Have you ever found yourself in a situation where you needed someone to handle your financial or legal matters on your behalf? Whether you’re traveling, in the hospital, or simply unable to manage your own affairs, a general power of attorney can provide a solution.

This legal document grants an agent broad authority to act on your behalf in a wide range of financial and legal matters for a limited time, as long as you still have the mental capacity to manage your own affairs.

Let’s delve deeper into the key aspects of a general power of attorney and how it can be beneficial in various situations.

What is a General Power of Attorney?

A general power of attorney is a legal document that allows you (the principal) to appoint an agent to act on your behalf in financial and legal matters. This authority can include managing bank accounts, signing contracts, buying or selling property, and making medical decisions.

The agent, also known as an attorney-in-fact, is granted broad powers to handle these tasks on your behalf.

Why Would You Need a General Power of Attorney?

There are several situations where having a general power of attorney can be beneficial:

Traveling

When you’re embarking on a journey, whether for business or pleasure, having a general power of attorney in place can provide peace of mind knowing that your affairs are being looked after in your absence. Your agent can manage financial transactions, sign documents, and make decisions on your behalf, ensuring that your affairs continue to run smoothly while you’re away.

Medical Issues

In the event of a medical emergency or incapacity, having a trusted agent with a general power of attorney can be invaluable. Your agent can work with healthcare providers, make medical decisions on your behalf, and ensure that your medical needs are being met according to your wishes. This can alleviate stress and uncertainty during challenging times.

Business Management

If you own a business or have significant financial interests that require ongoing management, a general power of attorney can be a practical solution. Your agent can handle business transactions, sign contracts, and make strategic decisions on your behalf, allowing your business operations to continue smoothly even when you are unable to be physically present. This can be especially helpful during periods of travel or temporary incapacity.

Estate Planning

As part of your overall estate plan, a general power of attorney can play a crucial role in ensuring that your financial and legal affairs are managed according to your wishes. By designating a trusted individual as your agent, you can have peace of mind knowing that someone you trust will oversee your affairs if you are unable to do so yourself. This can be particularly important in situations where timely decision-making is essential.

Key Elements of a General Power of Attorney

When creating a general power of attorney, it’s essential to include the following key elements:

Agent Designation

The first step in creating a general power of attorney is selecting a suitable agent to act on your behalf. Your agent should be someone you trust implicitly, who is capable of managing your financial and legal affairs responsibly. Clearly identify the agent in the power of attorney document, including their full name, contact information, and any specific instructions or limitations regarding their authority.

Duration

Specify the duration for which the general power of attorney will be valid. This can range from a specific period of time to an indefinite duration, depending on your needs and preferences. Consider including provisions that outline the circumstances under which the power of attorney will terminate, such as your regaining mental capacity or passing away. Clarity regarding the duration of the power of attorney can help avoid confusion and ensure that the document is used appropriately.

Specific Powers

Detail the specific powers and responsibilities that the agent will have under the general power of attorney. This may include managing bank accounts, paying bills, signing legal documents, making healthcare decisions, and conducting financial transactions on your behalf. By clearly outlining the scope of authority granted to the agent, you can ensure that they have the necessary powers to carry out your wishes effectively and efficiently.

Revocation Clause

Include a revocation clause in the general power of attorney document that allows you to cancel or revoke the agent’s authority at any time. This clause should clearly state the circumstances under which the power of attorney can be revoked, such as your regaining mental capacity or expressing a desire to terminate the agent’s authority. Having a revocation clause gives you the flexibility to make changes to the power of attorney as needed and ensures that you retain control over your affairs.

Backup Agents

Consider designating one or more backup agents in case your primary agent is unable or unwilling to act on your behalf. This can provide added security and continuity if your primary agent becomes unavailable for any reason. Clearly outline the order in which backup agents will assume responsibility and specify their powers and limitations to avoid any confusion or conflicts in decision-making.

Legal Consultation

Seeking legal advice when creating a general power of attorney is recommended to ensure that the document complies with relevant laws and regulations. An experienced attorney can help you draft a comprehensive and legally binding power of attorney that reflects your wishes and protects your interests. Professional guidance can also help you understand the implications of granting someone else authority over your financial and legal affairs.

Advance Directive

Consider including an advance directive or living will as part of your general power of attorney documents. An advance directive outlines your healthcare preferences and treatment decisions in advance, guiding your agent and healthcare providers if you are unable to communicate your wishes. By combining a general power of attorney with an advance directive, you can ensure that both your financial and healthcare needs are addressed comprehensively.

Regular Review

Reviewing your general power of attorney periodically is essential to ensure that it remains up-to-date and aligned with your current circumstances and preferences. Life changes, such as marriage, divorce, birth of children, or significant financial transactions, may necessitate revisions to the power of attorney document. By regularly reviewing and updating the document as needed, you can ensure that your affairs are managed according to your wishes and in the most effective manner possible.

How to Create a General Power of Attorney

Creating a general power of attorney involves the following steps:

Choose Your Agent

Selecting the right agent to act on your behalf is a crucial decision when creating a general power of attorney. Consider factors such as trustworthiness, reliability, financial acumen, and willingness to take on the responsibilities of managing your affairs. Discuss your expectations and preferences with the chosen agent to ensure that they understand their role and obligations under the power of attorney.

Draft the Document

Consult with an experienced attorney to draft a comprehensive general power of attorney document that reflects your specific needs and preferences. The document should clearly outline the agent’s powers, limitations, duration of authority, and any specific instructions or conditions that apply. Consider including provisions for revocation, backup agents, and advance directives to ensure that your wishes are carried out effectively.

Sign and Notarize

Once the general power of attorney document is drafted, review it carefully to ensure that it accurately reflects your intentions and preferences. Sign the document in the presence of witnesses or a notary public to make it legally valid and enforceable. Notarization provides an added layer of authenticity and verification, enhancing the document’s credibility and ensuring that

Notify Relevant Parties

After signing and notarizing the general power of attorney document, it’s important to notify relevant parties, such as banks, healthcare providers, legal advisors, and other institutions where the agent may need to act on your behalf. Provide copies of the power of attorney to these parties to ensure that they are aware of the agent’s authority and can facilitate their interaction effectively. Keeping key stakeholders informed can help streamline the process of the agent managing your affairs.

Maintain Communication

Establish clear lines of communication with your agent to ensure that they understand your wishes, preferences, and expectations regarding the management of your financial and legal affairs. Regularly discuss any updates or changes to your circumstances that may impact the agent’s responsibilities. Open and transparent communication can help prevent misunderstandings and ensure that the agent acts in accordance with your best interests.

Monitor Activities

Stay informed about the agent’s activities and decisions made on your behalf under the general power of attorney. Review financial statements, transaction records, and any documents signed by the agent to ensure that they are acting in accordance with your instructions. If you have concerns or questions about the agent’s actions, address them promptly to avoid any issues or discrepancies in the management of your affairs.

Update as Needed

As life circumstances change, it may be necessary to update your general power of attorney to reflect new preferences, relationships, or financial arrangements. Review the document periodically and make revisions as needed to ensure that it accurately reflects your current wishes and circumstances. Consult with legal advisors to ensure that any modifications comply with relevant laws and regulations and are legally enforceable.

Seek Professional Guidance

If you have questions or concerns about creating or managing a general power of attorney, seek professional guidance from experienced attorneys who specialize in estate planning and legal matters. Legal professionals can provide valuable insight, advice, and assistance in creating a comprehensive and effective power of attorney document that meets your needs and protects your interests. Professional guidance can help you navigate complex legal issues and ensure that your affairs are managed according to your wishes.

Tips for Successful General Power of Attorney

Here are some tips to ensure a successful general power of attorney arrangement:

Choose Wisely

Selecting the right agent is a critical decision when creating a general power of attorney. Choose someone you trust implicitly, who has the skills, knowledge, and integrity to manage your affairs responsibly. Consider factors such as reliability, communication skills, financial acumen, and willingness to take on the responsibilities of acting as your agent. Discuss your expectations and preferences with the chosen agent to ensure that they understand their role and obligations.

Communicate Clearly

Establish open and transparent communication with your agent to ensure that they understand your wishes, preferences, and expectations regarding the management of your affairs. Clearly articulate your instructions, preferences, and any specific conditions or limitations that apply to the agent’s authority. Regularly discuss any updates or changes to your circumstances that may impact the agent’s responsibilities, and address any questions or concerns promptly to prevent misunderstandings.

Monitor Activities

Stay informed about the agent’s activities and decisions made on your behalf under the general power of attorney. Review financial statements, transaction records, and any documents signed by the agent to ensure that they are acting in accordance with your instructions. If you have concerns or questions about the agent’s actions, address them promptly to avoid any issues or discrepancies in the management of your affairs.

Update as Needed

Regularly review and update your general power of attorney document to ensure that it remains aligned with your current circumstances and preferences. Life changes, such as marriage, divorce, birth of children, or significant financial transactions, may necessitate revisions to the document. Consult with legal advisors to ensure that any modifications comply with relevant laws and regulations and are legally enforceable.

Plan for Contingencies

Consider including provisions for contingencies in your general power of attorney document to address unforeseen circumstances or events that may impact the agent’s ability to act on your behalf. Designate one or more backup agents to ensure continuity of management in case your primary agent is unavailable or unable to fulfill their duties. Clearly outline the order in which backup agents will assume responsibility and specify their powers and limitations to prevent any confusion or conflicts.

Review Regularly

Make it a practice to review your general power of attorney document regularly to ensure that it remains up-to-date and reflects your current wishes and circumstances. Schedule periodic reviews with your legal advisors to discuss any changes or updates that may be necessary. By staying proactive and vigilant in managing your power of attorney, you can ensure that your affairs are handled according to your wishes and in the most effective manner possible.

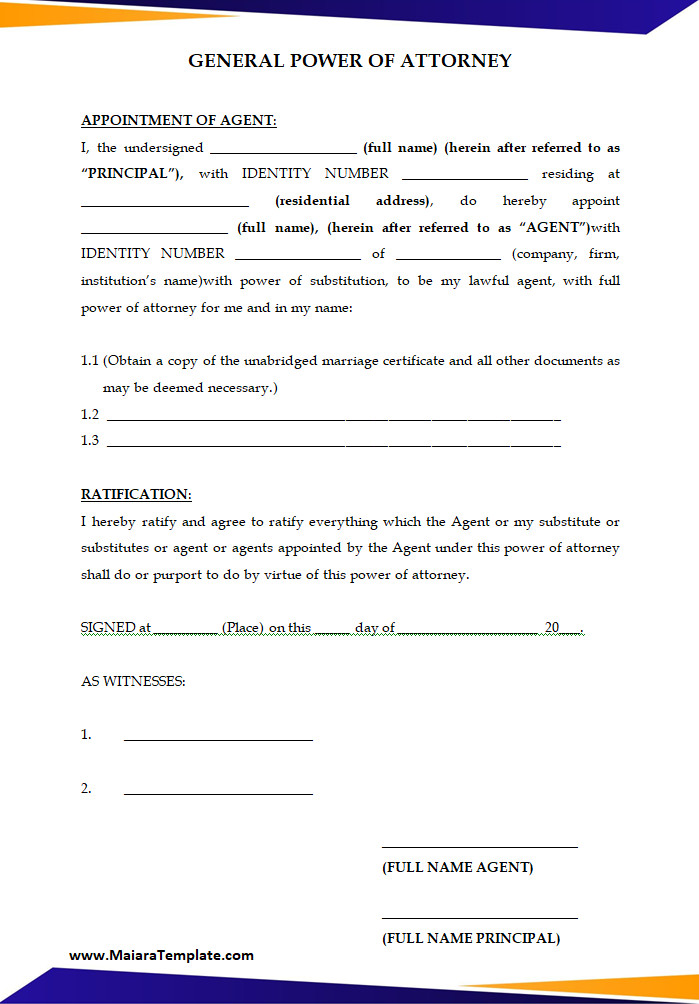

General Power of Attorney Template

A general power of attorney is a legal document that allows you to authorize someone you trust to act on your behalf in financial, legal, or personal matters. It ensures that your affairs are managed smoothly if you’re unavailable or unable to handle them yourself. This template provides clarity, security, and flexibility for both you and your appointed agent.

Download and use our general power of attorney template today to protect your interests, delegate authority confidently, and ensure peace of mind in important decisions.

General Power of Attorney Template – WORD

- Free Notary Acknowledgement Form Template - February 27, 2026

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026