What is a Generic Invoice?

A generic invoice is a crucial document used in business transactions to request payment from a buyer for goods or services provided by a seller. It serves as a formal record of the transaction, containing detailed information about the items purchased, costs, taxes, due date, and payment terms.

By issuing a generic invoice, sellers can ensure that buyers have a clear understanding of their payment obligations and create a legal record of the transaction.

Why Use a Generic Invoice?

The use of a generic invoice is essential in business transactions for several reasons.

Legal Protection and Compliance

One of the primary reasons to use a generic invoice is to provide legal protection and ensure compliance with regulations. A generic invoice serves as a legally binding document that outlines the terms and conditions of the transaction, including payment terms, due date, and accepted payment methods. By issuing a generic invoice, sellers can protect their rights in case of payment disputes, establish proof of the transaction, and comply with legal requirements for documenting sales and revenue.

Efficient Record-Keeping and Financial Management

Using generic invoices helps businesses maintain accurate records of their sales, expenses, and revenue, leading to better financial management and decision-making. By keeping detailed records of all transactions, businesses can track their cash flow, monitor payment statuses, analyze sales trends, and prepare financial reports. Generic invoices also simplify accounting tasks, tax preparation, and audit processes by providing a clear and organized record of all business transactions.

Improved Payment Tracking and Cash Flow Management

Generic invoices play a crucial role in tracking payments, managing cash flow, and ensuring the timely collection of funds. By including payment terms, due dates, and accepted payment methods on the invoice, sellers can streamline their payment processes, reduce late payments, and improve cash flow predictability. Generic invoices help businesses monitor outstanding payments, follow up with customers on overdue invoices, and maintain healthy financial liquidity for ongoing operations.

Enhanced Professionalism and Customer Relationships

Using well-designed generic invoices demonstrates professionalism and credibility in business communications, enhancing the reputation of the seller and building trust with customers. A professional invoice reflects attention to detail, clear communication, and commitment to quality service, making a positive impression on clients and partners. By issuing professional invoices promptly and accurately, businesses can strengthen customer relationships, encourage repeat business, and secure long-term partnerships.

Streamlined Payment Processes and Financial Transparency

Generic invoices help streamline payment processes by providing clear and concise information about the transaction, making it easier for buyers to understand their payment obligations and process payments efficiently. By using standardized invoice templates, businesses can create consistent, professional invoices that promote financial transparency and accountability. Generic invoices also help businesses keep track of their sales activities, identify revenue sources, and analyze the performance of their products or services.

Key Elements of a Generic Invoice

While the specific format of a generic invoice may vary depending on the industry and business preferences, there are essential elements that should be included in every invoice. These key elements help ensure clarity, accuracy, and legal compliance in business transactions.

Invoice Number

An invoice number is a unique identifier assigned to each invoice to differentiate it from other invoices and track the transaction. The invoice number helps both the seller and the buyer reference the invoice easily, especially in case of payment follow-ups or disputes. Including an invoice number on a generic invoice is essential for record-keeping, organization, and tracking purposes.

Invoice Date

The invoice date is the date when the invoice is issued to the buyer, indicating the time when the transaction took place. Including the invoice date on a generic invoice helps establish a timeline for the payment terms and provides a reference point for both parties involved in the transaction. The invoice date is crucial for determining the due date for payment and complying with accounting and tax regulations.

Buyer and Seller Information

Providing accurate contact information for both the buyer and the seller on a generic invoice is essential for ensuring clear communication and record-keeping. The buyer’s information should include their name, address, phone number, email address, and any other relevant contact details. Similarly, the seller’s information should also be complete and accurate to facilitate payment processing, communication, and dispute resolution if necessary.

Itemized List

An itemized list on a generic invoice includes a detailed description of the goods or services provided, quantity, unit price, and total cost for each item. Breaking down the costs into individual line items helps the buyer understand the pricing structure and verify the accuracy of the charges. An itemized list also enables the seller to track sales, monitor inventory levels, and analyze the profitability of each product or service offered.

Taxes and Fees

Any applicable taxes, fees, or discounts should be clearly outlined on a generic invoice to provide a transparent breakdown of the total amount due. Including taxes and fees in the invoice helps buyers understand the additional costs associated with the transaction and ensures compliance with tax regulations. Sellers should calculate taxes accurately, apply discounts if applicable, and present the total amount due clearly to avoid confusion or disputes with buyers.

Payment Terms

Specifying the payment terms on a generic invoice is essential for establishing the due date for payment, accepted payment methods, and any late payment penalties. Payment terms outline the conditions under which the buyer is required to pay the invoice amount, including the timeframe for payment, preferred payment methods, and consequences of late payment. Clear payment terms help both parties manage expectations, avoid misunderstandings, and facilitate timely payment collection.

How to Create a Generic Invoice

Creating a generic invoice is a straightforward process that can be done using software programs, online invoicing platforms, or manual templates. By following a few simple steps, businesses can generate professional invoices that meet their specific needs and comply with legal requirements.

Choose an Invoice Template

The first step in creating a generic invoice is to select an invoice template that matches the business’s branding, layout preferences, and required fields. Many software programs and online invoicing platforms offer customizable templates that can be tailored to fit the business’s unique needs. Choosing a well-designed template can enhance the professionalism of the invoice and make it easier for both the seller and the buyer to understand the information presented.

Fill in Buyer and Seller Information

Once the template is selected, the next step is to fill in the buyer and seller information accurately. This includes providing the full name, address, phone number, email address, and any other relevant contact details for both parties involved in the transaction. Ensuring that the information is complete and up-to-date helps facilitate communication, payment processing, and record-keeping.

Some businesses may also include additional information, such as a logo, business registration number, or terms and conditions, to further personalize the invoice and convey professionalism.

Itemize Products or Services

After entering the buyer and seller information, the next step is to itemize the products or services provided in the transaction. This involves listing each item or service, including a brief description, quantity, unit price, and total cost for each line item. Itemizing products or services helps the buyer understand the breakdown of charges and verify the accuracy of the invoice against the goods or services received.

Calculate Taxes and Fees

If applicable, calculate any taxes, fees, or discounts associated with the transaction and include them in the invoice. This ensures that the total amount due is accurate and transparent, helping the buyer understand the additional costs included in the invoice. Calculating taxes and fees correctly is essential for complying with tax regulations and providing a clear breakdown of the total amount owed by the buyer.

Specify Payment Terms

Clearly outline the payment terms on the invoice, including the due date for payment, accepted payment methods, and any late payment penalties. Payment terms help set expectations for the buyer regarding when and how payment should be made, reducing the risk of misunderstandings or delays. Including specific payment terms on the invoice encourages timely payment and establishes a clear agreement between the buyer and seller.

Review and Send

Before finalizing the invoice, it is crucial to review all information for accuracy, completeness, and clarity. Check for any errors in calculations, typos in contact information, or missing details that could impact the payment process. Once the invoice is thoroughly reviewed and verified, send it promptly to the buyer via email, mail, or online invoicing platform for payment processing.

Tips for Successful Invoicing

Successfully invoicing customers or clients is essential for maintaining a healthy cash flow, tracking revenue, and building strong business relationships. By following some best practices and tips for effective invoicing, businesses can streamline their payment processes, reduce late payments, and improve financial management.

Send Invoices Promptly

Issue invoices promptly after delivering goods or services to customers to expedite the payment process and avoid delays in payment collection. Sending invoices promptly sets clear expectations for payment and allows customers to process payments efficiently within the specified timeframe. Prompt invoicing also demonstrates professionalism and reliability in business transactions.

Follow Up on Overdue Payments

Monitor payment statuses regularly and send polite reminders to customers with overdue payments to encourage timely settlement. Following up on late payments helps businesses maintain a steady cash flow, reduce outstanding balances, and foster positive relationships with customers. Sending gentle reminders can prompt customers to prioritize payment and resolve any payment issues promptly.

Offer Multiple Payment Options

Provide customers with various payment methods to make it convenient for them to pay invoices promptly. Offering multiple payment options, such as credit card, bank transfer, online payment platforms, or checks, allows customers to choose the method that suits their preferences and capabilities. By accommodating diverse payment preferences, businesses can make it easier for customers to settle invoices quickly and efficiently.

Keep Accurate Records

Maintain detailed records of all invoices issued and payments received to track revenue, monitor outstanding balances, and reconcile financial transactions. Accurate record-keeping is essential for accounting purposes, tax preparation, and financial reporting. By organizing invoices systematically and documenting payment activities, businesses can ensure transparency, compliance, and accuracy in their financial records.

Set Clear Payment Terms

Establish clear and concise payment terms on invoices to avoid misunderstandings and disputes with customers regarding payment obligations. Clearly outlining the due date for payment, accepted payment methods, and any late payment penalties helps set expectations upfront and reduces the risk of payment delays or miscommunications. Including specific payment terms on invoices promotes transparency, accountability, and timely payment collection.

Automate Invoicing Processes

Consider using automated invoicing software or online invoicing platforms to streamline the invoicing process, save time, and reduce manual errors. Automated invoicing tools can generate invoices, send payment reminders, track payment statuses, and organize financial data efficiently. By automating invoicing processes, businesses can improve efficiency, accuracy, and overall financial management.

Provide Detailed Invoices

Create detailed invoices that include all necessary information, such as itemized lists, taxes, fees, payment terms, and contact details, to ensure clarity and transparency. Providing detailed invoices helps customers understand the charges, verify the accuracy of the invoice, and process payments without confusion. Clear and comprehensive invoices contribute to a positive customer experience and facilitate smooth payment transactions.

Establish Communication Channels

Maintain open communication channels with customers to address any questions, concerns, or issues related to invoices promptly. Being accessible and responsive to customer inquiries builds trust, resolves payment issues efficiently, and fosters positive relationships. Establishing effective communication channels helps businesses provide excellent customer service and ensure smooth payment processing.

Monitor Payment Activities

Regularly monitor payment activities, track payment statuses, and reconcile invoices to identify any discrepancies or outstanding payments. Keeping a close eye on payment activities helps businesses stay on top of their receivables, follow up on overdue payments, and maintain a healthy cash flow. Monitoring payment activities proactively allows businesses to address payment issues promptly and maintain financial stability.

Review Invoicing Procedures

Periodically review and evaluate invoicing procedures to identify areas for improvement, streamline processes, and enhance efficiency. Assessing invoicing procedures helps businesses optimize their payment workflows, reduce errors, and implement best practices for successful invoicing. Regularly reviewing invoicing procedures ensures that businesses stay organized, compliant, and efficient in their financial operations.

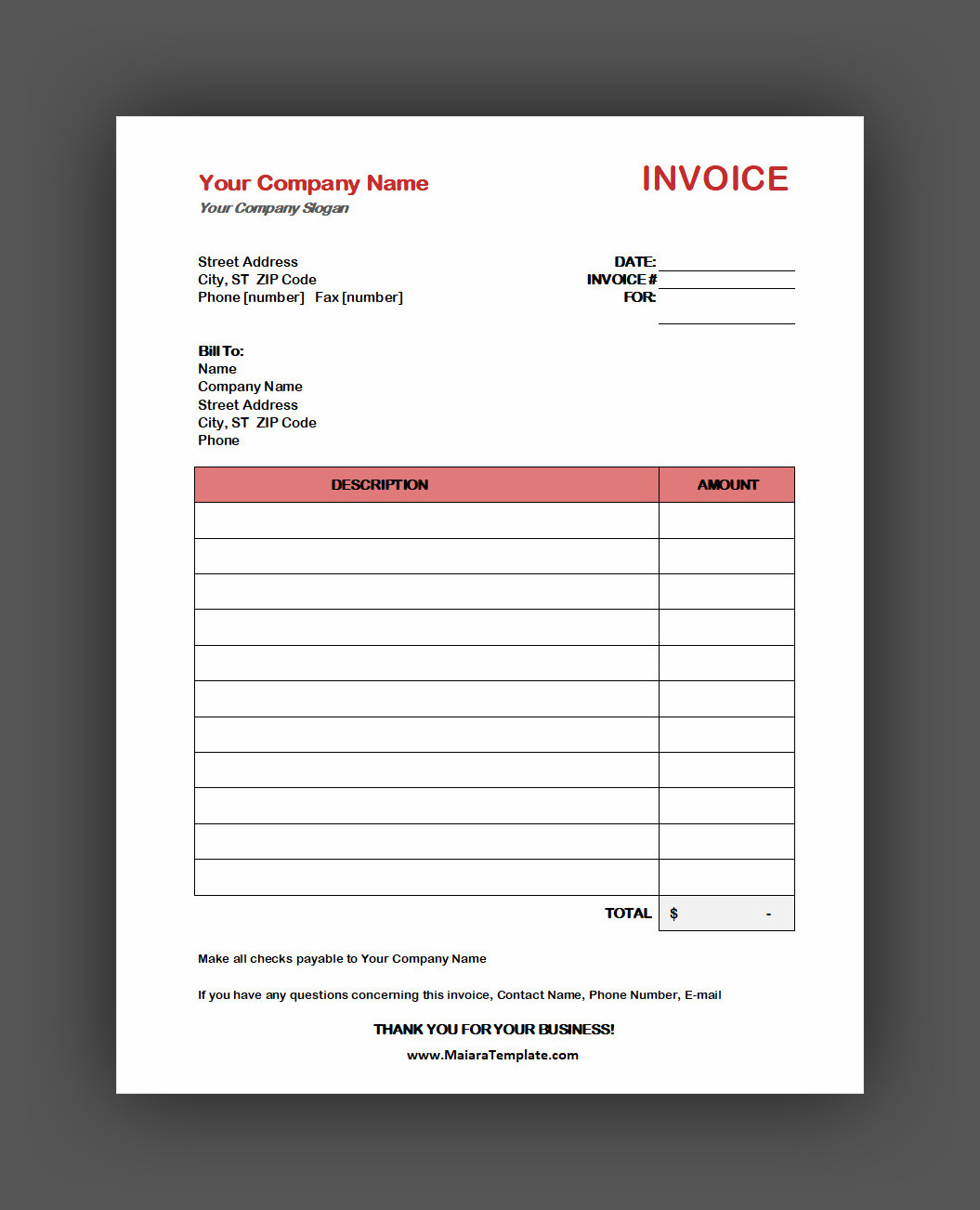

Free Generic Invoice Template

A generic invoice is a versatile tool for billing clients across any industry. It includes essential details such as company information, services or products provided, payment terms, and total amounts due—making it easy to create professional invoices quickly. This template helps you maintain consistency and streamline your payment process.

Download and use our free generic invoice template today to bill clients efficiently, stay organized, and get paid faster.

Generic Invoice Template – EXCEL

- Free Notary Acknowledgement Form Template - February 27, 2026

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026