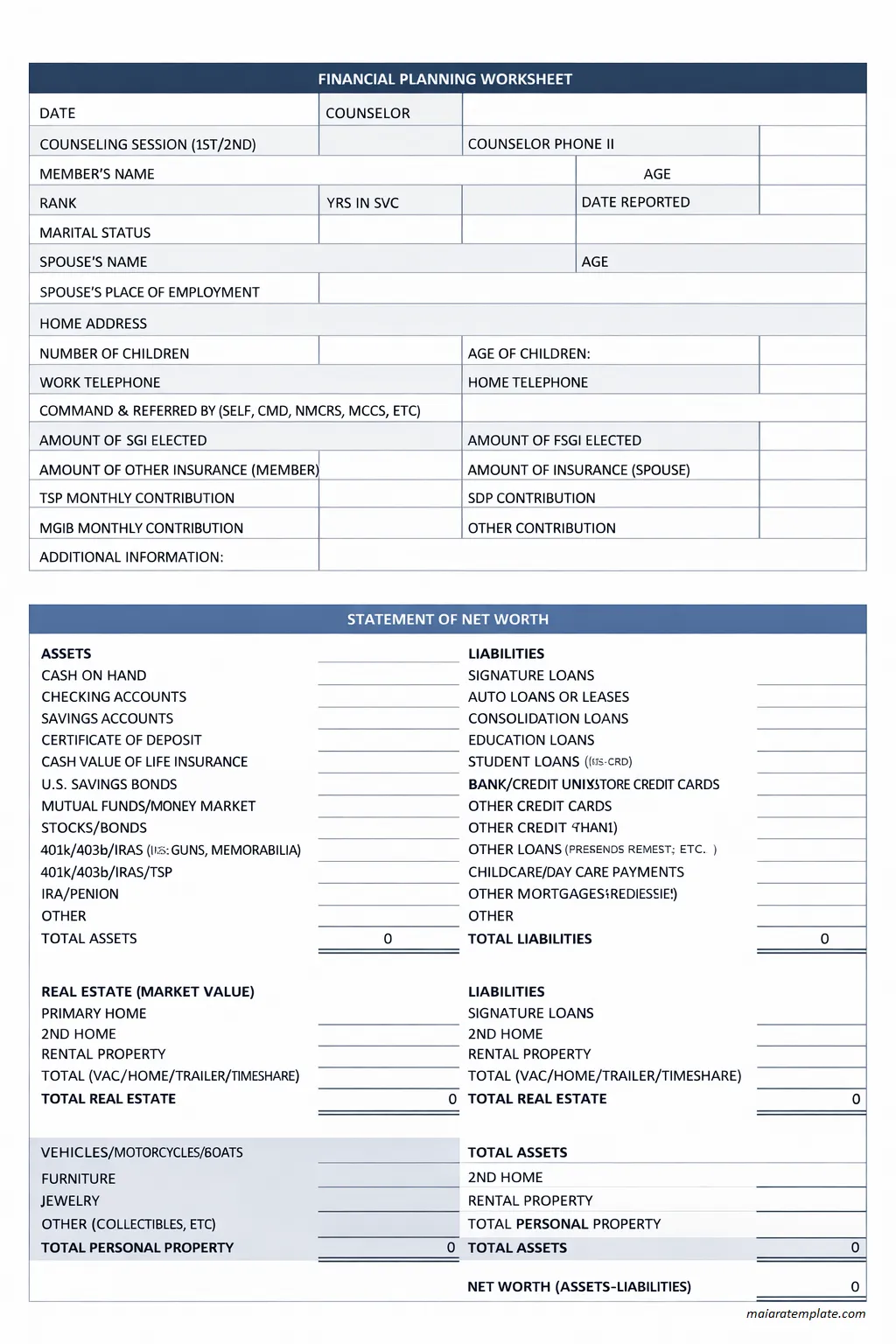

Another key component of a financial plan is taking stock of your assets and liabilities. Your assets may include savings, investments, real estate, and other valuable possessions, while your liabilities may consist of debts, mortgages, and other financial obligations. By understanding your net worth and the relationship between your assets and liabilities, you can make informed decisions about how to grow your wealth and manage your financial responsibilities.

Investment Strategy

Developing an investment strategy is an important part of a comprehensive financial plan. Your investment strategy should be based on your risk tolerance, time horizon, and financial goals. Whether you prefer conservative investments like bonds and cash or more aggressive options like stocks and real estate, having a well-thought-out investment plan can help you maximize your returns and achieve your long-term financial objectives.

Insurance Coverage

Protecting yourself and your loved ones from financial risks is a critical aspect of financial planning. This includes reviewing your insurance coverage to ensure that you have adequate protection in place for unexpected events such as illness, disability, or death. Whether you need health insurance, life insurance, disability insurance, or other types of coverage, incorporating insurance into your financial plan can provide you with peace of mind and financial security in times of need.

Estate Planning

Planning for the future is another essential component of financial planning. Estate planning involves creating a plan for passing on your assets to your heirs or charitable organizations in a tax-efficient and orderly manner. By developing an estate plan that includes a will, trusts, powers of attorney, and other important documents, you can ensure that your wishes are carried out and your loved ones are taken care of after you are gone.

How to Create a Financial Plan

Creating a financial plan can be a complex and time-consuming process, but it is well worth the effort in the long run. To create an effective financial plan, follow these steps:

Evaluate Your Financial Situation

The first step in creating a financial plan is to evaluate your current financial situation. This involves taking stock of your income, expenses, assets, and liabilities to create a complete picture of your financial health. By understanding where you stand financially, you can identify areas for improvement and develop strategies to reach your long-term financial goals.

Set Financial Goals

Once you have assessed your financial situation, the next step is to set clear, achievable financial goals. Your goals may include saving for retirement, paying off debt, buying a home, or starting a business. By defining your goals, you can create a roadmap for your financial journey and stay motivated to take the necessary steps to achieve them.

Develop a Strategy

With your goals in place, the next step is to develop a strategy for achieving them. This may involve creating a budget, saving a certain percentage of your income, investing in opportunities that align with your goals, and managing financial risks. Your strategy should be tailored to your unique financial situation and designed to help you reach your objectives in a timely and efficient manner.

Implement Your Plan

Implementing your financial plan is a critical step in the financial planning process. This involves putting your plan into action by making the necessary changes to your budget, investments, insurance coverage, and other financial decisions. By following through on your plan and staying disciplined in your financial habits, you can begin to see progress towards achieving your goals and building a more secure financial future.

Monitor and Adjust

Financial planning is not just about creating a plan and implementing it; it also involves regularly monitoring your progress and making adjustments as needed. By reviewing your financial plan on a regular basis, you can track your progress towards your goals, identify any areas that may need attention, and make strategic adjustments to keep your plan on track. Monitoring and adjusting your financial plan ensures that it remains relevant and effective in helping you achieve your long-term financial objectives.

Tips for Successful Financial Planning

To ensure the success of your financial plan and maximize your financial future, consider the following tips:

Start Early

One of the most important tips for successful financial planning is to start early. The earlier you begin planning for your financial future, the more time you have to build wealth and achieve your goals. Starting early allows you to take advantage of compound interest, time in the market, and other long-term financial strategies that can help you grow your wealth over time.

Seek Professional Advice

Consider working with a financial advisor or planner to help you create and implement a comprehensive financial plan. A professional can provide you with expert guidance, personalized recommendations, and ongoing support to help you navigate the complexities of financial planning and make informed decisions about your money.

Stay Flexible

Life is full of unexpected twists and turns, so it’s important to stay flexible in your financial planning. Be prepared to adjust your plan as needed in response to changing circumstances, new opportunities, or unforeseen challenges. A flexible financial plan can adapt to your evolving needs and help you stay on track towards your goals.

Automate Savings

One way to make saving easier and more consistent is to automate your savings. Set up automatic transfers from your checking account to your savings or investment accounts to ensure that you are consistently setting aside money for your goals. Automating your savings can help you build a nest egg over time without having to rely on willpower or discipline to save.

Stay Informed

Stay up-to-date on financial news, trends, and developments to make informed decisions about your investments and financial strategies. By staying informed, you can take advantage of new opportunities, avoid potential pitfalls, and make smart choices that align with your long-term financial goals. Knowledge is power when it comes to financial planning.

Review Regularly

Regularly review your financial plan to track your progress, assess your performance, and make any necessary adjustments. Set aside time each month or quarter to review your budget, investments, goals, and overall financial health. By staying on top of your financial plan and making regular reviews a habit, you can ensure that you are staying on track towards your goals and making the most of your financial resources.

By incorporating these tips into your financial planning process, you can set yourself up for success and maximize your financial future. Remember that financial planning is a dynamic and ongoing process that requires regular attention, adjustments, and monitoring. With a clear plan, achievable goals, and a proactive approach to managing your finances, you can build wealth, achieve your goals, and enjoy a secure and fulfilling financial future.

Financial Planning Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026