Being a student can be a challenging yet exciting time in one’s life. It’s a period where you’re gaining knowledge, meeting new people, and experiencing new things. However, it’s also a time when you need to start taking control of your finances and planning for your future. One effective way to achieve financial stability as a student is by creating a student budget.

This budget will help you manage your expenses, save money, and work towards your short-term, mid-term, and long-term financial goals.

What is a Student Budget?

A student budget is a tool that helps you track your income and expenses, set financial goals, and plan your spending. It provides you with a clear picture of where your money is coming from and where it’s going.

By using a student budget, you can make informed decisions about your finances and ensure that you’re on the right track to achieve your financial goals.

Why is a Student Budget Important?

A student budget is important for several reasons:

- Financial Awareness: Creating a budget makes you aware of your financial situation. It helps you understand how much money you have, how much you’re spending, and where you can make adjustments to save more.

- Goal Setting: A budget allows you to set specific financial goals. Whether it’s saving for a vacation, paying off student loans, or building an emergency fund, a budget helps you allocate your money towards these goals.

- Financial Stability: By tracking your income and expenses, a budget helps you maintain financial stability. It ensures that you’re not overspending and helps you avoid debt or financial struggles in the future.

- Decision Making: With a budget, you can make informed decisions about your spending. You can prioritize your needs, cut back on unnecessary expenses, and make choices that align with your financial goals.

- Long-Term Planning: A budget allows you to plan for the future. It helps you save for big-ticket items like a car or a down payment on a house. It also enables you to start investing and build wealth over time.

How to Create a Student Budget?

Creating a student budget is a straightforward process. Here are the steps to get started:

- Calculate Your Income: Determine how much money you have coming in each month. This can include income from a part-time job, scholarships, grants, or allowances from parents.

- List Your Expenses: Make a list of all your expenses, including tuition fees, rent, utilities, transportation, groceries, entertainment, and any other recurring expenses you have.

- Categorize Your Expenses: Group your expenses into categories such as housing, transportation, food, entertainment, and savings. This will help you see where your money is going.

- Assign a Dollar Amount: Allocate a specific dollar amount to each category based on your income and priorities. Be realistic and make sure to leave room for savings and unexpected expenses.

- Track Your Spending: Keep track of your actual expenses by recording them in your budget. This will help you stay accountable and make adjustments if needed.

- Review and Adjust: Regularly review your budget and make adjustments as necessary. If you notice that you’re overspending in certain categories, find ways to cut back or reallocate your money.

- Monitor Your Progress: Monitor your progress towards your financial goals. Celebrate your successes and make changes if you’re not on track. A budget is a dynamic tool that can be adjusted as your circumstances change.

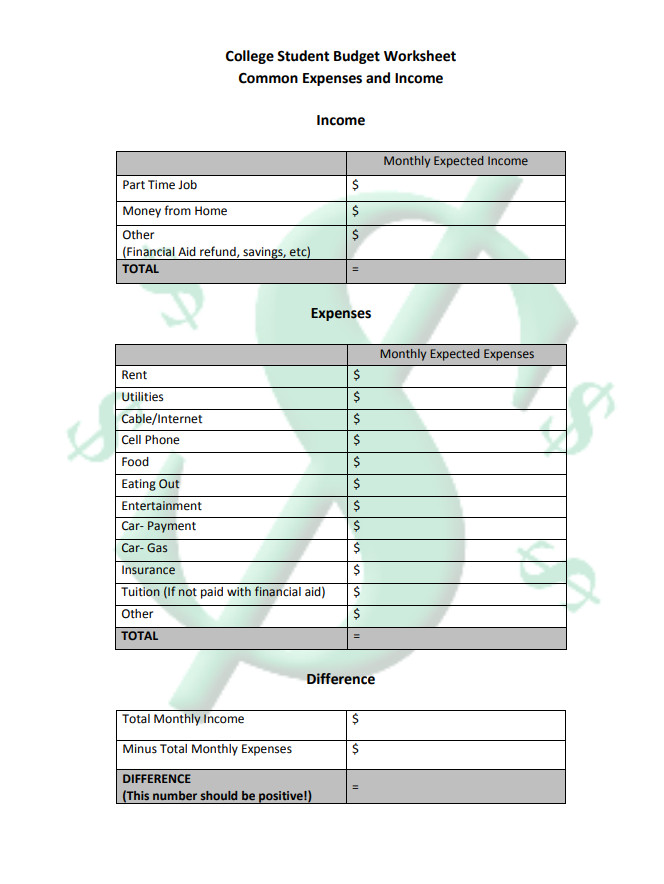

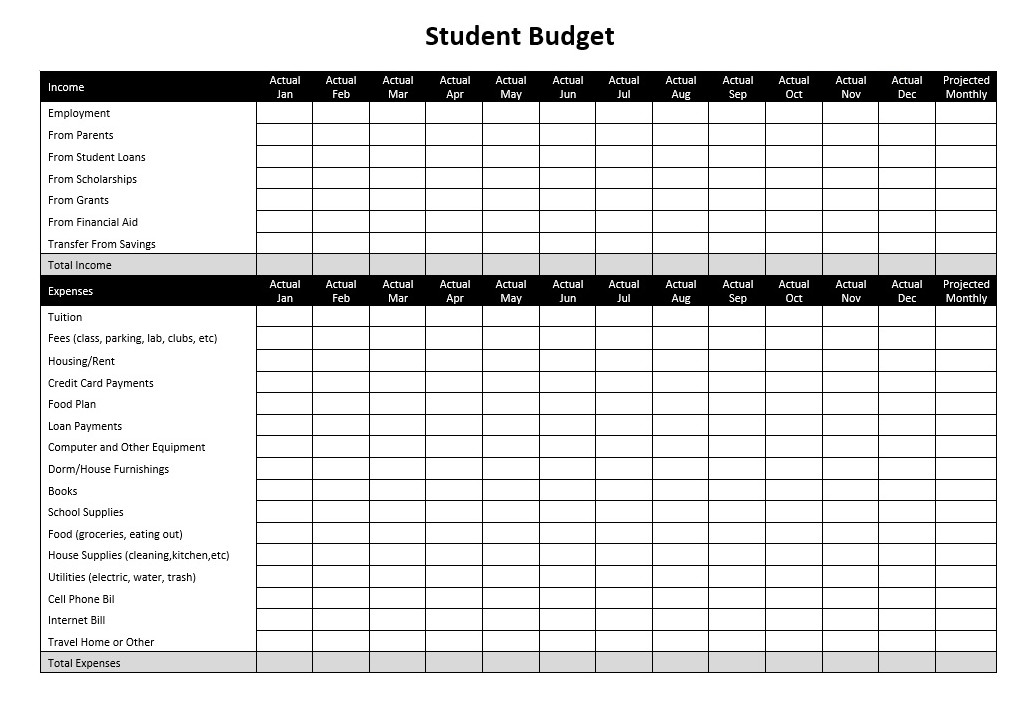

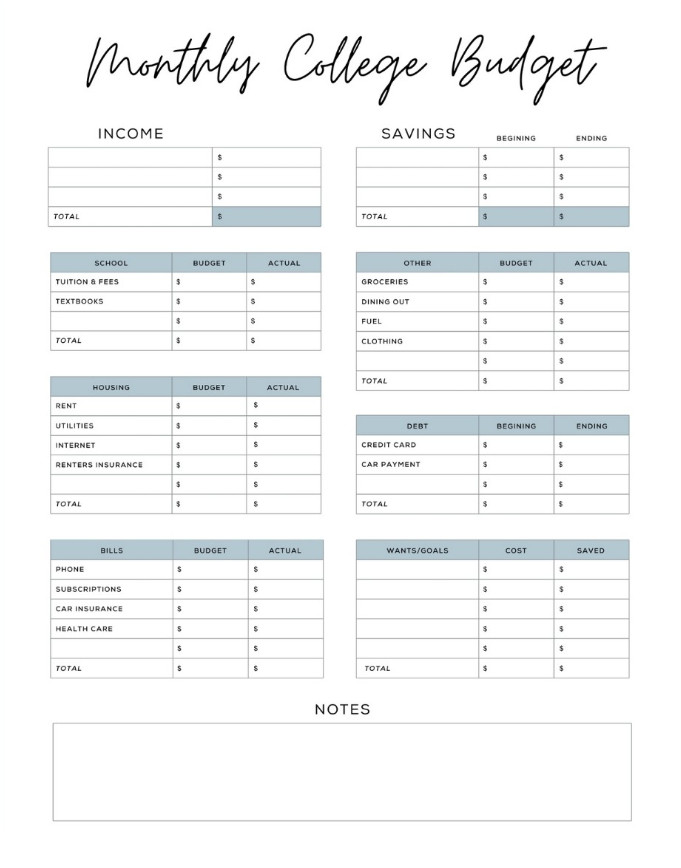

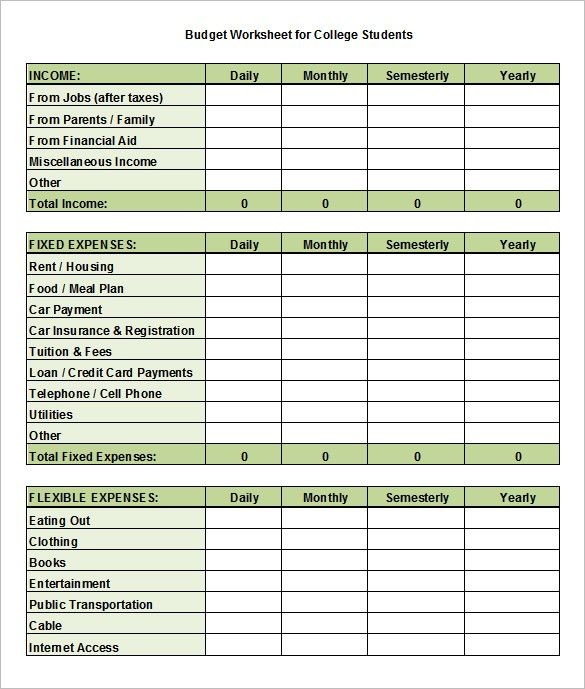

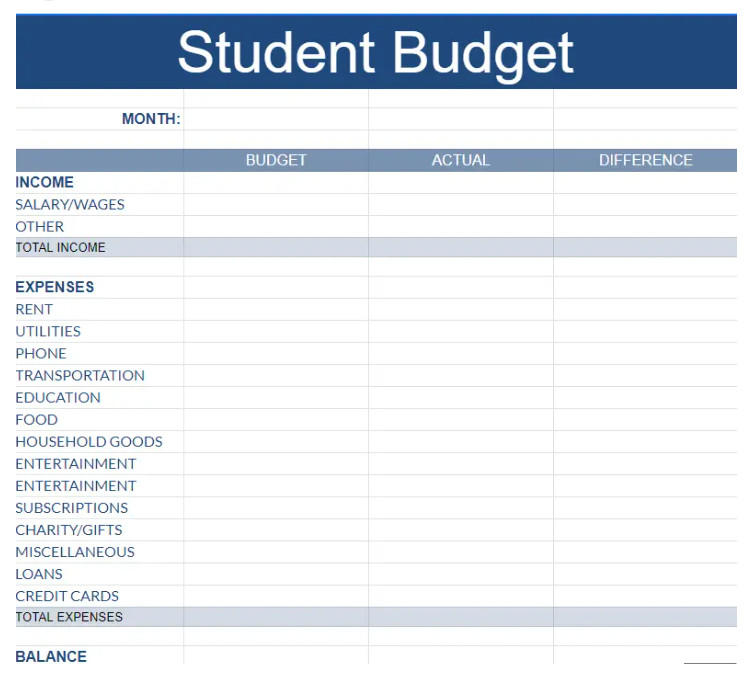

Examples of Student Budget Templates

There are various student budget templates available online that you can use as a starting point. Here are a few examples:

Tips for Successful Budgeting

Here are some tips to help you succeed with your student budget:

- Be Realistic: Set realistic goals and expectations for your budget. Don’t be too strict or too lenient with your spending. Find a balance that works for you.

- Track Your Expenses: Keep a record of all your expenses, big or small. This will help you identify areas where you can cut back and save more.

- Automate Your Savings: Set up automatic transfers to your savings account. This ensures that you save money consistently without having to think about it.

- Review Your Budget Regularly: Review your budget on a monthly basis and make adjustments as needed. Life circumstances change, and your budget should reflect those changes.

- Seek Support: If you’re struggling with budgeting, seek support from friends, family, or financial advisors. They can provide guidance and accountability.

- Celebrate Milestones: Celebrate your financial milestones along the way. Whether it’s paying off a debt or reaching a savings goal, acknowledge your achievements and stay motivated.

- Be Flexible: Be open to adjusting your budget as needed. It’s okay to make changes if your circumstances change or if you find a better way to manage your money.

Conclusion

A student budget is a valuable tool for managing your finances and achieving financial stability. By creating a budget, you can track your income and expenses, set financial goals, and make informed decisions about your spending. Remember to be realistic, track your expenses diligently, and review your budget regularly.

With discipline and consistency, you can achieve your short-term, mid-term, and long-term financial goals as a student.

Student Budget Template – Download

- Gift Voucher Template - January 8, 2026

- Printable Gift Thank-You Note Template - January 8, 2026

- Free Printable Gift Tag Template - January 7, 2026