As a self-employed individual, managing your finances is essential to the success of your business. One tool that can help you keep track of your financial performance is a profit and loss statement, also known as an income statement. This document provides a snapshot of your business’s revenues, expenses, and profits over a specified period.

By analyzing this information, you can make informed decisions about your company and ensure that you are on track to meet your profit goals.

What is a Profit and Loss Statement?

A profit and loss statement is a financial document that summarizes your business’s revenues, expenses, and profits over a specific period of time, typically a month, quarter, or year. This statement provides valuable insights into your business’s financial performance and can help you identify areas where you can improve efficiency and profitability.

Why do Self-Employed Individuals Need a Profit and Loss Statement?

For self-employed individuals, a profit and loss statement is a crucial tool for managing their finances and ensuring the success of their business. By regularly reviewing this document, you can track your business’s financial performance, identify trends, and make informed decisions about your operations.

1. Financial Monitoring

One of the primary reasons self-employed individuals need a profit and loss statement is to monitor their financial health. By analyzing revenues, expenses, and profits, you can gain valuable insights into your business’s performance and make adjustments to improve profitability.

2. Budgeting and Planning

A profit and loss statement is also essential for budgeting and planning purposes. By understanding your business’s financial performance, you can set realistic revenue and expense targets, allocate resources effectively, and make strategic decisions to achieve your profit goals.

3. Tax Reporting

In addition, a profit and loss statement is crucial for tax reporting. By accurately documenting your revenues and expenses, you can ensure compliance with tax regulations, maximize deductions, and avoid penalties for inaccurate reporting.

What Should Go Into a P&L Statement?

When preparing a profit and loss statement, there are several key components that you should include to ensure that it accurately reflects your business’s financial performance. These components typically include:

1. Revenue Sources

Revenues are the lifeblood of any business and should be accurately recorded in your profit and loss statement. Sources of revenue may include sales, services, investments, and other income streams. It is essential to categorize and track each revenue source to gain a comprehensive understanding of your business’s income.

2. Expense Categories

Expenses represent the costs incurred to operate your business efficiently. These may include rent, utilities, salaries, marketing expenses, and other overhead costs. By categorizing expenses into different categories, you can identify areas where you may be overspending and take corrective actions to optimize your financial performance.

3. Gross Profit Calculation

Gross profit is a critical metric that reflects the profitability of your core business activities. To calculate gross profit, subtract the total cost of goods sold from total revenues. This figure represents the profit generated from your primary business operations before accounting for other expenses.

4. Net Profit Determination

Net profit is the ultimate measure of your business’s profitability after accounting for all expenses, including taxes and interest. To calculate net profit, deduct all operating expenses, taxes, and interest from gross profit. A positive net profit indicates that your business is generating income after covering all costs.

How to Prepare a Profit and Loss Statement

Preparing a profit and loss statement for your self-employed business is a straightforward process that can be done using accounting software or a simple spreadsheet. To create an accurate and reliable statement, follow these steps:

1. Gather Financial Data

Collect all relevant financial data, including invoices, receipts, bank statements, and other documents that reflect your business’s revenues and expenses. Ensure that your data is accurate and up-to-date to create a reliable profit and loss statement.

2. Categorize Revenues and Expenses

Organize your revenues and expenses into different categories to provide a clear overview of your business’s financial performance. Common categories include sales revenue, cost of goods sold, operating expenses, and non-operating expenses. Categorizing your data will help you identify trends and make informed decisions.

3. Calculate Gross Profit

To calculate gross profit, subtract the total cost of goods sold from total revenues. This figure represents the profit generated from your core business activities before accounting for other expenses. Gross profit is a key indicator of your business’s operational efficiency and profitability.

4. Calculate Net Profit

After determining gross profit, deduct all operating expenses, taxes, interest, and other costs from gross profit to calculate net profit. Net profit reflects the overall profitability of your business after accounting for all expenses. A positive net profit indicates that your business is financially healthy and generating income.

5. Review and Analyze

Once you have prepared your profit and loss statement, review the data carefully to identify trends, patterns, and areas for improvement. Analyze your revenues, expenses, and profits to gain insights into your business’s financial performance and make informed decisions to drive growth and profitability.

6. Make Adjustments

If your profit and loss statement reveals areas where you are underperforming or overspending, consider making adjustments to improve your financial performance. This may involve cutting costs, increasing revenues, or restructuring your business operations to achieve your profit goals.

7. Monitor Regularly

Regularly monitoring your profit and loss statement is essential to tracking your business’s financial progress over time. Update your statement on a monthly, quarterly, or annual basis to stay informed about your financial performance, identify emerging trends, and make strategic decisions to achieve long-term success.

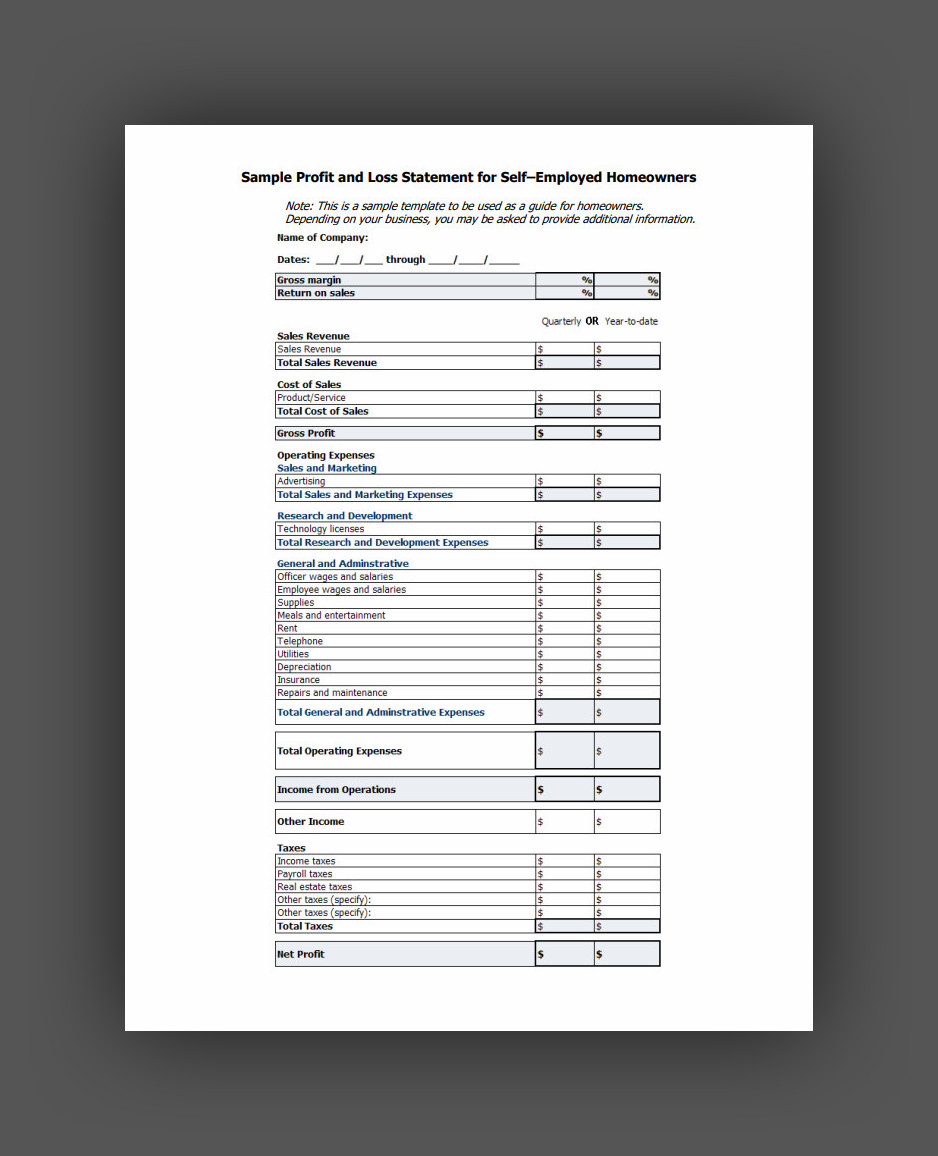

Profit and Loss Statement Template

A profit and loss statement is a valuable tool for self-employed individuals to manage their finances, organize their cash flow, and ensure that they are reaching their business profit goals. By regularly preparing and analyzing this document, you can gain valuable insights into your business’s financial performance and make informed decisions to drive success.

Start using our free profit and loss statement template for self-employed individuals today to track income and expenses, monitor business performance, and make informed financial decisions with ease.

Profit and Loss Statement Template for Self-Employed – Download

- Free Notary Acknowledgement Form Template - February 27, 2026

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026