In today’s digital age, the importance of keeping track of financial transactions cannot be overstated. Whether you are a business owner, freelancer, or simply managing your personal finances, having a record of payments made and received is crucial. One way to ensure you have a reliable record of transactions is by utilizing receipts of payment.

In this comprehensive guide, we will explore what receipts of payment are, why they are important, how to create them, examples of different types of receipts, and tips for successful implementation.

What are Receipts of Payment?

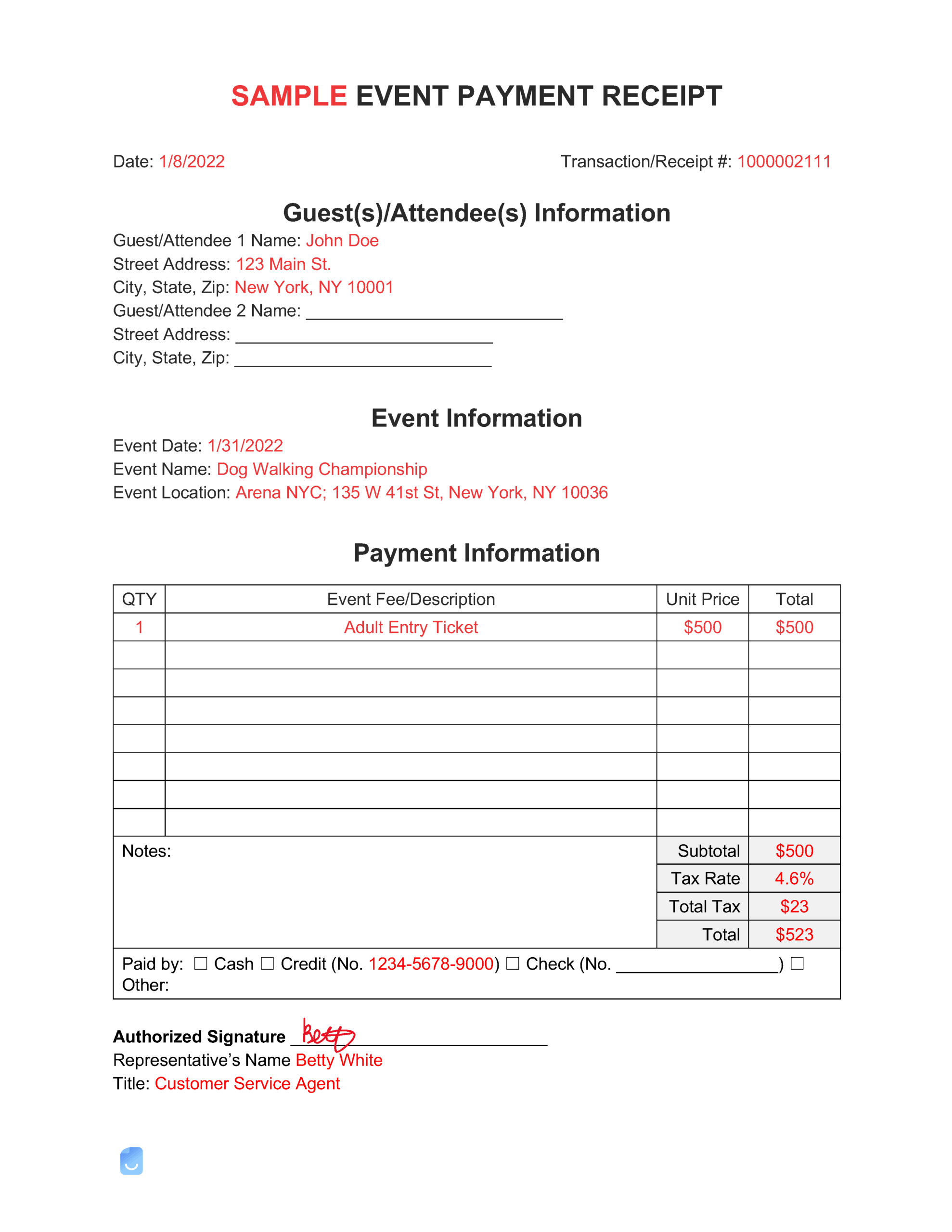

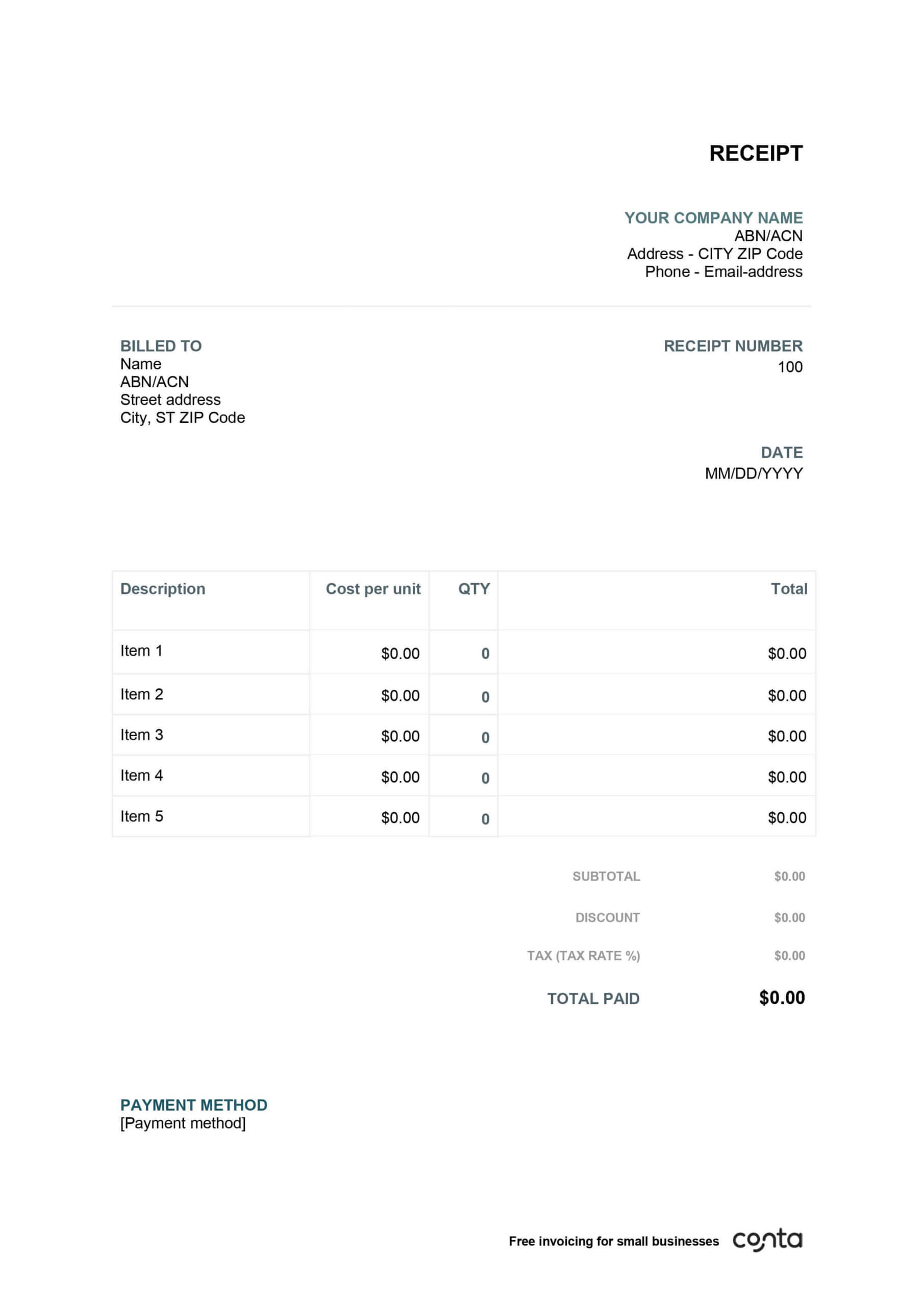

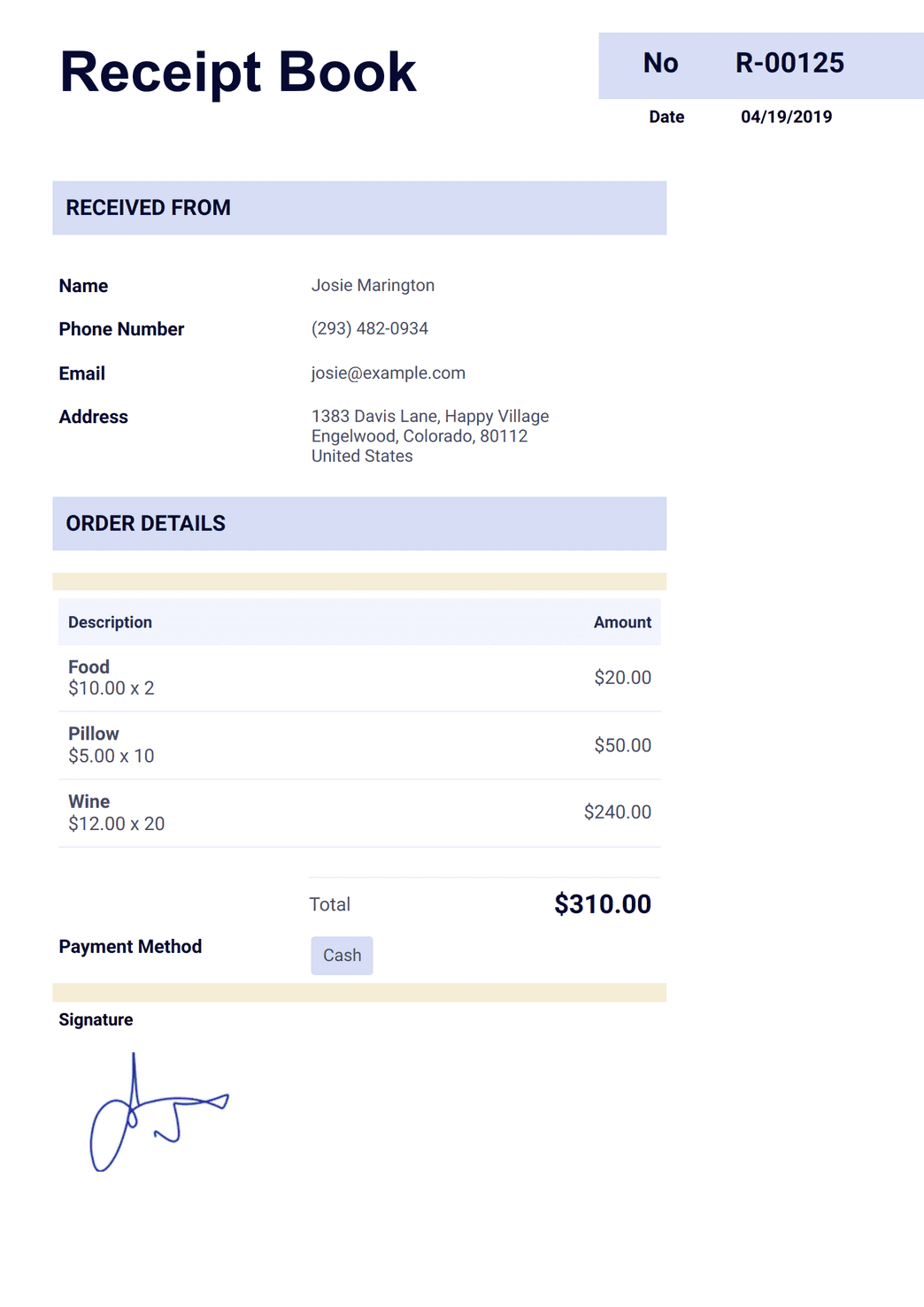

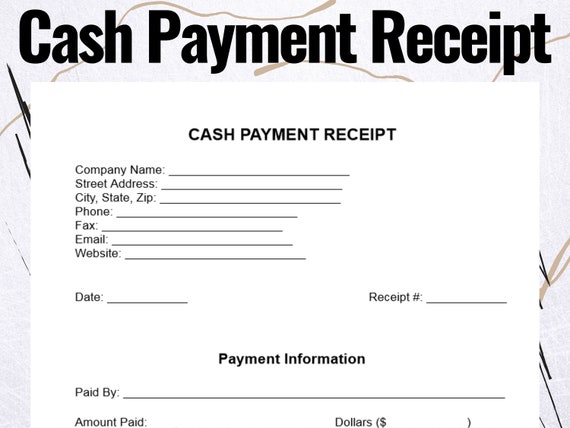

Receipts of payment are physical or digital documents that serve as proof of a financial transaction between two parties. They typically include details such as the date of the transaction, the amount paid, the method of payment, and the names of the payer and payee. These receipts can be generated by businesses, individuals, or organizations to provide evidence of a payment made or received.

Receipts of payment can come in various formats, including traditional paper receipts, PDF files, or digital images that can be easily printed or shared electronically. They serve as a record-keeping tool to track financial transactions and ensure accurate accounting.

Importance of Receipts of Payment

Receipts of payment play a crucial role in financial record-keeping for several reasons:

– They provide proof of payment for goods or services rendered.

– They help track expenses and income for budgeting and tax purposes.

– They can serve as evidence in case of disputes or discrepancies.

– They contribute to maintaining transparency and accountability in financial transactions.

Benefits of Using Receipts of Payment

There are several benefits to using receipts of payment:

– Organization: receipts help keep financial records organized and easily accessible.

– Compliance: They ensure compliance with tax regulations and accounting standards.

– Professionalism: Providing receipts to customers or clients enhances your professional image.

– Security: receipts can be stored securely for future reference.

How to Create Receipts of Payment

Creating receipts of payment is a straightforward process that can be done using various tools and templates. Here are the steps to create a receipt:

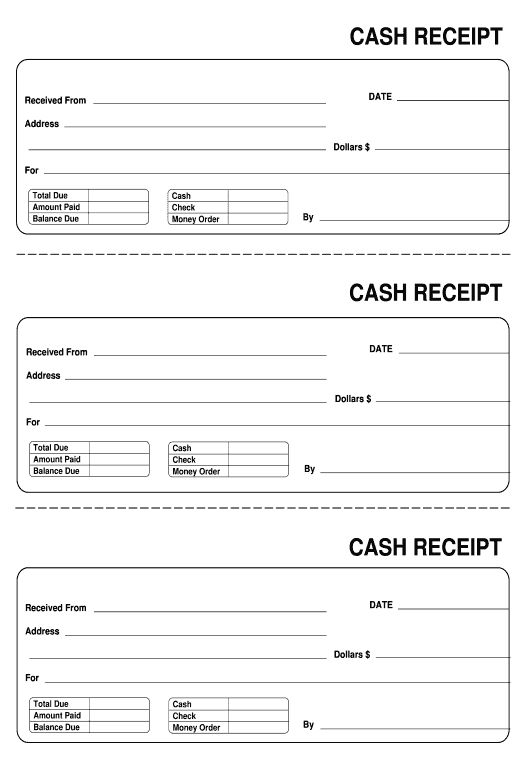

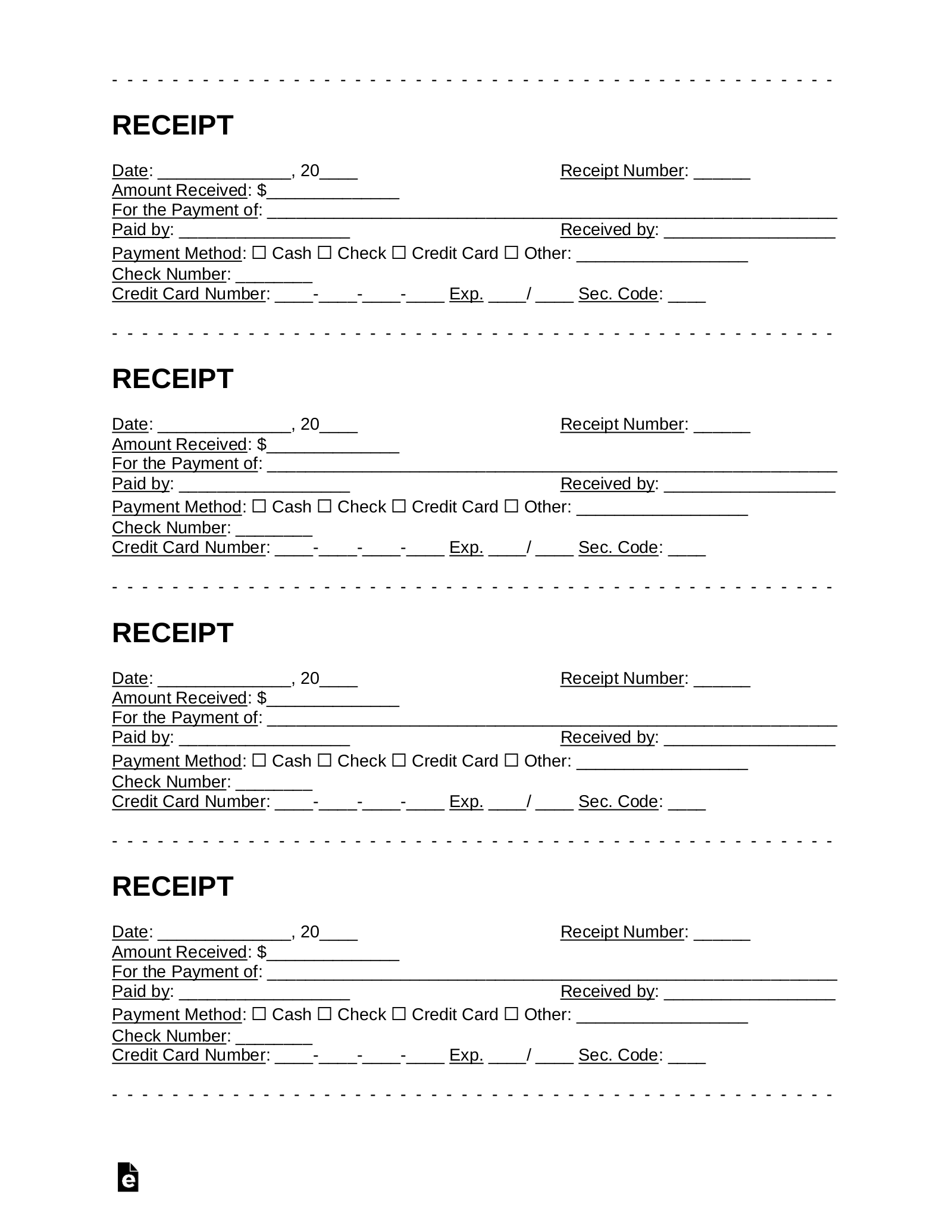

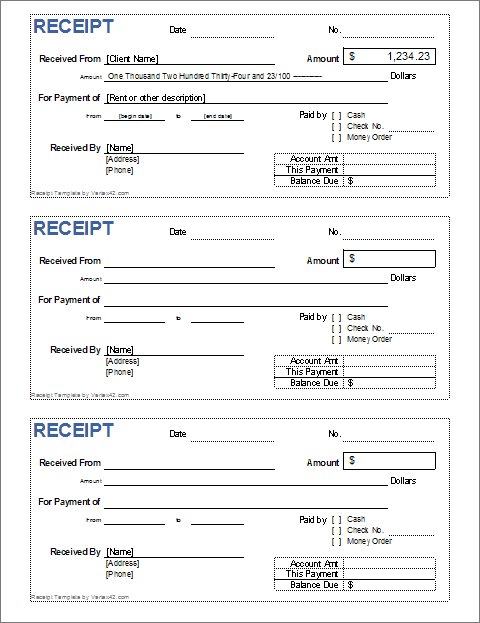

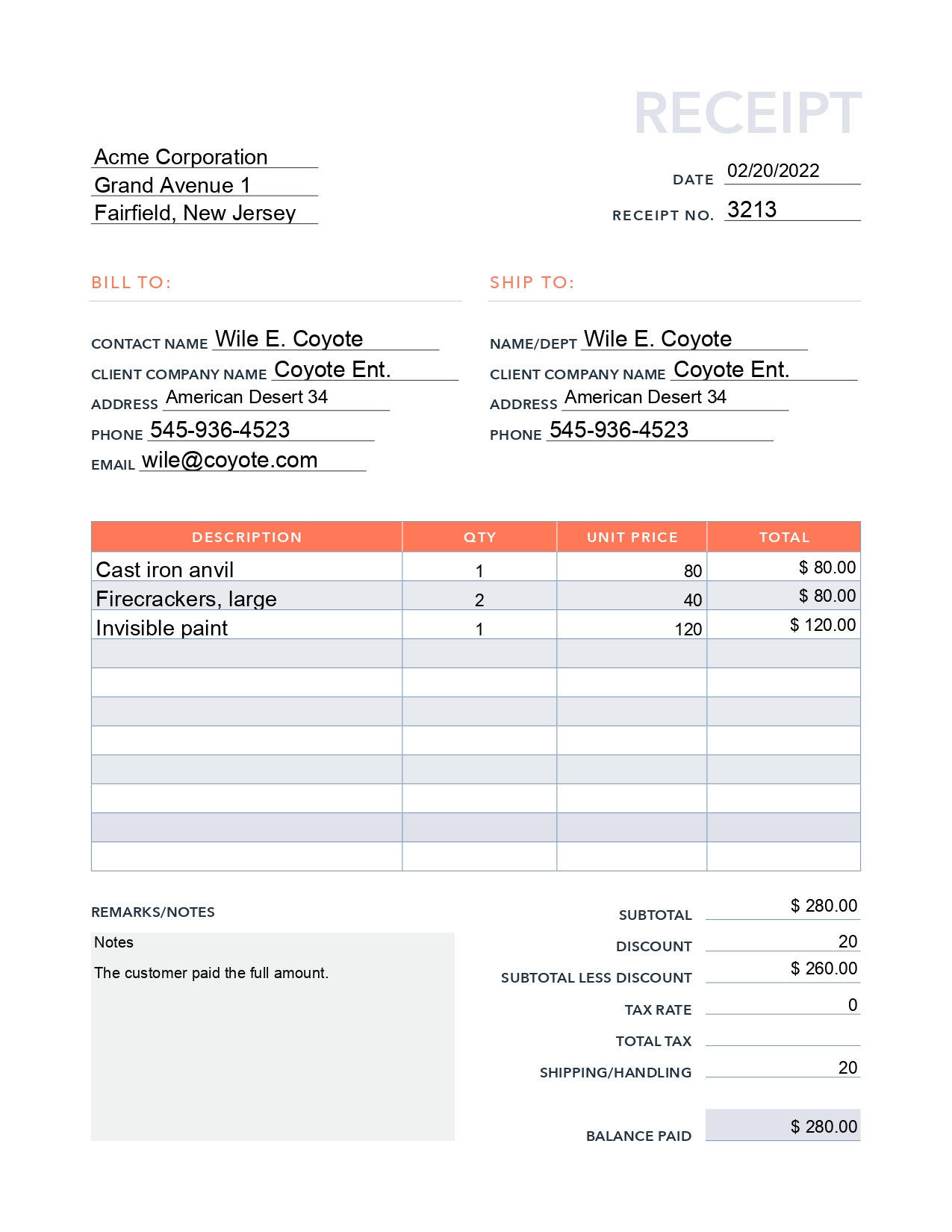

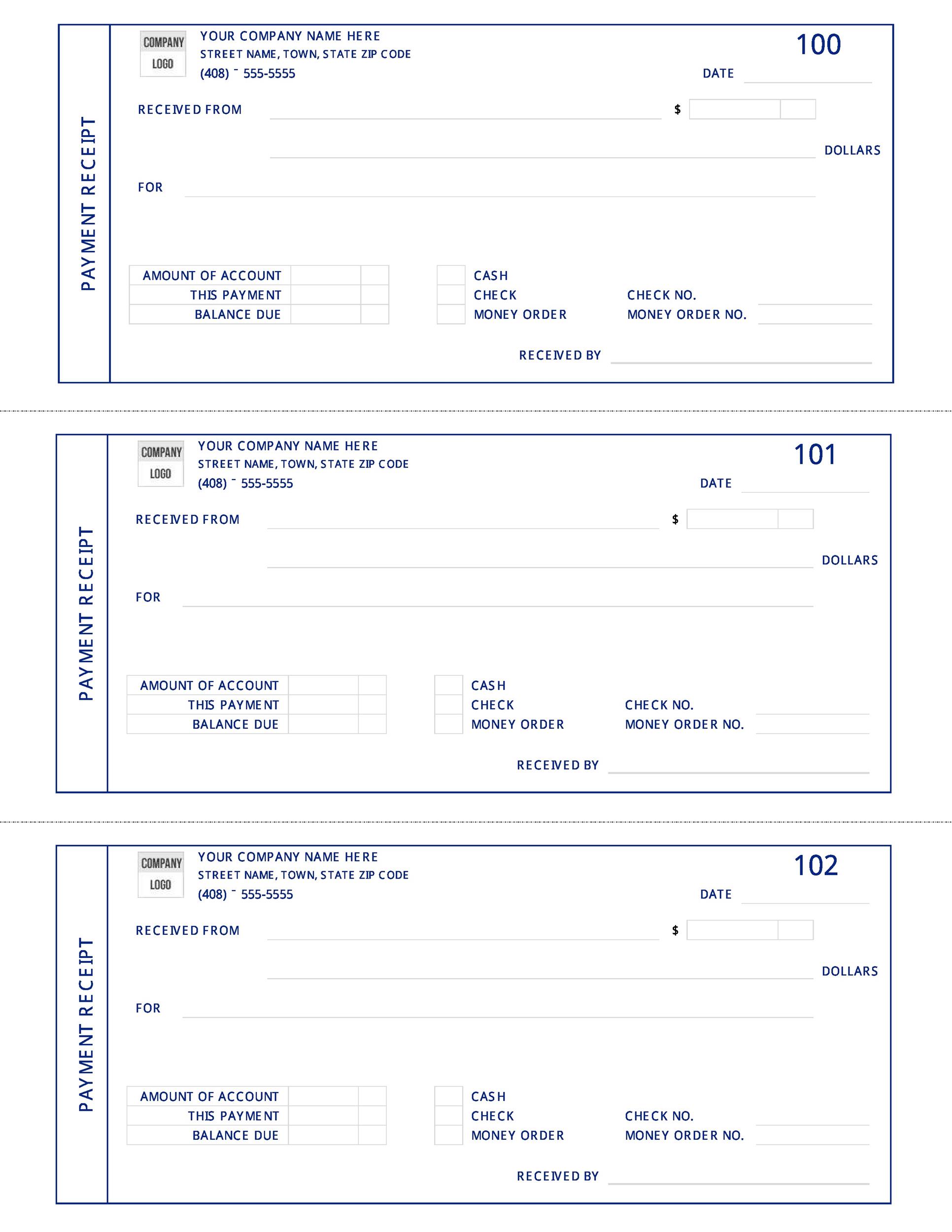

1. Choose a template: Select a receipt template that suits your needs, whether it’s a simple design or a more detailed format.

2. Enter transaction details: Fill in the date of the transaction, amount paid, payment method, and other relevant information.

3. Customize the receipt: Add your business logo, contact information, and any other branding elements to personalize the receipt.

4. Save and print: Save the receipt as a PDF file or print it directly for physical copies.

5. Distribute the receipt: Provide a copy of the receipt to the payer and keep a copy for your records.

Examples of Receipts of Payment

There are various types of receipts of payment that can be used in different situations. Some common examples include:

– Sales receipt: Issued by businesses to customers for goods or services purchased.

– Rent receipt: Given to tenants as proof of rent payment to landlords.

– Donation receipt: Provided to donors by nonprofit organizations for contributions.

– Invoice receipt: Sent by vendors to clients as a request for payment.

Each type of receipt serves a specific purpose and includes unique details relevant to the transaction.

Tips for Successful Implementation of Receipts

To make the most of receipts of payment, consider the following tips:

– Keep a record of all receipts in a secure and easily accessible location.

– Regularly review and reconcile receipts with financial statements to ensure accuracy.

– Provide clear and detailed receipts to customers or clients for transparency.

– Use software or apps to streamline the receipt creation and management process.

By following these tips, you can effectively utilize receipts of payment to track financial transactions and maintain accurate records.

In conclusion, receipts of payment are a valuable tool for businesses, individuals, and organizations to track financial transactions, maintain accurate records, and ensure transparency in their financial dealings. By understanding the importance of receipts, knowing how to create them, exploring examples of different types, and implementing best practices, you can effectively use receipts to manage your finances successfully.

Receipt Of Payment Template – Download

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026