Planning an event can be a thrilling experience, but it also comes with its own set of challenges, especially when it comes to managing finances. Creating a detailed event budget is essential for ensuring that your event stays within financial limits while achieving its objectives.

An event budget serves as a financial roadmap, providing control and guidance throughout the planning and execution process. It helps to detail projected income and expenses, allowing for effective resource allocation, risk mitigation, informed decision-making, and the ability to measure the event’s financial success.

What Is An Event Budget?

An event budget is a comprehensive financial plan that outlines all the costs associated with organizing and executing an event, as well as the expected revenue sources. It serves as a roadmap for financial control and guidance throughout the event planning process.

By detailing projected income and expenses, an event budget enables event planners to allocate resources effectively, plan for contingencies, make informed decisions, and measure the event’s financial success.

The Importance Of Budgeting In Event Planning

Creating a budget is a critical step in event planning for several reasons.

Financial Control and Guidance

An event budget provides a roadmap for financial control and guidance throughout the event planning process. It allows event planners to make informed decisions about resource allocation, risk mitigation, and financial management. By having a clear overview of projected income and expenses, event planners can stay within financial limits while achieving their event objectives.

Resource Allocation

Effective resource allocation is crucial in event planning, and a well-managed budget plays a key role in this process. By knowing how much money is available and where it needs to be spent, event planners can allocate resources effectively to ensure that all aspects of the event are adequately funded. This helps in maximizing the impact of the event while staying within budget constraints.

Risk Mitigation

Planning for contingencies is an essential aspect of event budgeting, as it helps to mitigate risks and uncertainties that may arise during the planning and execution of the event. By accounting for unexpected expenses or revenue shortfalls in the budget, event planners can better prepare for unforeseen circumstances and adjust their financial strategy accordingly.

Informed Decision-Making

Having a well-managed budget allows event planners to make informed decisions about financial priorities and investments. By understanding the financial implications of various choices, event planners can allocate resources strategically to achieve the desired outcomes. This helps in ensuring that the event meets its objectives while staying within budget constraints.

Measuring Financial Success

One of the key benefits of creating an event budget is the ability to measure the financial success of the event. By comparing actual income and expenses to the projected budget, event planners can assess the financial performance of the event and identify areas for improvement. This evaluation allows for continuous learning and refinement of budgeting strategies for future events.

What To Include In An Event Budget

When creating an event budget, there are several key elements to include to ensure its effectiveness. These may vary depending on the type and scale of the event, but some common components to consider are:

Venue Costs

Venue costs are often one of the largest expenses in an event budget. This includes rental fees, setup and teardown costs, security deposits, and any additional services provided by the venue. When budgeting for venue costs, it’s essential to consider the location, size, and amenities of the venue to ensure that it meets the needs of the event while staying within budget constraints.

Catering Expenses

Catering expenses encompass food and beverage costs for attendees, as well as any additional services provided by the caterer. When budgeting for catering, it’s important to consider the number of guests, dietary restrictions, and menu options to provide a memorable dining experience within budget limits.

Marketing and Promotion

Marketing and promotion are essential components of any event budget, as they help to attract attendees and generate awareness. This includes costs for advertising, social media promotions, printed materials, and any other marketing efforts. When budgeting for marketing, it’s important to consider the target audience, messaging, and channels to maximize the impact of promotional activities within budget constraints.

Entertainment Expenses

Entertainment expenses include costs for performers, speakers, musicians, or other entertainment options at the event. When budgeting for entertainment, it’s crucial to consider the type of entertainment, duration of performance, and technical requirements to provide a memorable experience for attendees while staying within budget limits.

Staffing Costs

Staffing costs encompass expenses for hiring event staff, security personnel, ushers, or volunteers to ensure the smooth execution of the event. When budgeting for staffing, it’s important to consider the number of staff needed, their roles and responsibilities, and any additional training or equipment required to support the event while staying within budget constraints.

Production Expenses

Production expenses include costs for audiovisual equipment, lighting, sound systems, staging, and other production needs to enhance the overall event experience. When budgeting for production, it’s essential to consider the technical requirements, equipment rentals, and setup costs to create a visually engaging and immersive event environment within budget limits.

Contingency Fund

A contingency fund is an essential component of any event budget to account for unexpected expenses or revenue shortfalls that may arise during the planning and execution of the event. When budgeting for contingencies, it’s important to allocate a percentage of the total budget as a buffer to address unforeseen circumstances and ensure that the event stays within financial limits.

How To Plan Your Event Budget

Creating an effective event budget requires careful planning and attention to detail. Here are seven steps to help you plan your event budget successfully:

Establish Clear Objectives

Before you begin budgeting, establish clear objectives for the event. This includes defining the goals, target audience, desired outcomes, and key performance indicators to guide your budgeting decisions. By setting clear objectives, you can align your budget with the overall vision of the event and ensure that all financial decisions support its success.

Research Costs

Research the costs associated with each aspect of your event, from venue rental to catering to entertainment. This includes obtaining quotes, comparing prices, negotiating discounts, and identifying cost-saving opportunities to optimize your budget. By conducting thorough research, you can ensure that your budget is accurate, realistic, and aligned with the financial requirements of the event.

Determine Revenue Sources

Identify where your revenue will come from, whether it’s ticket sales, sponsorships, donations, or other sources of income. This includes setting revenue goals, developing pricing strategies, creating sponsorship packages, and implementing fundraising initiatives to generate the necessary funds for the event. By diversifying your revenue sources, you can reduce financial risks and increase financial stability for the event.

Create a Detailed Budget Spreadsheet

Develop a detailed budget spreadsheet that outlines all projected income and expenses for the event. This includes itemizing all costs, categorizing expenses, calculating totals, and incorporating contingencies to create a comprehensive financial plan. By creating a detailed budget spreadsheet, you can track your spending, monitor your financial status, and make informed decisions about resource allocation throughout the planning process.

Monitor Spending Closely

Keep track of your spending closely to ensure that you stay within your budget. This includes recording all expenses, updating your budget spreadsheet regularly, tracking variances, and making adjustments as needed to manage costs effectively. By monitoring your spending closely, you can identify potential budget overruns, address financial discrepancies, and maintain financial control throughout the event planning process.

Evaluate the Financial Success of the Event

After the event has taken place, evaluate its financial success by comparing actual income and expenses to your projected budget. This financial evaluation allows you to assess the event’s profitability, identify areas of overspending or underspending, and measure the financial return on investment. By analyzing the financial outcomes of the event, you can gain valuable insights into the effectiveness of your budgeting strategies and make data-driven decisions for future events.

Adjust and Improve for Future Events

Use the insights gained from evaluating the financial success of your event to adjust and improve your budgeting process for future events. This includes identifying lessons learned, analyzing budget variances, implementing best practices, and refining your budgeting techniques to enhance financial performance. By continuously improving your budgeting skills, you can optimize the financial success of your events and achieve better outcomes in the future.

How To Keep Track Of Spending In Your Event Budget

Tracking your spending is essential to ensuring that you stay within your event budget. Here are some tips for effectively monitoring your expenses:

Use a Budget Spreadsheet

Create a detailed budget spreadsheet that outlines all projected income and expenses for the event. This includes itemized costs, estimated revenues, actual expenditures, and budget variances to provide a clear overview of your financial status. By using a budget spreadsheet, you can track spending, analyze financial data, and make informed decisions about resource allocation.

Update Regularly

Update your budget spreadsheet regularly to reflect any changes in spending or income. This includes recording new expenses, updating revenue projections, adjusting budget estimates, and reconciling financial data to ensure accuracy. By updating your budget regularly, you can stay informed about your financial status, identify budget deviations, and take corrective actions as needed.

Monitor Expenses Closely

Keep track of all expenses related to the event to avoid overspending and stay within budget limits. This includes categorizing expenses, tracking receipts, documenting transactions, and analyzing spending patterns to identify cost-saving opportunities. By monitoring expenses closely, you can control your spending, reduce financial risks, and maintain financial discipline throughout the event planning process.

Review Regularly

Review your budget regularly to assess your financial status and make adjustments as needed. This includes comparing actual income and expenses to your projected budget, analyzing budget variances, identifying areas of overspending or underspending, and developing action plans to address financial discrepancies. By reviewing your budget regularly, you can stay on top of your finances, make informed decisions, and optimize your budget for success.

Seek Feedback

Get input from stakeholders, team members, and financial advisors to ensure that you are tracking spending effectively. This includes seeking feedback on budget assumptions, expense categories, revenue projections, and financial reporting to gain different perspectives and insights. By collaborating with others, you can validate your budgeting decisions, address blind spots, and improve your financial management practices.

Adjust as Needed

Be prepared to make adjustments to your budget as unexpected expenses or revenue sources arise. This includes revising budget estimates, reallocating resources, renegotiating contracts, and implementing cost-saving measures to address financial challenges. By being flexible and adaptive, you can respond to changing financial conditions, mitigate risks, and ensure that your event stays within budget constraints.

Learn from Mistakes

Use any budgeting mistakes as learning opportunities to improve your financial planning for future events. This includes analyzing budget deviations, identifying root causes of financial errors, implementing corrective actions, and developing strategies to prevent similar mistakes in the future. By learning from your mistakes, you can strengthen your budgeting skills, enhance financial accountability, and achieve greater success in your event planning endeavors.

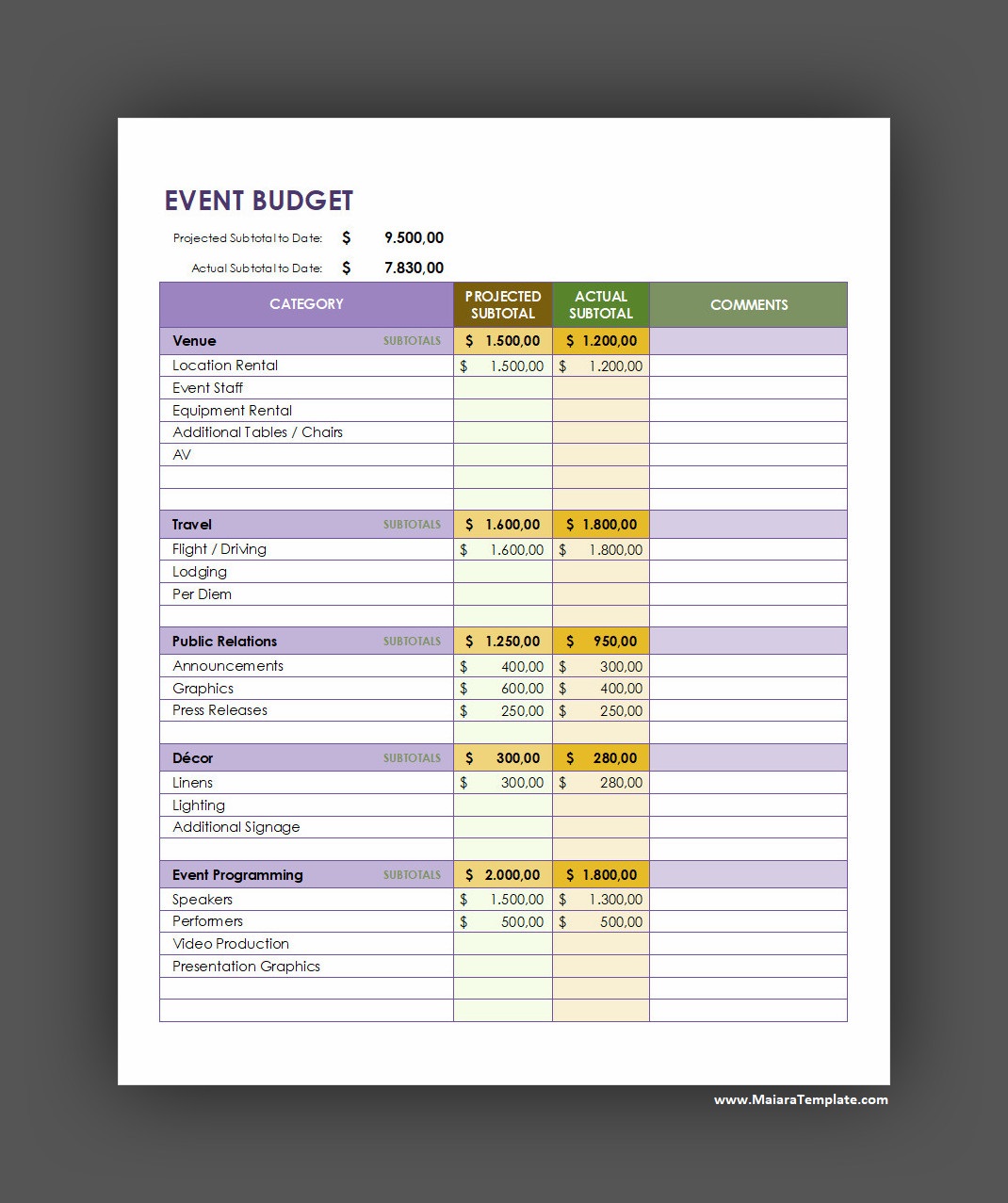

Event Budget Template

An event budget is a practical tool for planning and tracking expenses, from venue and catering to decorations and entertainment. It helps you stay on budget, avoid overspending, and keep your event financially organized.

To make event planning smooth and stress-free, use our free event budget template and manage your expenses with confidence!

Event Budget Template – Excel

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026