Financial reports are vital tools that provide stakeholders with a clear and detailed view of a company’s financial health, performance, and cash flows. These reports are essential for various stakeholders, including internal management, investors, creditors, and regulators, as they rely on the information presented in financial reports to make informed decisions.

Let’s delve deeper into the significance of financial reports and how they benefit stakeholders across different sectors.

What Are Financial Reports?

Financial reports are comprehensive documents that offer a snapshot of a company’s financial status and performance over a specific period. These reports typically consist of several key components, such as the balance sheet, income statement, cash flow statement, and statement of changes in equity.

Each of these components plays a crucial role in providing stakeholders with insights into different aspects of the company’s financial position.

Why Are Financial Reports Important?

Financial reports serve multiple essential purposes that are crucial for stakeholders in making informed decisions. These reports provide transparency, accountability, and valuable insights that enable stakeholders to assess a company’s financial health and performance accurately.

Decision Making

Financial reports are essential for stakeholders in making strategic decisions regarding their interactions with the company. Internal management relies on financial reports for strategic planning and performance evaluation, while investors use these reports to evaluate investment opportunities and make informed decisions about their portfolios. Creditors assess loan risk based on financial reports, and regulators ensure compliance with tax and legal requirements.

Transparency

Transparency is a key aspect of financial reporting that helps build trust and credibility with stakeholders. By disclosing financial information in reports, companies demonstrate transparency and accountability in their operations. Stakeholders, such as investors and creditors, rely on financial reports to assess the company’s financial position and performance accurately.

Risk Assessment

Stakeholders use financial reports to assess the financial risk associated with engaging with a company. Investors analyze financial reports to evaluate the company’s risk profile and make informed investment decisions. Creditors review financial reports to assess the company’s creditworthiness and determine the risk of extending loans or credit to the company.

Performance Evaluation

Investors and other stakeholders use financial reports to evaluate a company’s financial performance over time. By analyzing key financial metrics and ratios presented in the reports, stakeholders can assess the company’s profitability, efficiency, and overall financial health. Financial reports help stakeholders compare the company’s performance to industry benchmarks and make informed decisions based on the information provided.

Compliance

Regulators rely on financial reports to ensure that companies are complying with tax laws, accounting standards, and other legal requirements. Financial reports provide regulators with valuable information about the company’s financial transactions, performance, and compliance with regulatory standards. By reviewing financial reports, regulators can ensure that companies are operating within the legal framework and meeting their reporting obligations.

What to Include in Financial Reports?

Financial reports should include several key components to provide stakeholders with a comprehensive view of the company’s financial position and performance. Each of these components plays a critical role in helping stakeholders understand the company’s financial health and make informed decisions based on the information presented.

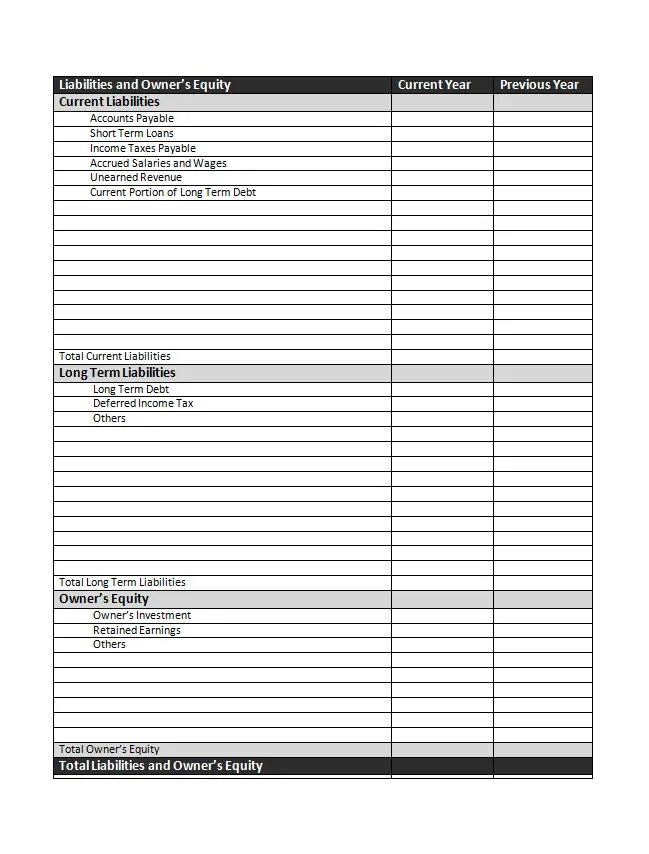

Balance Sheet

The balance sheet is a crucial component of financial reports that provides stakeholders with an overview of the company’s assets, liabilities, and equity at a specific point in time. Assets include cash, accounts receivable, inventory, property, plant, and equipment, while liabilities encompass accounts payable, loans, and other obligations. Equity represents the company’s ownership interest and is calculated as assets minus liabilities.

Income Statement

The income statement details the company’s revenues, expenses, and profits or losses over a specified period, typically a quarter or a year. Revenues are generated from the company’s primary business activities, while expenses include costs associated with operations, such as salaries, rent, utilities, and taxes. The bottom line of the income statement shows the company’s net income or loss for the period.

Cash Flow Statement

The cash flow statement outlines how cash flows in and out of the company during the reporting period. It categorizes cash flows into three main activities: operating activities, investing activities, and financing activities. Operating activities include cash flows from the company’s core business operations, such as sales and expenses. Investing activities involve cash flows related to buying or selling assets, such as equipment or investments. Financing activities include cash flows from issuing or repurchasing stock, paying dividends, or borrowing money.

Statement of Changes in Equity

The statement of changes in equity tracks changes in the company’s equity over time. It includes details about contributions from shareholders, distributions to shareholders, and retained earnings. Changes in equity can result from issuing new shares, repurchasing shares, paying dividends, or generating profits or losses. The statement of changes in equity provides stakeholders with insights into how the company’s equity has evolved over the reporting period.

Notes to the Financial Statements

The notes to the financial statements include additional information and explanations that complement the main financial statements. These notes provide important context and details that help stakeholders better understand the financial data presented in the reports. They may include explanations of accounting policies, contingent liabilities, related party transactions, and other relevant information that enhances the understanding of the financial statements.

How to Interpret Financial Reports

Interpreting financial reports requires a certain level of financial literacy and understanding of accounting principles. Stakeholders can analyze financial reports by comparing key metrics, trends, and ratios to assess the company’s financial health and performance accurately. It is essential to look beyond the numbers and consider the context in which the company operates to make meaningful interpretations.

1. Understand Key Financial Ratios

Financial reports include various financial ratios that help stakeholders assess a company’s financial health and performance. These ratios compare different financial metrics to provide insights into the company’s liquidity, solvency, profitability, and efficiency. Some common financial ratios include the current ratio, quick ratio, debt-to-equity ratio, return on equity, and profit margin. By understanding and analyzing these ratios, stakeholders can gain a deeper understanding of the company’s financial position.

2. Analyze Trends Over Time

Stakeholders should analyze trends in the company’s financial performance over time to identify patterns and potential areas of concern. By comparing financial data from multiple reporting periods, stakeholders can assess the company’s growth, profitability, and financial stability. Trends in revenue, expenses, profits, and cash flows can reveal insights into the company’s operational efficiency and long-term performance.

3. Consider Industry Benchmarks

Comparing the company’s financial performance to industry benchmarks can provide valuable insights into its competitiveness and performance relative to its peers. Industry benchmarks help stakeholders assess how well the company is performing compared to similar companies in the same industry. By benchmarking key financial metrics against industry averages, stakeholders can identify areas where the company excels or lags behind its competitors.

4. Evaluate Risk Factors

Stakeholders should evaluate the risk factors disclosed in the financial reports to assess the company’s exposure to various risks. Companies are required to disclose potential risks and uncertainties that could impact their financial performance in the notes to the financial statements. By reviewing these risk factors, stakeholders can better understand the challenges and potential threats facing the company and make informed decisions based on this information.

5. Consider External Factors

It is essential to consider external factors that may impact the company’s financial performance when interpreting financial reports. Economic conditions, industry trends, regulatory changes, and competitive pressures can all affect the company’s financial health and performance. Stakeholders should analyze how these external factors may influence the company’s operations and financial results to gain a more comprehensive understanding of its financial position.

6. Seek Professional Advice

For stakeholders who may not have the expertise or experience to interpret financial reports effectively, seeking professional advice can be beneficial. Financial analysts, accountants, and consultants can provide valuable insights and guidance on how to analyze financial reports and make informed decisions based on the information presented. Professional advice can help

7. Conduct Ratio Analysis

Ratio analysis is a powerful tool for interpreting financial reports and assessing a company’s performance relative to its industry peers. Stakeholders can calculate and analyze various financial ratios, such as liquidity ratios, profitability ratios, leverage ratios, and efficiency ratios, to gain insights into the company’s financial health and operational efficiency. Ratio analysis helps stakeholders identify strengths and weaknesses in the company’s financial position and make informed decisions based on this analysis.

8. Consider Qualitative Factors

In addition to quantitative data presented in financial reports, stakeholders should also consider qualitative factors that may impact the company’s financial performance. Qualitative factors, such as management expertise, competitive advantages, brand reputation, and market positioning, can influence the company’s long-term success and financial sustainability. By combining quantitative and qualitative analysis, stakeholders can gain a more holistic view of the company’s overall performance.

9. Monitor Key Performance Indicators

Key performance indicators (KPIs) are critical metrics that help stakeholders track the company’s performance against specific goals and objectives. By monitoring KPIs related to revenue growth, profitability, customer retention, and operational efficiency, stakeholders can assess the company’s progress and identify areas that require improvement. KPIs provide a real-time snapshot of the company’s performance and help stakeholders make timely decisions to drive business success.

10. Communicate with Stakeholders

Effective communication with stakeholders is essential when interpreting financial reports and making informed decisions based on the information presented. Companies should provide clear explanations of the financial data and be transparent in their reporting practices. Stakeholders, such as investors, creditors, and regulators, rely on accurate and timely information to assess the company’s financial health and performance. By communicating openly and proactively with stakeholders, companies can build trust and credibility in their financial reporting.

Tips for Successful Stakeholder Engagement

Engaging stakeholders with financial reports effectively requires clear communication, transparency, and responsiveness. Here are some tips for successful stakeholder engagement through financial reporting:

1. Provide Clear Explanations

Ensure that financial reports are accompanied by clear explanations to help stakeholders understand the information presented. Use plain language and avoid jargon to make the financial data accessible to a broader audience. Providing context and explanations for key financial metrics and trends can help stakeholders interpret the reports more effectively.

2. Address Stakeholder Concerns

Listen to stakeholder feedback and address any concerns or questions they may have regarding the financial reports. Engage with stakeholders to understand their perspectives and provide clarifications where needed. By showing a willingness to address stakeholder concerns and questions, companies can build trust and credibility with their stakeholders.

3. Be Transparent

Demonstrate transparency in financial reporting by disclosing relevant information and being forthcoming about any challenges or risks the company faces. Transparency builds trust with stakeholders and enhances the credibility of the company’s financial reports. Companies should disclose material information accurately and timely to ensure stakeholders have access to the information they need to make informed decisions.

4. Engage Proactively

Proactively engage with stakeholders to gather input and feedback on the financial reports to improve communication and understanding. Seek opportunities to communicate with stakeholders through meetings, presentations, and other channels to ensure they have a clear understanding of the company’s financial performance. By engaging proactively, companies can build stronger relationships with their stakeholders and foster a culture of openness and transparency.

5. Seek Professional Advice

Consider seeking advice from financial experts or consultants to enhance the quality and credibility of financial reports. Financial professionals can provide valuable insights and guidance on best practices in financial reporting, accounting standards, and regulatory requirements. By seeking professional advice, companies can ensure that their financial reports are accurate, reliable, and compliant with industry standards.

6. Leverage Technology

Use technology to streamline the financial reporting process and enhance stakeholder engagement. Financial reporting software can help automate data collection, analysis, and presentation, making it easier to generate accurate and timely financial reports. By leveraging technology, companies can improve the efficiency and accuracy of their financial reporting practices and provide stakeholders with real-time access to critical financial information.

7. Educate Stakeholders

Educate stakeholders on how to interpret financial reports and understand key financial metrics. Provide training sessions, workshops, or educational materials to help stakeholders build their financial literacy and enhance their ability to analyze financial reports effectively. By empowering stakeholders with the knowledge and skills to interpret financial information, companies can foster a more informed and engaged stakeholder community.

8. Establish Clear Reporting Policies

Establish clear reporting policies and procedures to ensure consistency and accuracy in financial reporting practices. Define roles and responsibilities for preparing and reviewing financial reports, establish reporting timelines and deadlines, and communicate reporting requirements to all stakeholders. By setting clear reporting policies, companies can maintain integrity and transparency in their financial reporting practices.

9. Monitor and Evaluate Performance

Regularly monitor and evaluate the company’s financial performance against key metrics and benchmarks. Analyze trends, identify areas for improvement, and track progress towards financial goals and objectives. By monitoring performance metrics and conducting regular evaluations, companies can identify opportunities for growth and address potential challenges proactively.

10. Solicit Feedback

Solicit feedback from stakeholders on the quality and effectiveness of financial reports. Seek input on the clarity, relevance, and usefulness of the information presented in the reports. Use stakeholder feedback to make improvements to the financial reporting process and enhance the value of the reports for stakeholders. By actively seeking feedback, companies can demonstrate a commitment to continuous improvement in their financial reporting practices.

Financial reports are indispensable tools that provide stakeholders with valuable insights into a company’s financial health, performance, and cash flows. By leveraging these reports effectively, stakeholders can make informed decisions that drive business success and ensure compliance with regulatory requirements. Companies need to prioritize clear communication, transparency, and stakeholder engagement to maximize the benefits of financial reporting.

Financial Report Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026