What Is a Family Loan Agreement?

A family loan agreement is a legal document that outlines the terms and conditions of a loan between family members. This type of agreement is crucial for maintaining transparency and clarity in financial transactions within families.

By formalizing the loan agreement in writing, both the lender and borrower can protect their interests and ensure a smooth borrowing and repayment process.

Why Document Family Loans?

Documenting family loans is essential for a variety of reasons, each contributing to the overall success and transparency of financial transactions within families. Let’s explore some of the key benefits of documenting family loans in detail:

Clarity and Transparency

One of the primary reasons to document family loans is to ensure clarity and transparency in financial dealings. By outlining the terms of the loan in writing, both the lender and borrower have a clear understanding of the agreement. This transparency helps prevent misunderstandings and disputes that may arise from verbal agreements.

Legal Protection

Documenting family loans provides legal protection for both parties involved. In the event of a dispute or default, a written agreement serves as evidence of the agreed-upon terms. This legal document can be used to enforce the loan agreement and ensure that both parties adhere to their respective responsibilities.

Preservation of Relationships

Clear documentation of family loans can help preserve relationships within the family. By formalizing the borrowing process, family members can avoid conflicts that may arise from misunderstandings or disagreements. A written agreement fosters trust and accountability, contributing to positive relationships among relatives.

Setting Expectations

Documenting family loans helps set clear expectations for both the lender and borrower. By specifying the loan amount, interest rate, repayment schedule, and other terms in writing, individuals know what is expected of them. This clarity reduces the likelihood of confusion or assumptions regarding the loan agreement.

Managing Risks

A documented family loan allows both parties to manage risks associated with the borrowing process. By outlining the consequences of default, late payments, or other breaches of the agreement, individuals can assess and mitigate potential risks upfront. This proactive approach to risk management promotes responsible borrowing and lending practices.

Financial Planning

Documenting family loans is an essential aspect of financial planning within families. Whether the loan is for a specific purpose or general use, having a written agreement in place helps individuals plan for their financial obligations. This strategic approach to financial planning ensures that all family members are aware of their financial commitments.

Legal Compliance

Family loan agreements help ensure legal compliance in financial transactions. By documenting the loan terms and conditions, individuals can adhere to relevant laws and regulations governing lending practices. This legal compliance protects both the lender and borrower from legal implications that may arise from undocumented loans.

Avoiding Misunderstandings

Documenting family loans minimizes the risk of misunderstandings between family members. By clearly articulating the terms of the loan in writing, individuals can avoid confusion or misinterpretations that may occur with verbal agreements. This proactive communication strategy prevents potential conflicts and promotes mutual understanding.

Financial Accountability

Family loan agreements promote financial accountability among family members. By formalizing the borrowing process through a written agreement, individuals commit to fulfilling their financial obligations. This accountability encourages responsible financial behavior and instills a sense of duty toward meeting repayment terms.

Building Trust

Clear documentation of family loans builds trust among family members. By demonstrating a commitment to honoring the terms of the agreement, individuals establish trust and credibility in their financial dealings. This trust is essential for maintaining harmonious relationships and fostering a sense of reliability within the family.

Avoiding Family Conflicts

Documenting family loans helps prevent conflicts within the family. By addressing potential issues upfront through a written agreement, individuals can navigate financial transactions without jeopardizing family relationships. This proactive conflict resolution strategy promotes peace and understanding among relatives.

Common Scenarios Where Documentation Matters

Family loan agreements are particularly crucial in various scenarios where documentation plays a significant role in ensuring financial clarity and security. Let’s explore some common scenarios where documenting family loans is essential:

Large Loan Amounts

When borrowing significant sums of money from family members, having a written agreement is paramount. Large loan amounts require detailed terms and conditions to protect both the lender and borrower. By documenting the loan agreement, individuals can mitigate risks associated with substantial financial transactions.

Business Ventures

Family loans intended for business ventures require clear documentation to outline ownership stakes, investment terms, and profit-sharing agreements. Whether the loan is for startup capital, expansion purposes, or operational costs, having a formal agreement in place ensures that all parties understand their roles and responsibilities in the business venture.

Estate Planning

Family loans may play a significant role in estate planning scenarios. Whether providing financial assistance to heirs, funding trust accounts, or gifting assets to beneficiaries, documenting loans is essential for estate planning purposes. By formalizing loan agreements, individuals can clarify their intentions regarding inheritance and asset distribution.

Real Estate Transactions

Family loans related to real estate transactions, such as home purchases, renovations, or investments, require detailed documentation to protect both the buyer and lender. Real estate transactions involve substantial financial commitments, and having a written agreement in place ensures that all terms and conditions are clearly defined for a smooth transaction.

Education Funding

Family loans intended for education funding, such as tuition fees, books, or living expenses, should be documented to establish repayment terms and expectations. Educational loans often have long repayment periods, and a written agreement helps both the student and lender manage the financial aspects of funding education effectively.

Emergency Financial Assistance

In cases where family members require emergency financial assistance, having a written agreement can help address immediate needs while safeguarding long-term financial stability. Documenting emergency loans ensures that repayment terms are clear and that both parties understand the short-term nature of the financial support provided.

Debt Consolidation

Family loans used for debt consolidation purposes require detailed documentation to outline the debts being consolidated, repayment schedules, and interest rates. By formalizing the loan agreement, individuals can consolidate their debts effectively and manage their finances in a structured manner. This documentation safeguards the borrower and lender in the debt consolidation process.

Healthcare Expenses

Family loans for healthcare expenses, such as medical bills, treatments, or insurance premiums, should be documented to ensure clear repayment terms and responsibilities. Healthcare costs can be unpredictable and burdensome, and having a written agreement in place helps families navigate these financial challenges with transparency and accountability.

Retirement Planning

Family loans used for retirement planning purposes, such as funding retirement accounts, purchasing annuities, or investing in retirement properties, require detailed documentation to protect retirement assets. By formalizing loan agreements, individuals can secure their retirement savings and ensure that future financial goals are met effectively.

Travel and Vacation Funding

Family loans for travel and vacation funding should be documented to establish repayment terms and vacation expenses covered by the loan. Travel expenses can add up quickly, and having a written agreement in place helps individuals manage their vacation finances responsibly. This documentation ensures that all travel costs are accounted for and repaid accordingly.

Legal Fees and Court Costs

Family loans for legal fees and court costs require detailed documentation to specify the legal matters being addressed and repayment arrangements. Legal expenses can be significant, and having a written agreement in place ensures that all parties understand the financial implications of legal proceedings. This documentation protects individuals involved in legal disputes and ensures that legal costs are managed efficiently.

Gifts and Inheritance Advances

Family loans used for gifting or inheritance advances should be documented to clarify the nature of the transaction and repayment expectations. Whether providing financial gifts to family members or advancing inheritance funds, having a written agreement in place helps prevent misunderstandings and disputes over the financial arrangement. This documentation safeguards the interests of both the giver and receiver of the financial assistance.

Personal Loans and Financial Support

Family loans for personal expenses and financial support require clear documentation to outline the purpose of the loan and repayment terms. Whether borrowing money for personal emergencies, lifestyle upgrades, or unexpected expenses, having a written agreement in place helps individuals manage their finances responsibly. This documentation promotes financial accountability and transparency in personal financial transactions.

The Pros and Cons of Family Loan Agreements

Family loan agreements come with their own set of advantages and disadvantages, each impacting the borrowing and lending process within families. Let’s explore the pros and cons of family loan agreements in detail:

Pros

- Clarity and Transparency: Family loan agreements promote clarity and transparency in financial transactions, ensuring that all terms and conditions are clearly defined.

- Legal Protection: Documenting family loans offers legal protection for both the lender and borrower, safeguarding their interests in case of disputes.

- Relationship Preservation: Family loan agreements help preserve relationships by setting expectations and boundaries upfront, preventing conflicts and misunderstandings.

Cons

- Potential Strain on Family Dynamics: Family loan agreements may strain relationships if not handled carefully, leading to tension or conflicts among relatives.

- Complex Repayment Management: Managing repayment schedules and ensuring timely payments can be challenging, especially if there are multiple family loans to track.

- Legal Implications: Incorrectly executed family loan agreements can have legal implications, potentially leading to disputes or financial consequences.

The Essential Elements of a Family Loan Agreement

When drafting a family loan agreement, certain essential elements should be included to ensure clarity, transparency, and legal compliance. Let’s explore the key components that should be present in a family loan agreement:

Loan Amount

The loan amount is a fundamental aspect of any family loan agreement. Clearly specify the exact amount borrowed by the borrower, ensuring there is no ambiguity regarding the sum of money involved in the transaction.

Interest Rate

If applicable, the interest rate should be clearly outlined in the agreement. This includes specifying whether the loan will be interest-free or if interest will be charged on the borrowed amount. The interest rate should be agreed upon by both parties and documented in the agreement.

Repayment Terms

Detail the repayment terms in the family loan agreement, including the repayment schedule, frequency of payments, and the total duration of the repayment period. This section should clearly outline when payments are due and the method by which they should be made.

Default Consequences

Define the consequences of default or late payments in the family loan agreement. This includes specifying any penalties or fees that may be incurred if the borrower fails to adhere to the repayment schedule. Clear consequences help incentivize timely payments and protect the lender’s interests.

Collateral or Security

In some cases, family loan agreements may require collateral or security to guarantee the repayment of the loan. If collateral is involved, it should be clearly identified in the agreement, along with the terms and conditions of its use in the event of default by the borrower.

Signatures of Parties

Both the lender and borrower should sign the family loan agreement to indicate their acceptance of the terms and conditions outlined in the document. Signatures validate the agreement and signify the parties’ commitment to fulfilling their respective obligations.

Witness Signatures

Having witnesses sign the family loan agreement can provide additional legal protection and verification of the document. Witnesses can attest to the authenticity of the agreement and the willingness of both parties to enter into the loan transaction.

Notarization

While not always required, notarizing the family loan agreement can add an extra layer of legal validity to the document. A notary public can verify the identities of the parties involved and ensure that the agreement is executed voluntarily and with full understanding.

Amendment Procedures

Include provisions for amending the family loan agreement if necessary. Circumstances may change over time, and having a process for modifying the agreement can help accommodate unforeseen events or adjustments to the loan terms.

Governing Law

Specify the governing law that will apply to the family loan agreement. This ensures that the agreement is interpreted and enforced according to the laws of a particular jurisdiction, providing clarity and consistency in legal matters related to the loan.

Confidentiality Clause

Consider including a confidentiality clause in the family loan agreement to protect the privacy of both parties. This clause can specify that the terms of the loan agreement are confidential and should not be disclosed to third parties without consent.

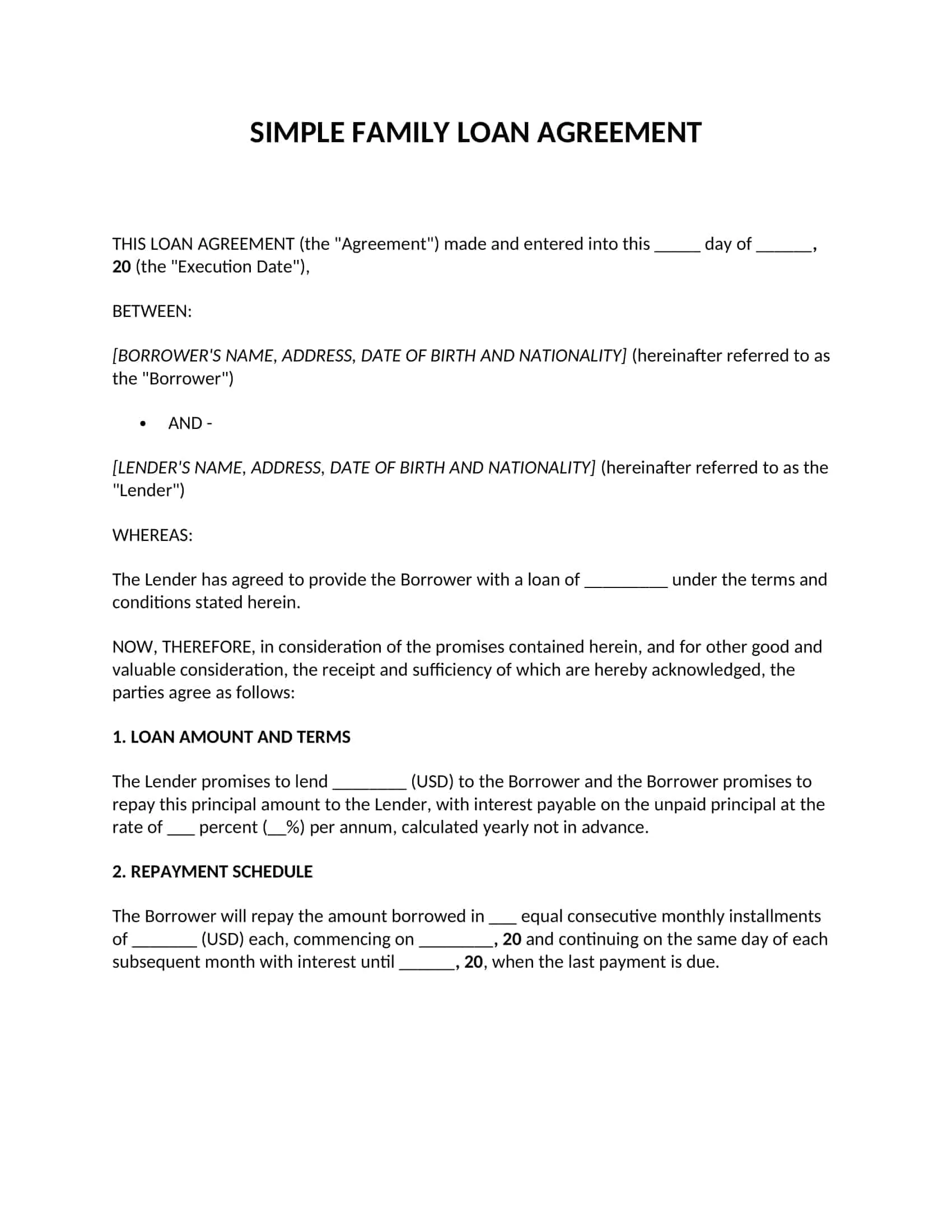

Family Loan Agreement Template – DOWNLOAD

- Home Purchase Agreement Template - January 28, 2026

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026