Marriage is a beautiful union between two individuals, but it is also a legal contract that comes with financial responsibilities. To provide legal protection and financial clarity for couples, many choose to enter into a marriage agreement.

These agreements help regulate assets, debts, and financial responsibilities before or during marriage, ensuring that both parties are protected in the event of divorce or death. By pre-determining how property will be managed and divided, couples can avoid future conflicts and ensure legal certainty.

What is a Marriage Agreement?

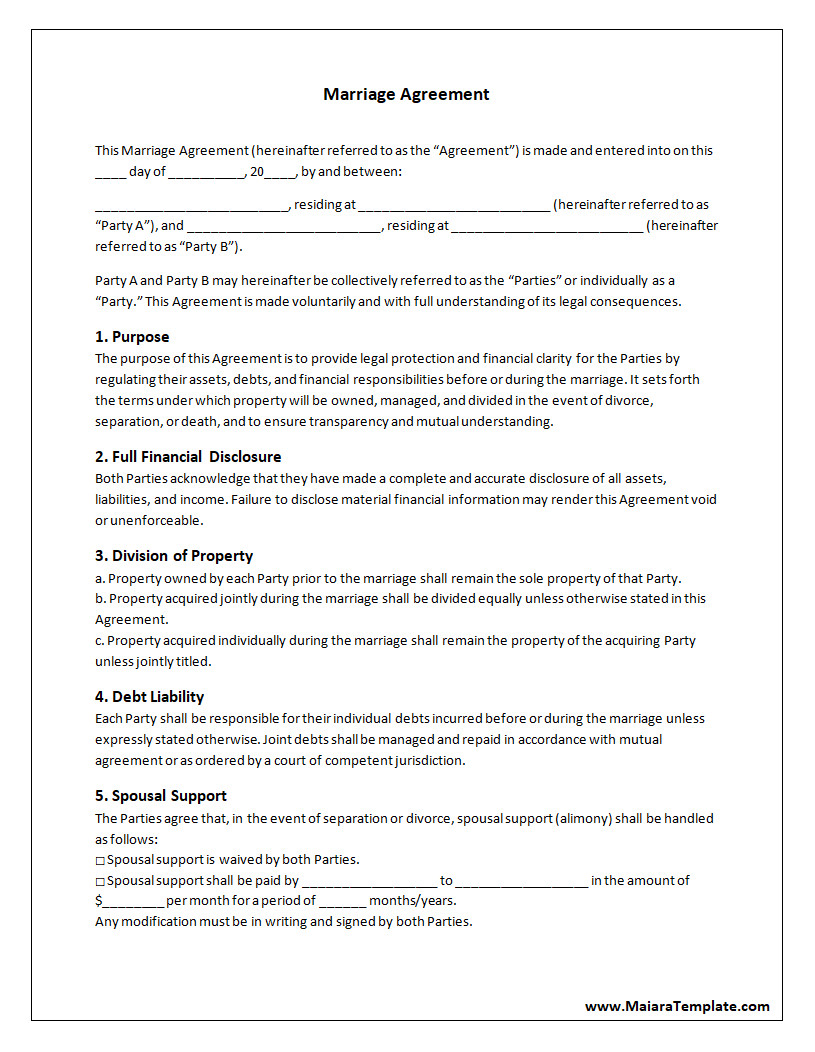

A marriage agreement, also known as a prenuptial agreement or prenup, is a legal document that outlines the financial responsibilities and rights of each spouse before or during the marriage. It allows couples to specify how their property will be managed and divided in the event of divorce or death.

Additionally, a marriage agreement can be used to protect children from previous marriages and provide financial security for both parties.

Why Consider a Marriage Agreement?

There are several important reasons why couples may choose to enter into a marriage agreement:

- Asset Protection: A marriage agreement can safeguard assets acquired before the marriage.

- Debt Protection: It outlines how debts will be handled, protecting each spouse from the other’s debts.

- Financial Clarity: Provides a clear understanding of each spouse’s financial rights and responsibilities, preventing conflicts.

- Child Protection: Ensures children from previous marriages are financially secure and inherit their rightful share.

By addressing these key aspects, a marriage agreement offers security and peace of mind for both partners.

Benefits of a Marriage Agreement

Marriage agreements offer a range of benefits that contribute to a couple’s financial security and overall well-being:

- Asset Division: Clearly defines how assets will be divided, minimizing disputes during divorce.

- Debt Allocation: Specifies how debts will be apportioned, protecting each spouse from taking on excessive debt.

- Business Protection: Safeguards businesses owned by either spouse, preventing complications in case of separation.

- Healthcare Decisions: Addresses medical decisions and healthcare expenses, ensuring clarity in times of need.

By acknowledging these benefits, couples can make informed decisions about establishing a marriage agreement.

What to Include in a Marriage Agreement?

When drafting a marriage agreement, it is crucial to include specific details to ensure comprehensive protection for both parties:

- Asset Inventory: List all assets owned individually or jointly, including real estate, investments, and personal property.

- Debt Inventory: Outline all debts owed by each spouse, such as loans, credit card balances, and mortgages.

- Property Division: Specify how property will be distributed in case of divorce or death, including any provisions for spousal support.

- Child Support: Address financial support for children from previous relationships, covering education, healthcare, and living expenses.

By incorporating these elements, a marriage agreement can offer clarity and protection for all involved.

How to Create a Marriage Agreement

Establishing a marriage agreement involves several key steps to ensure its effectiveness and enforceability:

- Open Communication: Hold open and honest discussions with your partner about your financial goals and concerns.

- Legal Guidance: Consult with a family law attorney to ensure compliance with state laws and create a legally binding document.

- Complete Disclosure: Provide full and accurate information about assets, debts, and financial status to prevent future disputes.

- Regular Review: Periodically review and update the agreement to reflect any changes in your financial situation or relationship status.

By following these steps, couples can create a robust and tailored marriage agreement that meets their specific needs.

Tips for Successful Marriage Agreements

To maximize the effectiveness and success of a marriage agreement, consider the following tips:

- Begin Early: Initiate discussions about a marriage agreement well before the wedding to allow ample time for negotiation and revisions.

- Transparency is Key: Be transparent and forthcoming about your financial situation to build trust and avoid misunderstandings.

- Professional Assistance: Work with a reputable family law attorney to create a comprehensive and legally sound agreement.

- Maintain Communication: Continuously communicate with your partner about financial matters to ensure the agreement remains relevant and effective.

By adhering to these tips, couples can navigate the process of creating a marriage agreement successfully and pave the way for a secure financial future together.

Marriage Agreement Template – WORD

- Home Purchase Agreement Template - January 28, 2026

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026