Investment agreements are essential documents that outline the terms and conditions of an investment deal between two parties. Whether you are a seasoned investor or a newcomer to the world of investing, understanding the basics of investment agreements is crucial to making informed decisions and protecting your interests.

In this article, we will delve into the what, why, what to include, how to, and tips for successful investment agreements.

What is an Investment Agreement?

An investment agreement is a legal contract between an investor and a company in which the investor provides funding in exchange for equity or a return on investment. These agreements lay out the rights and responsibilities of each party, as well as the terms of the investment deal. They serve as a roadmap for the investment journey, ensuring that both parties are aligned and that expectations are clearly defined.

Investment agreements can encompass a broad range of investment types, including seed funding, venture capital, private equity, and other forms of investment. The specific terms of the agreement will vary depending on the type of investment and the preferences of the parties involved. It is crucial to carefully review and negotiate the terms of an investment agreement to protect your interests and ensure a successful investment partnership.

Why are Investment Agreements Important?

Investment agreements are crucial for several reasons. Firstly, they provide legal protection for both parties involved in the investment deal. By clearly outlining the terms and conditions of the investment, these agreements help prevent misunderstandings and disputes down the line. Additionally, investment agreements help ensure that both parties are on the same page regarding expectations, rights, and obligations.

Furthermore, investment agreements provide a framework for the investment deal, helping to streamline the investment process and facilitate smooth communication between the investor and the company. By setting out the terms of the investment in writing, these agreements help build trust and transparency between the parties, laying the foundation for a successful and mutually beneficial partnership.

What to Include in an Investment Agreement

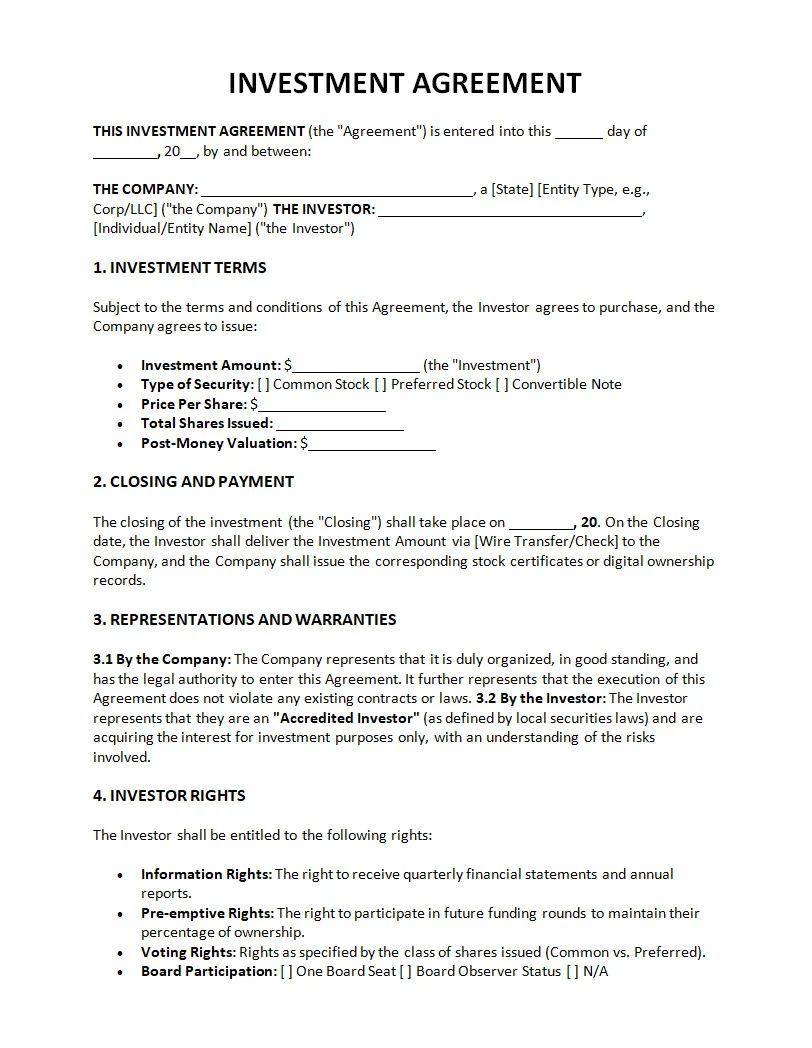

When drafting an investment agreement, there are several key elements that should be included to ensure clarity and protection for both parties. These may include:

- Investment amount and equity stake: Clearly specify the amount of funding being provided by the investor and the equity stake or return on investment they will receive in exchange.

- Terms and conditions: Outline the terms and conditions of the investment, including any milestones, deadlines, or performance metrics that must be met.

- Rights and responsibilities: Define the rights and responsibilities of each party, including voting rights, decision-making authority, and reporting obligations.

- Exit strategy: Detail the exit strategy for the investment, including provisions for buyouts, acquisitions, or IPOs.

- Confidentiality and non-disclosure: Include provisions for confidentiality and non-disclosure to protect sensitive information shared during the investment process.

- Dispute resolution: Specify the process for resolving disputes between the parties, including mediation, arbitration, or litigation.

How to Negotiate an Investment Agreement

Negotiating an investment agreement can be a complex process, but with careful preparation and attention to detail, you can ensure that your interests are protected and your investment is successful. Here are some tips for negotiating an investment agreement:

- Do your research: Before entering into negotiations, thoroughly research the company, its industry, and the terms of the investment deal.

- Seek legal advice: Consult with a lawyer experienced in investment agreements to help you understand the terms of the agreement and protect your interests.

- Communicate openly: Clearly communicate your expectations, concerns, and priorities with the other party to ensure a transparent and productive negotiation process.

- Be flexible: While it is important to advocate for your interests, be open to compromise and creative solutions to reach a mutually beneficial agreement.

- Review the fine print: Carefully review all the terms and conditions of the agreement before signing to ensure that you fully understand and are comfortable with the terms.

Tips for Successful Investment Agreements

When entering into an investment agreement, it is essential to keep the following tips in mind to maximize the success of your investment:

- Build a strong relationship: Cultivate open and honest communication with the other party to build trust and ensure a successful partnership.

- Monitor progress: Stay engaged with the company and monitor the progress of the investment to ensure that it is on track and meeting expectations.

- Seek guidance: Consult with financial advisors, legal experts, and other professionals to help you navigate the complexities of the investment process.

- Stay informed: Stay up to date on market trends, industry developments, and regulatory changes that may impact your investment.

- Prepare for the unexpected: Anticipate potential risks and challenges that may arise during the investment journey and have contingency plans in place to mitigate them.

In conclusion, investment agreements are essential tools for safeguarding your interests and ensuring the success of your investment. By understanding what, why, what to include, how to, and tips for successful investment agreements, you can navigate the investment process with confidence and set yourself up for a fruitful partnership. So, whether you are a seasoned investor or a newcomer, take the time to familiarize yourself with investment agreements and make informed decisions that will benefit you in the long run.

Investment Agreement Template – DOWNLOAD

- Free Influencer Agreement Template - February 13, 2026

- Free Interior Design Agreement Template - February 13, 2026

- Free Printable Interview Schedule Template - February 13, 2026