What is a Profit and Loss Account?

A profit and loss account, commonly referred to as an income statement, is a financial document that provides a summary of a company’s revenues and expenses during a specific period. This statement is crucial for businesses of all sizes as it helps determine the net profit or loss over the defined period.

By detailing the company’s financial performance, the profit and loss account assists in evaluating the success and sustainability of the business.

Why is a Profit and Loss Account Important?

A profit and loss account is a fundamental tool for businesses and stakeholders alike due to its multifaceted benefits. The importance of this financial statement extends beyond simple number crunching and offers valuable insights into the company’s operations and financial health.

Financial Performance Evaluation

One of the primary reasons why a profit and loss account is important is its role in evaluating the financial performance of a business. By analyzing revenue, expenses, and net profit, stakeholders can get a comprehensive view of how well the company is performing. This information is crucial for making informed decisions about investments, expansion, and resource allocation.

Trend Analysis for Strategic Planning

Another key benefit of a profit and loss account is its ability to provide trend analysis over multiple periods. By comparing profit and loss statements from different quarters or years, businesses can identify patterns and trends in revenue and expenses. This data is invaluable for strategic planning and can help businesses anticipate future challenges and opportunities.

Decision-Making Support

The information contained in a profit and loss account serves as a valuable resource for decision-making at all levels of the organization. From budget planning to marketing strategies, having a clear understanding of the company’s financial performance can guide decision-makers in making choices that align with the overall goals of the business. Stakeholders can use this data to make informed decisions about investing, expanding, or restructuring the company.

Investor and Lender Confidence

Investors and lenders rely heavily on profit and loss accounts to assess the financial health of a company before committing funds. A positive net profit indicates that the business is profitable and has growth potential, making it an attractive investment opportunity. Conversely, a consistent net loss may raise red flags for investors and lenders, leading to decreased confidence in the company’s ability to repay debts or generate returns.

Identifying Areas for Improvement

Perhaps one of the most significant benefits of a profit and loss account is its ability to identify areas for improvement within the business. By analyzing expenses and revenue streams, businesses can pinpoint inefficiencies, cost overruns, or underperforming products or services. This granular level of detail enables companies to make strategic changes that can lead to increased profitability and sustainability in the long run.

What to Include in a Profit and Loss Account?

A well-prepared profit and loss account should contain several key components that provide a comprehensive overview of the company’s financial performance. These components include revenue, expenses, and net profit, each of which plays a critical role in understanding the business’s operations.

Sales Revenue

Sales revenue is the total income generated from the sale of goods or services during the reporting period. This figure represents the primary source of income for the business and is essential for calculating profitability. Sales revenue can be further broken down by product, service, or customer segment to provide a more detailed analysis of revenue sources.

Cost of Goods Sold

The cost of goods sold (COGS) represents the direct costs associated with producing or acquiring the products or services sold by the business. This includes expenses such as raw materials, labor, and manufacturing overhead. Calculating COGS accurately is crucial for determining the gross profit margin, which reflects the efficiency of the company’s production process.

Gross Profit

Gross profit is calculated by subtracting the cost of goods sold from the total sales revenue. This figure represents the profitability of the core business activities before accounting for operating expenses. A high gross profit margin indicates that the company is effectively managing production costs and generating revenue, while a low margin may signal inefficiencies that need to be addressed.

Operating Expenses

Operating expenses encompass all costs incurred in the day-to-day operations of the business, excluding COGS. This category includes expenses such as rent, utilities, salaries, marketing, and administrative costs. Tracking operating expenses is essential for understanding the overall financial health of the company and identifying opportunities for cost savings.

Net Profit or Loss

The net profit or loss is the final figure calculated by subtracting all expenses from the total revenue. This number represents the bottom line of the business and indicates whether the company is generating a profit or operating at a loss. Net profit is a key metric for assessing the financial performance of the business and is used by stakeholders to make strategic decisions about future investments and operations.

How to Interpret a Profit and Loss Account?

Interpreting a profit and loss account requires a deep understanding of financial concepts and the ability to analyze data effectively. Business owners, managers, and stakeholders can use several strategies to interpret the information presented in the profit and loss statement accurately.

Analyze Revenue Sources

One of the first steps in interpreting a profit and loss account is to analyze the various revenue sources contributing to the total income. By breaking down sales revenue by product, service, or customer segment, businesses can identify which areas are driving profitability and which may need further attention. This analysis can help businesses prioritize resources and focus on strategies that maximize revenue.

Assess Cost Structures

In addition to revenue analysis, it is essential to assess the cost structures outlined in the profit and loss account. Understanding where the company is spending money and how those expenses impact profitability is crucial for making informed decisions. By analyzing operating expenses and cost of goods sold, businesses can identify areas for cost reduction and efficiency improvements.

Calculate Profit Margins

Profit margins are key indicators of a company’s financial health and efficiency. Gross profit margin, which measures the profitability of core business activities, and net profit margin, which reflects overall profitability after accounting for all expenses, are critical metrics to calculate and analyze. By comparing profit margins over time or against industry benchmarks, businesses can assess their competitiveness and identify areas for improvement.

Identify Trends and Patterns

Trend analysis is another essential aspect of interpreting a profit and loss account. By comparing financial data from multiple periods, businesses can identify trends, patterns, and anomalies that provide valuable insights into the company’s performance. Recognizing trends early allows businesses to capitalize on opportunities, address potential challenges, and make data-driven decisions that drive sustainable growth.

Tips for Using Profit and Loss Accounts Effectively

Effectively utilizing profit and loss accounts requires more than just generating the statement—it involves analyzing the data, interpreting the results, and using the insights to drive strategic decision-making. Business owners and managers can follow several tips to make the most of their profit and loss accounts and optimize financial performance.

Regularly Review Financial Statements

One of the most important tips for using profit and loss accounts effectively is to review them regularly. By monitoring financial performance on a consistent basis, businesses can stay informed about their operations, identify trends, and make timely adjustments to their strategies. Regular reviews also help businesses track progress towards financial goals and make informed decisions based on up-to-date information.

Set Financial Goals Based on Data

Profit and loss accounts provide valuable data that can be used to set financial goals for the business. By analyzing revenue, expenses, and profitability metrics, businesses can identify areas for improvement and establish realistic, achievable goals. Setting specific, measurable targets based on the insights gained from the profit and loss statement helps businesses focus their efforts and track progress towards financial success.

Compare Against Industry Benchmarks

Benchmarking is a powerful tool for assessing a company’s financial performance in relation to its industry peers. By comparing profit and loss accounts against industry benchmarks, businesses can gain valuable insights into their competitiveness, efficiency, and profitability. Identifying areas where the business lags behind competitors can highlight opportunities for improvement and provide a roadmap for achieving industry-leading performance.

Seek Professional Advice for Complex Analysis

Interpreting profit and loss accounts can be a complex process, especially for businesses with limited financial expertise. In such cases, seeking professional advice from accountants, financial advisors, or consultants can provide valuable insights and guidance

Consulting with financial experts

Financial experts can provide valuable insights into interpreting profit and loss accounts and offer strategic advice on how to use the information effectively. These professionals have the expertise and experience to analyze financial data, identify trends, and make recommendations for improving financial performance. Consulting with financial experts can help businesses gain a deeper understanding of their profit and loss accounts and make informed decisions based on expert guidance.

Use Software for Financial Analysis

In today’s digital age, businesses have access to a wide range of financial software tools that can streamline the process of analyzing profit and loss accounts. These software solutions automate data entry, perform complex calculations, and generate detailed reports that provide valuable insights into the company’s financial performance. By using software for financial analysis, businesses can save time, reduce errors, and make informed decisions based on accurate, up-to-date information.

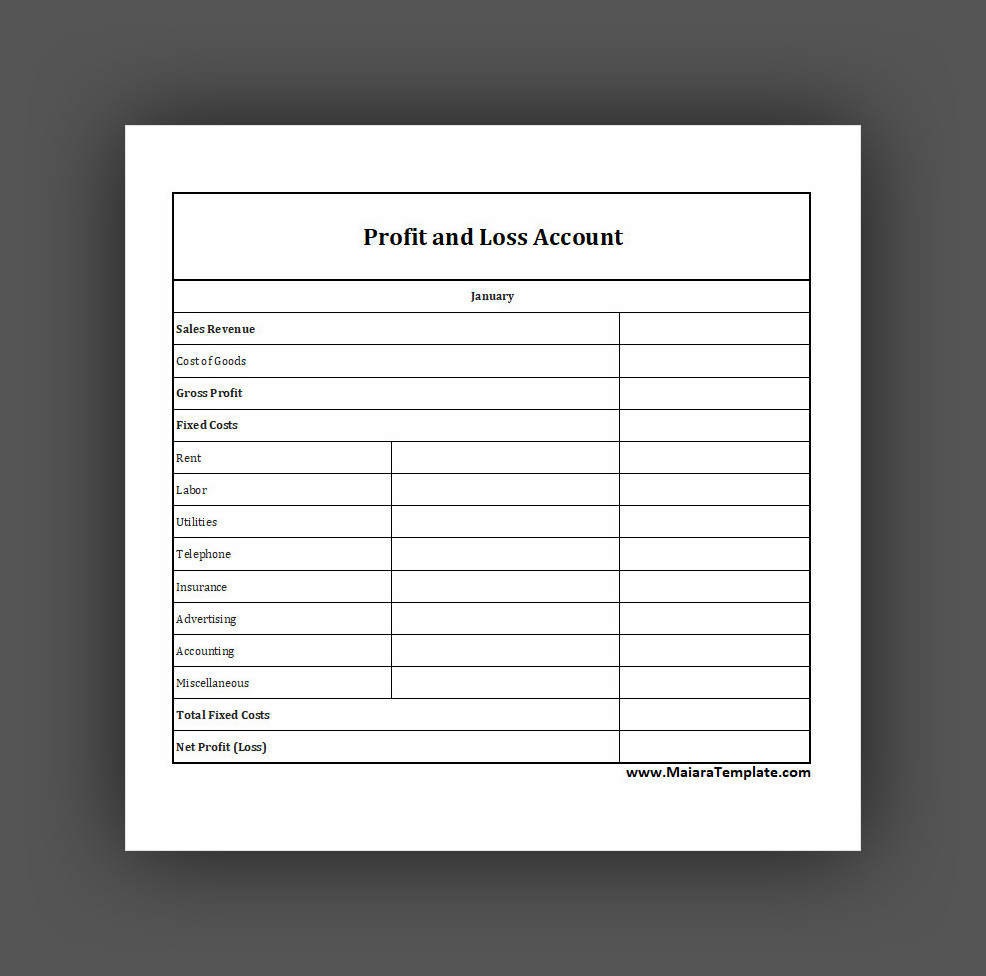

Profit And Loss Account Template

In conclusion, a Profit and Loss Account is a powerful tool for tracking your business’s income, expenses, and overall profitability. It helps you analyze financial performance and make informed decisions for growth.

Stay on top of your finances—download our Profit and Loss Account Template and start managing your business earnings with confidence!

Profit And Loss Account Template – EXCEL

- Home Purchase Agreement Template - January 28, 2026

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026