Expense budgeting is a crucial aspect of financial management that provides individuals and businesses with the tools to track and plan spending.

By creating a budget, individuals can achieve their financial goals, avoid overspending, and prepare for emergencies. It offers a clear picture of spending habits, enabling adjustments to improve long-term financial health.

What is an Expense Budget?

An expense budget is a financial plan that outlines how much money an individual or business expects to spend over a specific period. It serves as a roadmap for managing cash flow and ensuring that funds are allocated appropriately to cover necessary expenses.

By tracking spending and income, individuals can gain insight into their financial habits and make informed decisions to achieve their financial goals.

Why is Expense Budgeting Important?

Expense budgeting is essential for financial control as it helps individuals and businesses manage their finances effectively. Here are some key reasons why expense budgeting is important:

Achieving Financial Goals

Setting financial goals is an essential part of personal or business finance. An expense budget helps individuals or businesses allocate resources towards specific goals, whether it’s saving for a vacation, purchasing a home, or growing a business. By tracking expenses and income, individuals can measure progress towards their financial objectives and make adjustments as needed to stay on track.

Avoiding Overspending

Overspending can quickly derail financial plans and lead to debt or financial instability. An expense budget provides a clear outline of how much money is available for various expenses, helping individuals prioritize spending and avoid unnecessary purchases. By adhering to a budget, individuals can ensure that they are living within their means and not accumulating debt that could harm their financial health in the long run.

Emergency Preparedness

Emergencies are an inevitable part of life, whether it’s a medical expense, car repair, or unexpected job loss. By including an emergency fund in their budget, individuals can prepare for unforeseen circumstances and avoid financial distress when unexpected costs arise. Having a financial safety net in place provides peace of mind and safeguards against the need to rely on high-interest loans or credit cards in times of crisis.

Improving Financial Health

Expense budgeting plays a significant role in improving overall financial health by promoting responsible money management habits. By tracking expenses, individuals can identify areas where they may be overspending or where they can cut back to increase savings. Budgeting also encourages regular savings contributions, debt repayment, and long-term financial planning, all of which contribute to a healthier financial outlook and greater financial stability.

What to Include in an Expense Budget?

When creating an expense budget, it is important to include the following key components:

Income Sources

The first step in creating an expense budget is to identify all sources of income. This may include salaries, wages, bonuses, rental income, investments, or any other money coming in on a regular basis. It’s essential to have an accurate picture of how much money is available to cover expenses and savings goals.

Fixed Expenses

Fixed expenses are recurring costs that remain relatively stable from month to month. These may include rent or mortgage payments, insurance premiums, car payments, utilities, and subscription services. By listing fixed expenses in the budget, individuals can ensure that essential bills are paid on time and accounted for in their financial plan.

Variable Expenses

Variable expenses are costs that fluctuate from month to month and may include groceries, dining out, entertainment, clothing, and personal care items. While variable expenses can be more challenging to predict, it’s essential to estimate these costs based on past spending habits and adjust as needed to stay within budget.

Savings Goals

Savings goals are a critical component of any expense budget as they help individuals plan for the future and build financial security. Whether saving for a down payment on a house, an emergency fund, retirement, or a dream vacation, allocating funds towards savings goals ensures that money is set aside for long-term objectives and not just immediate expenses.

How to Create an Expense Budget?

Creating an expense budget is a straightforward process that involves the following steps:

Calculate Total Income

The first step in creating an expense budget is to calculate the total amount of income received on a regular basis. This may include salaries, bonuses, investment income, rental income, or any other sources of money coming in each month. Having a clear understanding of total income allows individuals to allocate funds towards expenses and savings goals effectively.

List Expenses

Next, individuals should list all expenses, including fixed and variable costs, savings goals, debt repayments, and any other financial obligations. It’s essential to be thorough when listing expenses to ensure that all costs are accounted for and that nothing is overlooked in the budgeting process.

Allocate Funds

Once income and expenses are determined, it’s time to allocate funds to each expense category based on priority and necessity. Essential expenses like housing, utilities, and food should be prioritized, followed by savings goals and discretionary spending. By assigning a specific amount of money to each expense category, individuals can ensure that all financial obligations are met within their budget constraints.

Track Spending

Tracking actual spending against budgeted amounts is crucial in maintaining financial control and achieving financial goals. Individuals should regularly monitor their expenses and income to ensure that they are staying within the budget and making progress towards their savings goals. By keeping detailed records of spending habits, individuals can identify areas where adjustments may be necessary to improve financial health.

Tips for Effective Expense Budgeting

Here are some tips to help individuals and businesses create an effective expense budget:

Be Realistic

When creating an expense budget, it’s essential to be realistic about income and expenses. Setting unrealistic budget limits can lead to frustration and failure to stick to the budget. By accurately estimating income and expenses, individuals can create a budget that is achievable and sustainable in the long run.

Review Regularly

Regularly reviewing and adjusting the budget is key to successful expense budgeting. Life circumstances, income changes, and unexpected expenses can all impact the budget, requiring adjustments to be made. By reviewing the budget monthly or quarterly and making necessary changes, individuals can ensure that their financial plan remains relevant and effective.

Track Expenses

Keeping detailed records of expenses is essential in understanding spending habits and making informed financial decisions. Individuals should track all expenses, no matter how small, to identify areas where they may be overspending or where adjustments can be made to increase savings. Creating a system for tracking expenses, whether through a budgeting app, spreadsheet, or notebook, can help individuals stay organized and accountable for their spending.

Set Priorities

Setting priorities in the budget helps individuals allocate funds towards essential expenses and savings goals. By determining what is most important in their financial plan, individuals can ensure that money is being spent where it matters most. Whether prioritizing debt repayment, emergency savings, or retirement contributions, having clear financial priorities helps individuals stay focused on their long-term goals.

Seek Professional Help

For individuals or businesses struggling to create or maintain an expense budget, seeking professional help can provide valuable guidance and support. Financial advisors, accountants, or budgeting coaches can offer expertise in budgeting and financial planning, helping individuals create a budget that aligns with their goals and lifestyle. Professional assistance can also provide accountability and motivation to stick to the budget and achieve financial success.3

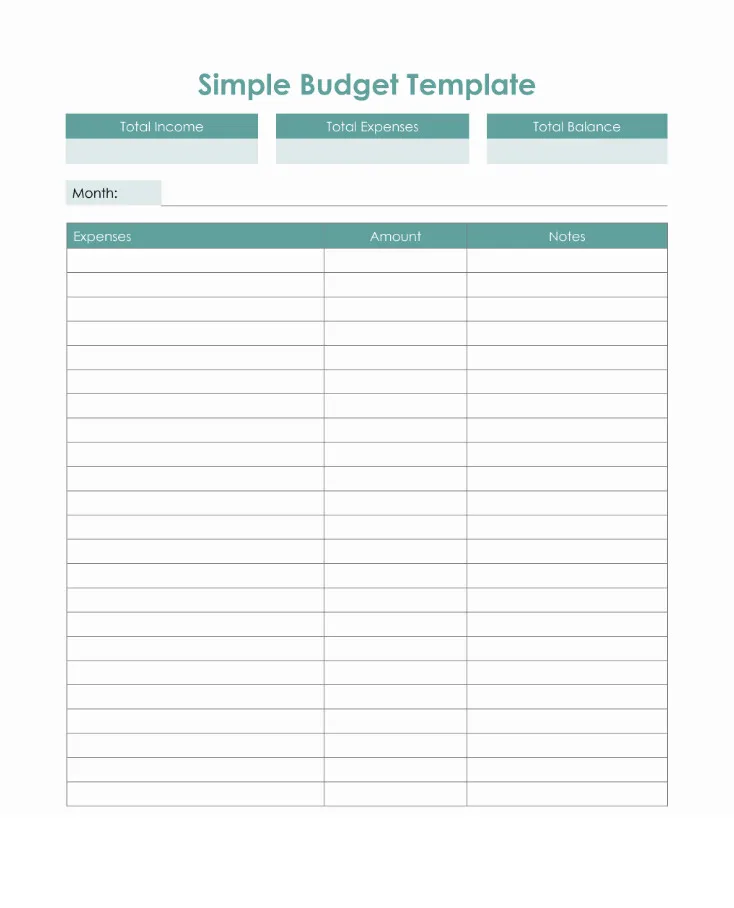

Expense Budget Template

An Expense Budget helps you organize and track your spending by outlining categories such as housing, transportation, food, utilities, savings, and discretionary costs. It provides a clear structure that makes it easier to monitor expenses, identify overspending, and plan smarter financial decisions. With a well-designed template, you can stay on top of your budget, reduce financial stress, and work toward your financial goals with confidence.

Download our Expense Budget Template today to take control of your finances and manage your spending more effectively.

Expense Budget Template – Excel

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026

- Printable Holiday Party Invitation Template - January 23, 2026