In the world of charitable giving, a receipt of donation letter plays a crucial role in acknowledging the generosity of donors. Whether you are a nonprofit organization or an individual seeking to support a cause, having a well-crafted donation receipt can make all the difference.

In this comprehensive guide, we will delve into the what, why, and how of receipt of donation letters, providing you with valuable insights and tips for successful implementation.

What is a Receipt of Donation Letter?

A receipt of donation letter is a document issued by a charitable organization to acknowledge a donation made by an individual or entity. This letter serves as a formal confirmation of the donation and provides the donor with important information for tax purposes.

The receipt typically includes details such as the amount of the donation, the date it was made, and the name of the organization receiving the donation.

Elements of a Donation Receipt

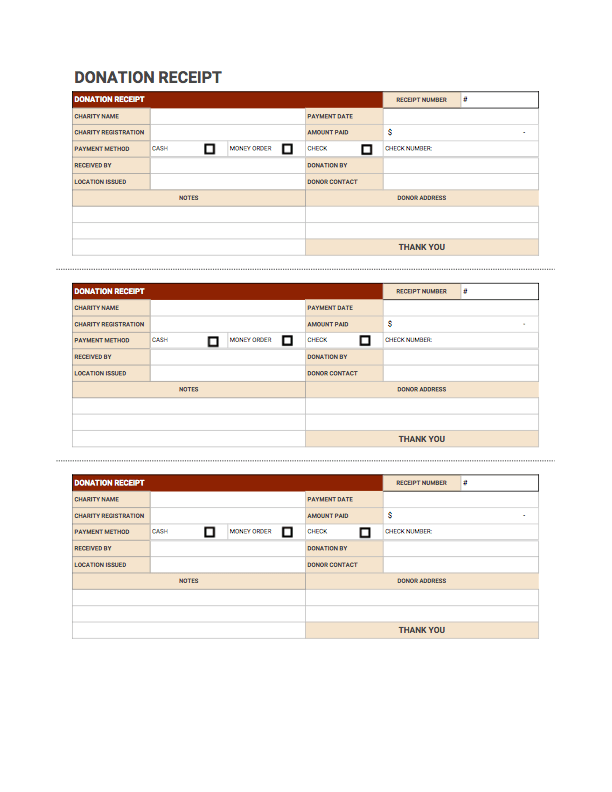

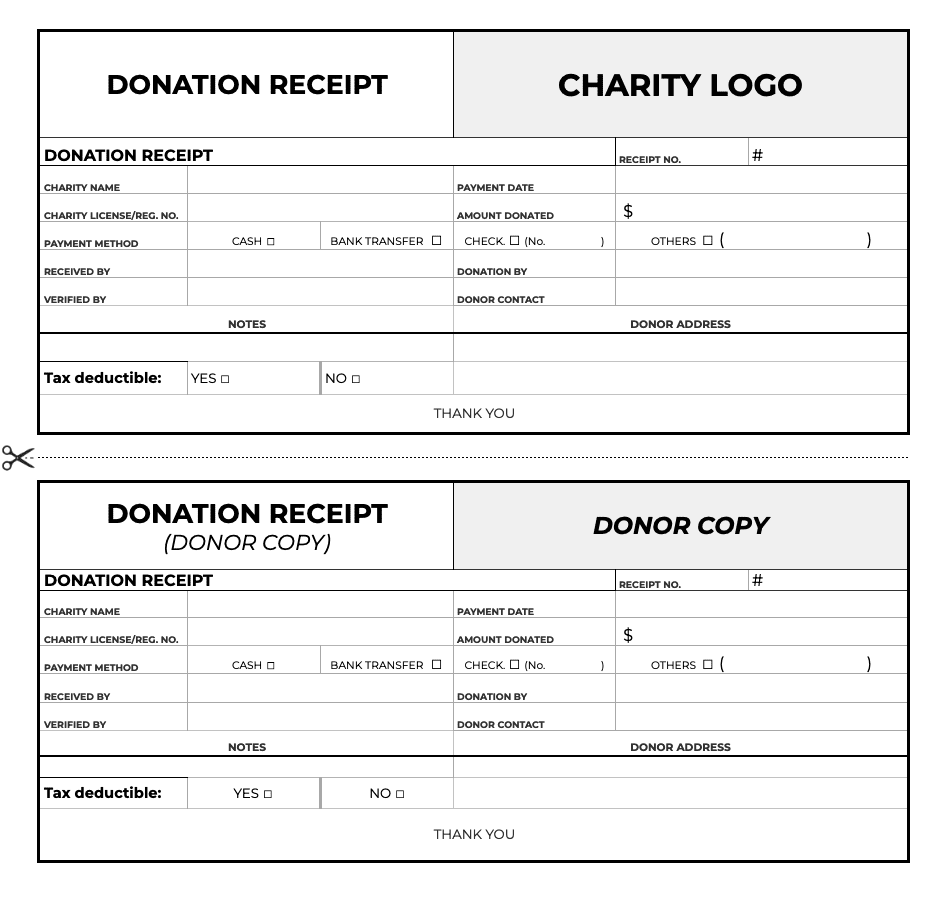

A well-designed donation receipt should include the following key elements:

– Name and contact information of the organization

– Donor’s name and contact information

– Date of the donation

– Amount of the donation

– Description of any goods or services provided in exchange for the donation (if applicable)

– Statement confirming that no goods or services were provided in exchange for the donation (if applicable)

– Signature of an authorized representative of the organization

Why Use a Receipt of Donation Letter?

Using a receipt of donation letter offers several benefits for both donors and organizations. For donors, it provides a tangible record of their charitable giving, which can be helpful when filing taxes. For organizations, it helps build trust and credibility with donors by demonstrating professionalism and transparency in their fundraising practices.

1. Tax Deductibility

Donors who itemize their deductions on their tax returns can claim a deduction for charitable contributions. In order to qualify for this deduction, donors must have documentation to support their donations, such as a valid donation receipt.

2. Donor Recognition

A well-crafted donation receipt is an opportunity to express gratitude to donors and recognize their generosity. By acknowledging their contribution in a thoughtful and personalized manner, organizations can strengthen their relationship with donors and encourage future giving.

How to Create a Receipt of Donation Letter

Creating a receipt of donation letter is a straightforward process that can be customized to suit the needs of your organization. Follow these steps to create an effective donation receipt:

1. Choose a template: Start by selecting a donation receipt template that aligns with your organization’s branding and messaging.

2. Customize the details: Fill in the necessary information, such as the donor’s name, donation amount, and date of the donation.

3. Add a personalized message: Include a brief thank-you message to express appreciation for the donor’s support.

4. Review and finalize: Double-check the receipt for accuracy and completeness before sending it to the donor.

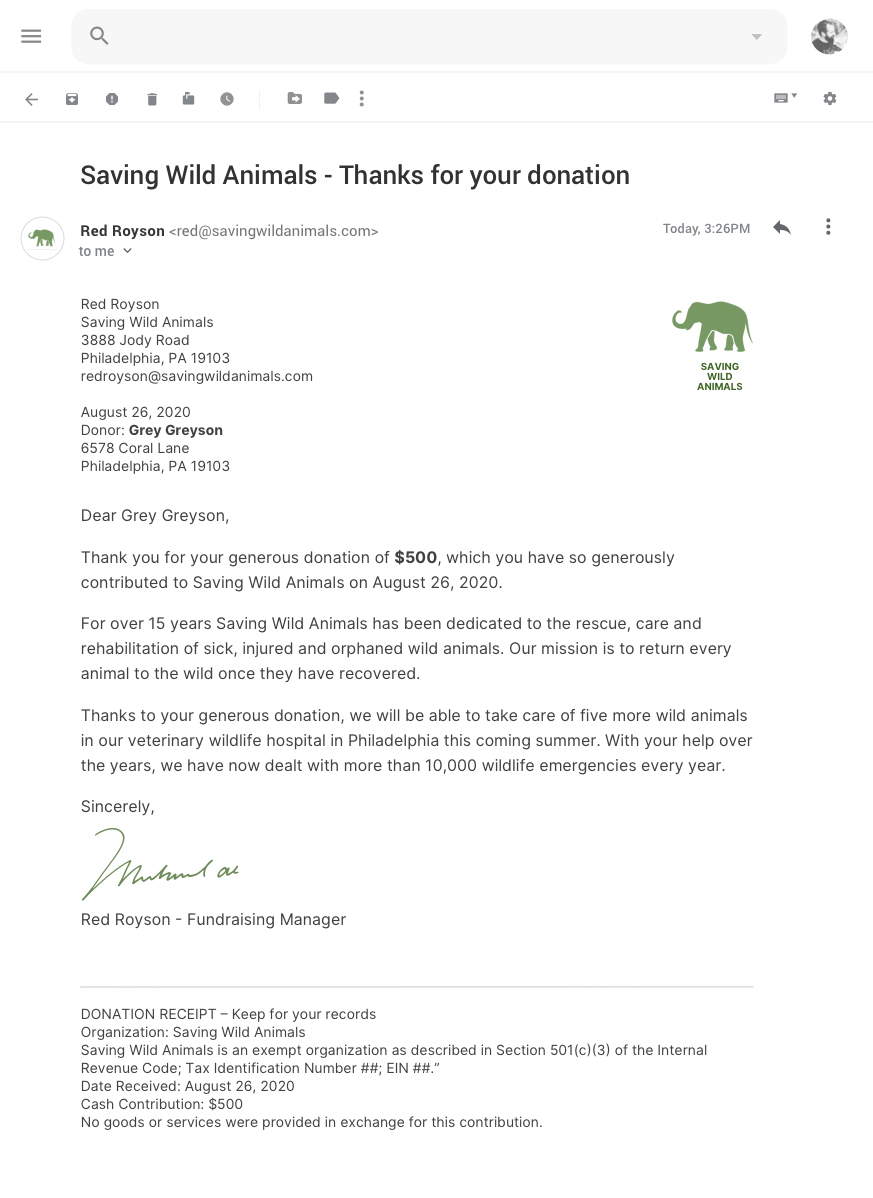

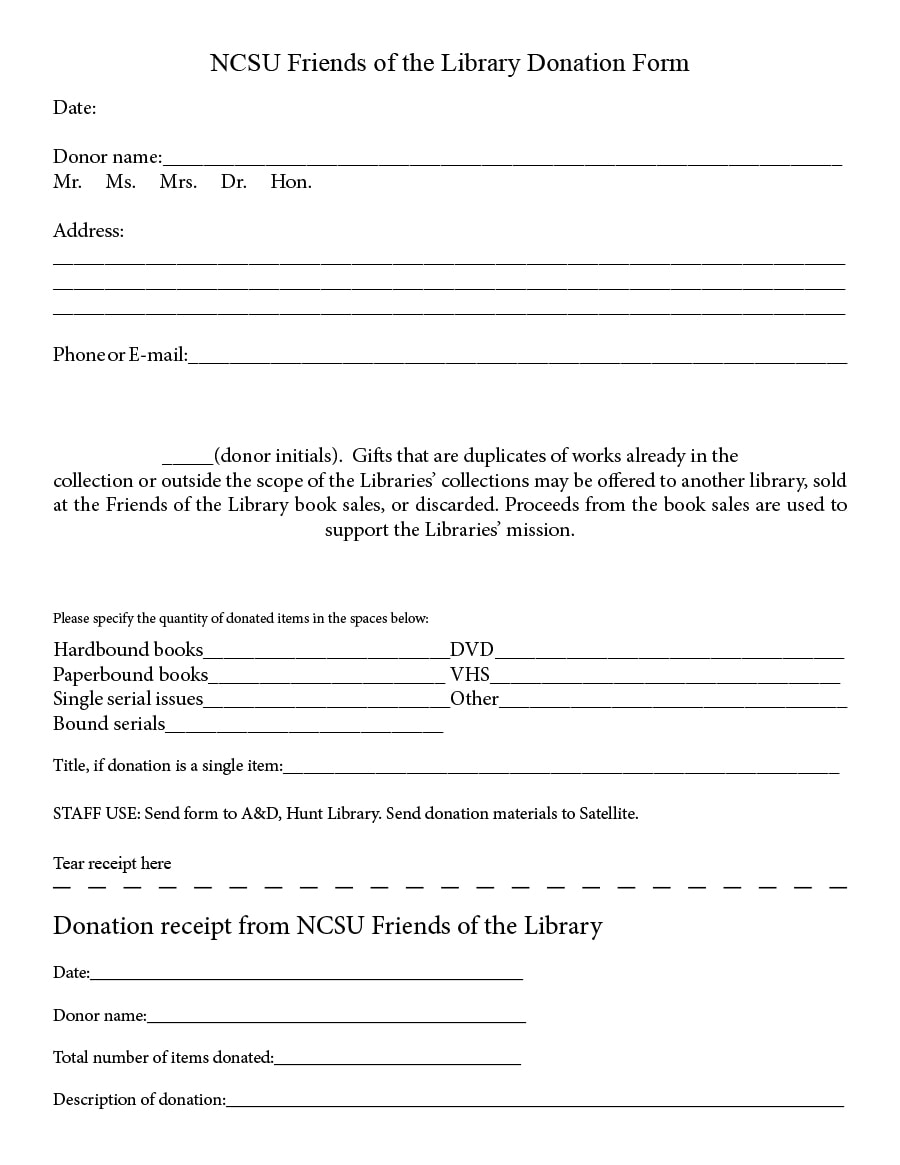

Examples of Receipt of Donation Letters

To help you get started, here are some examples of well-crafted receipt of donation letters:

Tips for Successful Receipt of Donation Letters

When creating receipt of donation letters, keep the following tips in mind to ensure their effectiveness:

– Be timely: Send out donation receipts promptly after receiving the donation to show appreciation and professionalism.

– Be accurate: Double-check all details on the receipt to avoid any errors that could cause confusion or delay in tax filings.

– Be personalized: Include a personalized message or note of thanks to make the donor feel valued and appreciated.

– Be compliant: Ensure that your donation receipts comply with IRS guidelines for tax-deductible charitable contributions.

In conclusion, a well-executed receipt of donation letter is a valuable tool for both donors and organizations in the realm of charitable giving. By following the guidelines outlined in this guide and incorporating best practices, you can create donation receipts that not only fulfill their administrative purpose but also serve as a meaningful gesture of gratitude and recognition for your donors.

Receipt Of Donation Letter Template – Download

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026