Are you struggling to keep track of your finances? Do you often find yourself worrying about money? Understanding your income and expenses is crucial for financial stability and peace of mind.

In this article, we will delve into the world of income and expenses, providing you with valuable insights and tips to help you take control of your financial situation.

What are Income and Expenses?

Income refers to the money you earn, whether through employment, investments, or other sources. It is the lifeblood of your financial well-being, providing you with the means to cover your expenses and achieve your financial goals. On the other hand, expenses refer to the costs incurred in your day-to-day life, such as rent, groceries, utilities, and entertainment.

Why is Understanding Income and Expenses Important?

Having a clear understanding of your income and expenses is essential for several reasons.

- Firstly, it allows you to create a budget that aligns with your financial goals and helps you manage your money effectively.

- Secondly, it enables you to identify areas where you can save money and cut unnecessary expenses.

- Finally, understanding your income and expenses gives you a sense of financial control and allows you to make informed decisions about your finances.

What to Include in Your Income and Expense Tracking

When tracking your income and expenses, it is important to include all sources of income and every expense, no matter how small. This includes your regular paycheck, side hustle earnings, investment income, rent, utilities, groceries, entertainment, and any other expenditure.

By capturing all aspects of your finances, you will have a comprehensive view of your financial situation and can make informed decisions accordingly.

How to Track Your Income and Expenses

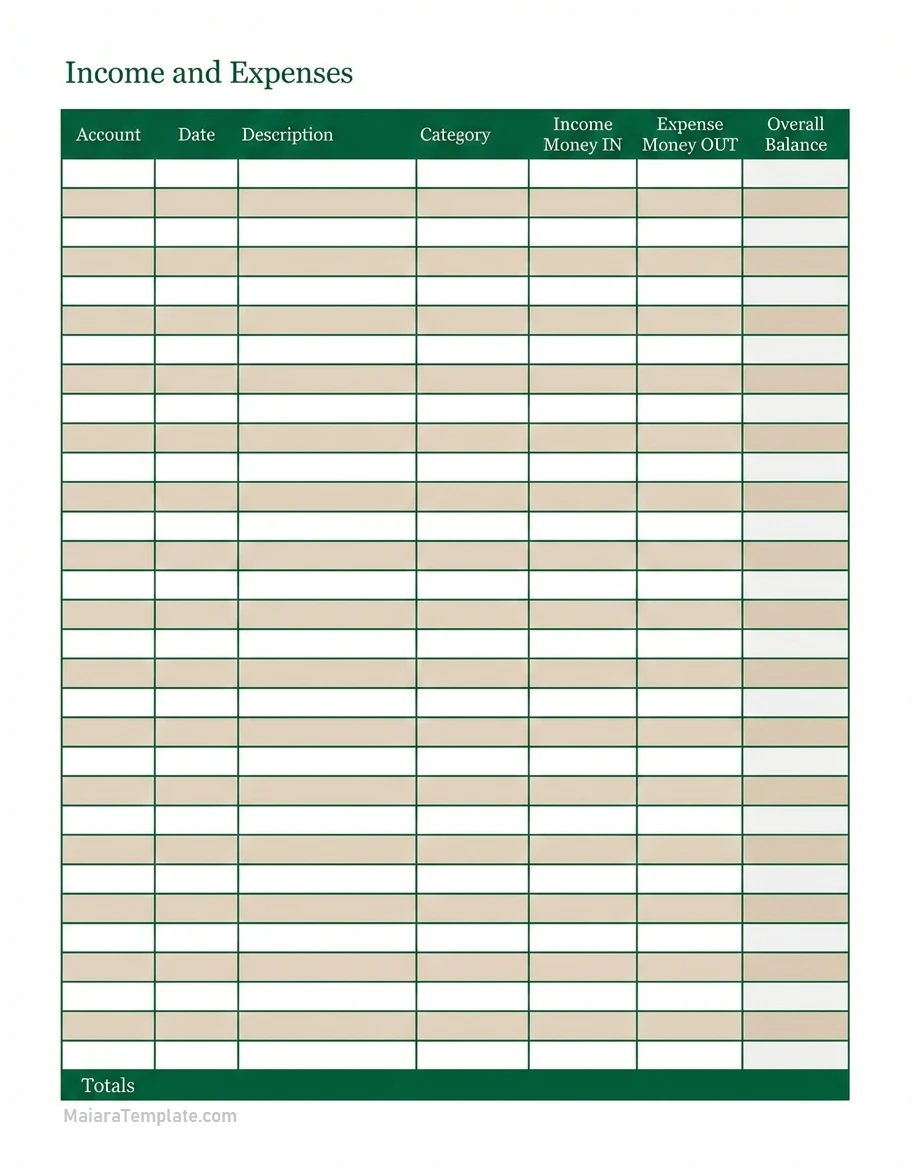

Tracking your income and expenses can be done manually using a spreadsheet or by using budgeting apps and software. Start by listing all your sources of income and categorizing your expenses. Make sure to review your finances regularly and adjust your budget as needed. Consider using tools like Mint, YNAB, or Excel to streamline the process and gain valuable insights into your spending habits.

Tips for Successful Income and Expense Management

- Set Financial Goals: Define your short-term and long-term financial goals to guide your income and expense management.

- Create a Budget: Develop a budget that reflects your income, expenses, and financial priorities.

- Track Your Spending: Monitor your expenses regularly to identify areas where you can cut back and save money.

- Build an Emergency Fund: Save a portion of your income in an emergency fund to cover unexpected expenses.

- Invest Wisely: Consider investing a portion of your income to grow your wealth over time.

- Seek Professional Advice: Consult with a financial advisor or planner to get personalized guidance on managing your income and expenses.

Conclusion

In conclusion, mastering your income and expenses is key to achieving financial stability and peace of mind. By understanding your financial situation, tracking your income and expenses, and following the tips outlined in this guide, you can take control of your finances and work towards your financial goals. Remember, financial success is within reach with the right knowledge and mindset. Start today and pave the way for a secure financial future.

Income And Expense Template – DOWNLOAD

- Free Printable Income And Expense Template - February 17, 2026

- Free Printable Incident Report Template - February 15, 2026

- Independent Contractor Agreement Template - February 15, 2026