Are you a small business owner looking to gain insights into your business’s financial performance? One essential tool that can help you understand how your business is doing is a profit and loss statement. This document provides a snapshot of your business’s revenues, expenses, and overall profitability.

What Is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement, is a financial document that shows the revenues and expenses of a business over a specific period. It provides valuable information on how much profit your business is making or how much it’s losing. By analyzing this statement, you can make informed decisions about your business operations.

When creating a profit and loss statement, you list all the revenues your business has earned during the period and subtract all the expenses incurred. The result is your net profit or loss. This statement is typically prepared on a monthly, quarterly, or annual basis to track your business’s financial performance over time.

Components of a Profit and Loss Statement

One of the essential components of a profit and loss statement is revenue. Revenue refers to the income your business generates from its primary activities, such as sales of products or services. It is crucial to accurately record all sources of revenue to calculate your business’s overall profitability.

On the other hand, expenses are another key component of a profit and loss statement. Expenses encompass all the costs incurred to operate your business, including salaries, rent, utilities, marketing, and supplies. By categorizing and tracking expenses, you can pinpoint areas where you can reduce costs and enhance your bottom line.

Importance of a Profit and Loss Statement

A profit and loss statement is essential for small businesses for several reasons. Firstly, it provides a clear picture of your business’s financial performance, allowing you to assess whether you’re making a profit or incurring losses. This information is crucial for making strategic decisions to improve your business’s profitability.

Additionally, a profit and loss statement helps you track trends in your business finances over time. By comparing statements from different periods, you can identify patterns and make adjustments to your operations. This historical data can also be useful for forecasting future revenues and expenses.

Types of Profit and Loss Statements

There are different types of profit and loss statements that businesses can use, depending on their structure and needs. One common type is the single-step profit and loss statement, which calculates net income by subtracting total expenses from total revenues. This straightforward format is suitable for small businesses with simple operations.

Another type is the multi-step profit and loss statement, which provides more detailed information by categorizing expenses into operating and non-operating expenses. This format offers a more comprehensive view of a business’s financial performance and can help identify areas where costs can be reduced or revenue increased.

Creating a Profit and Loss Statement

Creating a profit and loss statement for your small business involves several steps. Start by gathering all relevant financial data, including sales records, invoices, receipts, and expense reports. Organize this information into categories such as revenues, cost of goods sold, operating expenses, and non-operating expenses.

Next, list all your business’s revenues, including sales revenue, service revenue, and other sources of income. Be sure to include any discounts, returns, or allowances that may affect your overall revenue. Then, list all your expenses, such as payroll costs, rent, utilities, marketing expenses, and taxes.

Subtract total expenses from total revenues to calculate your business’s net profit or loss. This figure represents the financial health of your business and indicates whether you’re operating at a profit or a loss. Review the statement carefully to ensure all data is accurate and up-to-date.

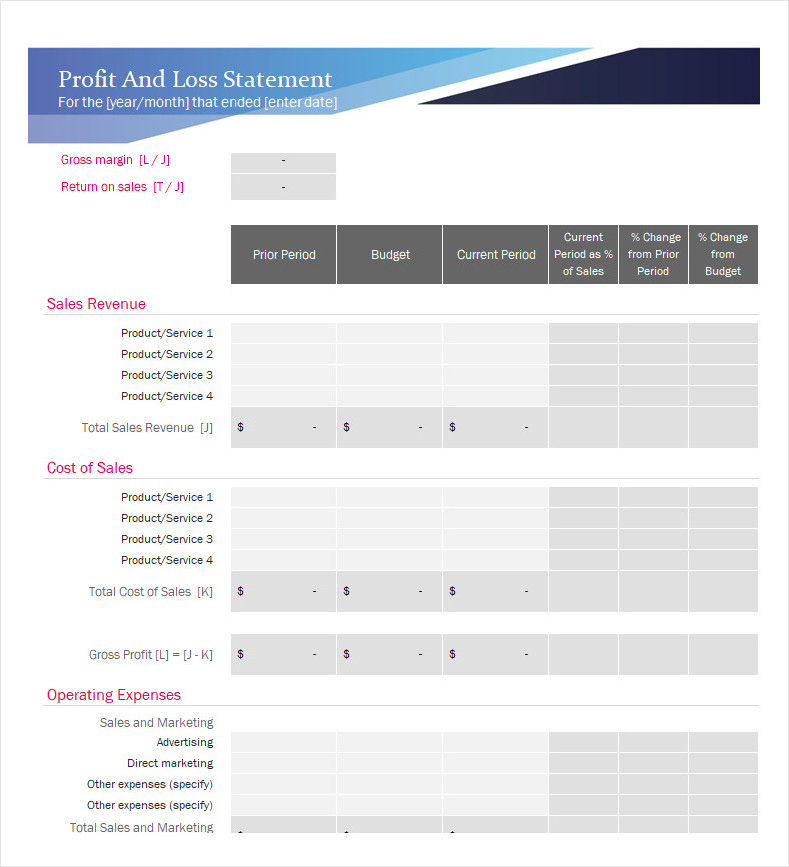

Profit And Loss Statement Template

Start using our free profit and loss statement template for small businesses today to track revenue and expenses, assess financial health, and make informed business decisions with confidence.

Profit And Loss Statement Template For Small Business – Excel

- Free Notary Acknowledgement Form Template - February 27, 2026

- Free Printable Nutrition Chart Template - February 26, 2026

- Free Student Reference Letter Template (Word) - February 22, 2026