Managing your finances can be a daunting task, but with the right tools and mindset, it can become a powerful way to gain control over your money and achieve your financial goals. One of the most effective ways to take charge of your finances is by creating and sticking to a home budget.

A home budget is a detailed plan that tracks your income and expenses to ensure that your spending does not exceed your earnings. In this guide, we will explore the importance of home budgeting, key elements to consider, and practical tips for successful budgeting.

What is Home Budgeting?

Home budgeting is the process of creating a financial plan that outlines your income sources, expenses, and savings goals. By tracking your income and expenses, you can gain a clear understanding of where your money is going and make informed decisions about your spending habits.

A home budget helps you prioritize your financial goals, whether it’s building savings for emergencies, paying off debt, or saving for a big purchase.

Why Home Budgeting is Important

Home budgeting is essential for several reasons:

- Financial Stability. A home budget helps you live within your means and avoid overspending, ensuring that you have enough money to cover your expenses.

- Savings Building. By tracking your income and expenses, you can identify areas where you can cut back and redirect those funds towards savings goals.

- Reduced Financial Stress. Knowing where your money is going can help alleviate financial stress and anxiety, allowing you to feel more in control of your finances.

- Identifying Bad Spending Habits. A home budget helps identify any unhealthy spending patterns, providing an opportunity to make positive changes and improve your financial situation.

Key Elements of a Home Budget

When creating a home budget, there are several key elements to consider:

- Income. Include all sources of income, such as wages, bonuses, and any other additional income.

- Expenses. List all your expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment.

- Savings Goals. Set specific savings goals for emergencies, retirement, vacations, or any other financial objectives you may have.

- Tracking System. Choose a tracking system that works for you, whether it’s a spreadsheet, budgeting app, or pen and paper method.

How to Create a Home Budget

Follow these steps to create an effective home budget:

1. Calculate Your Income

Start by totaling all your sources of income for a clear picture of your financial resources.

2. List Your Expenses

Record all your expenses, both fixed and variable, to understand where your money is going.

3. Set Savings Goals

Determine your savings goals and allocate a portion of your income towards achieving them.

4. Track Your Spending

Regularly track your expenses to ensure you are staying within your budget and adjust as needed.

5. Review and Adjust

Review your budget regularly and make adjustments to reflect any changes in your financial situation or goals.

6. Stay Disciplined

Stick to your budget and resist the temptation to overspend to achieve your financial goals.

7. Seek Professional Help

If you’re struggling to create or stick to a budget, consider consulting a financial advisor or counselor for guidance and support.

Tips for Successful Home Budgeting

Here are some tips to help you successfully manage your home budget:

- Track Your Spending. Keep a detailed record of your expenses to identify areas where you can save money.

- Automate Your Savings. Set up automatic transfers to your savings account to ensure you prioritize saving.

- Avoid Impulse Purchases. Think twice before making a purchase and consider if it aligns with your budget and financial goals.

- Review Your Budget Regularly. Check in on your budget monthly to make adjustments and stay on track.

- Celebrate Milestones. Reward yourself for reaching savings goals to stay motivated and committed to your budget.

- Stay Flexible. Life can be unpredictable, so be prepared to adjust your budget as needed to adapt to changes in your circumstances.

- Seek Support. Don’t be afraid to ask for help or guidance from financial professionals or friends and family who can offer advice and encouragement.

By implementing a home budget and following these tips, you can gain control over your personal finances, reduce financial stress, and work towards achieving your financial goals.

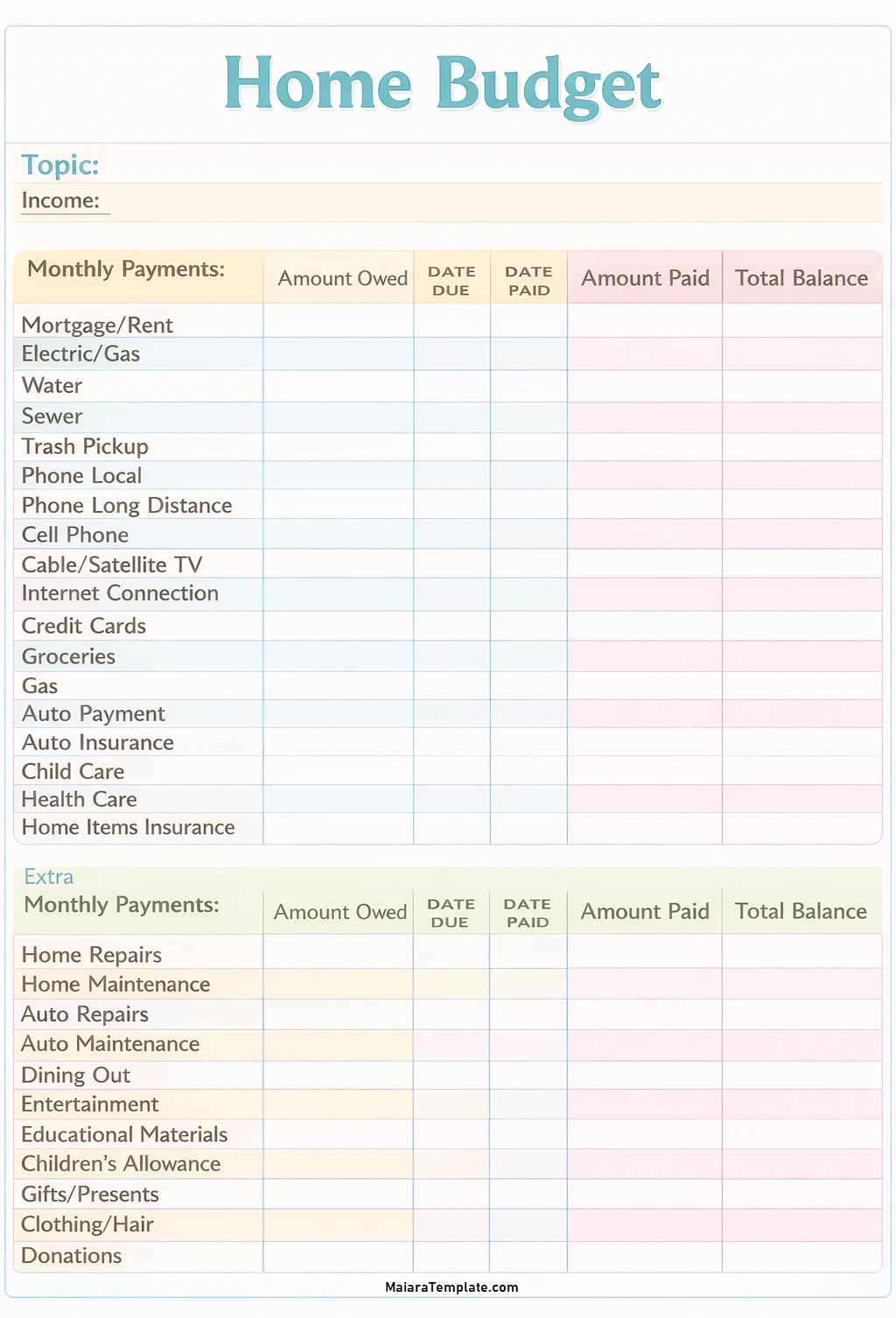

Home Budget Template – DOWNLOAD

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026

- Printable Holiday Party Invitation Template - January 23, 2026