Managing a family budget can be a daunting task, but it is crucial for maintaining financial stability and security.

A family’s monthly budget serves as a roadmap to help you track your income and expenses, prevent overspending, and ensure that money is allocated to meet both immediate needs and long-term goals such as saving for emergencies, education, or retirement. By creating and sticking to a budget, you can build an emergency fund, manage debt, and reduce financial stress.

Let’s delve deeper into the world of family budgets and explore how you can take control of your finances.

What is a Family Monthly Budget?

A family’s monthly budget is a financial plan that outlines its income and expenses for a specific period, usually a month. It helps you keep track of where your money is coming from and where it is going, allowing you to make informed decisions about your spending habits.

By creating a budget, you can identify areas where you may be overspending and take steps to adjust your expenses accordingly.

Why is a Family Monthly Budget Important?

A family’s monthly budget is essential for several reasons:

Financial Control

One of the primary reasons a family’s monthly budget is important is that it gives you control over your finances. By tracking your income and expenses, you can make informed decisions about how to allocate your money and ensure that you are living within your means.

Preventing Overspending

Another key benefit of having a family monthly budget is that it helps prevent overspending. By tracking your expenses and setting spending limits, you can avoid going over budget and accumulating unnecessary debt.

Meeting Immediate Needs and Long-Term Goals

A family’s monthly budget ensures that it allocates money for both its immediate needs and long-term financial goals. Whether it’s paying bills, saving for a vacation, or investing in your retirement, a budget helps you prioritize your spending and allocate resources accordingly.

Building Financial Security

By following a budget and setting aside money for savings and emergencies, you can build financial security for your family. Having a financial cushion can help protect you from unexpected expenses and give you peace of mind knowing that you are prepared for any financial challenges that may arise.

Reducing Financial Stress

One of the most significant benefits of having a family’s monthly budget is that it can reduce financial stress. Knowing where your money is going and having a plan in place can alleviate anxiety about your finances and help you feel more in control of your financial future.

What to Include in Your Family Monthly Budget?

When creating a family monthly budget, be sure to include the following components:

Income

Start by listing all sources of income, including wages, salaries, bonuses, and any other money coming into your household. Having a clear understanding of your total income is essential for creating a realistic budget.

Expenses

Track all your expenses, including fixed expenses like rent or mortgage payments, utilities, insurance, and variable expenses like groceries, entertainment, and dining out. Be thorough in documenting all your expenses to get an accurate picture of your spending habits.

Savings Goals

Allocate a portion of your income towards savings goals, such as building an emergency fund, saving for a vacation, or contributing to a retirement account. Setting specific savings goals helps you stay motivated and focused on achieving your financial objectives.

Debt Payments

Include any debt payments you need to make, such as credit card payments, student loans, or car loans. By prioritizing debt repayment in your budget, you can work towards becoming debt-free and improving your financial health.

Emergency Fund

Set aside money each month for an emergency fund to cover unexpected expenses such as car repairs, medical bills, or job loss. Having an emergency fund can provide a financial safety net and protect you from financial hardship in times of need.

How to Create a Family Monthly Budget

Creating a family monthly budget involves the following steps:

Calculate Your Total Monthly Income

Determine how much money you bring in each month from all sources of income, including your salary, investments, and any other sources of income. Having a clear understanding of your total income is essential for creating a realistic budget.

List All Your Expenses

Track all your expenses for the month, including fixed expenses like rent or mortgage payments, utilities, insurance, and variable expenses like groceries, entertainment, and dining out. Be thorough in documenting all your expenses to get an accurate picture of your spending habits.

Set Savings Goals

Determine how much money you want to save each month and allocate it towards specific savings goals. Whether you’re saving for a vacation, a down payment on a house, or your children’s education, setting concrete savings goals can help you stay on track with your finances.

Allocate Money for Debt Payments

If you have any outstanding debts, make sure to include them in your budget and allocate money towards paying them off. Prioritizing debt repayment can help you reduce your overall debt burden and improve your financial well-being.

Create an Emergency Fund

Set aside a portion of your income each month to build an emergency fund to cover unexpected expenses such as car repairs, medical bills, or job loss. Having an emergency fund can provide you with financial peace of mind and protect you from unexpected financial setbacks.

Track Your Spending

Monitor your expenses throughout the month to ensure that you are staying within your budget and making adjustments as needed. Keeping a close eye on your spending habits can help you identify areas where you may be overspending and make necessary changes to stay on track with your financial goals.

Review and Adjust

At the end of the month, review your budget and assess how well you stuck to your spending plan. Identify any areas where you may have overspent or underspent and make adjustments for the following month as needed. Regularly reviewing and adjusting your budget is essential for staying on track with your financial goals.

Stick to Your Budget

Once you have created a family’s monthly budget, it’s crucial to stick to it to achieve your financial goals. Stay disciplined with your spending habits, avoid unnecessary purchases, and make conscious decisions about how you allocate your money to ensure that you are living within your means.

Communicate with Your Family

Involve your family in the budgeting process and communicate openly about your financial goals and priorities. By working together as a family to create and stick to a budget, you can ensure that everyone is on the same page and committed to achieving your financial objectives.

Seek Help If Needed

If you are struggling to create or stick to a budget, don’t hesitate to seek help from a financial advisor or counselor who can provide guidance and support. Professional assistance can help you develop a more effective budgeting strategy and overcome any financial challenges you may be facing.

Tips for Managing Your Family’s Monthly Budget

Here are some tips to help you effectively manage your family’s monthly budget:

Be Realistic

Set achievable goals and be realistic about your income and expenses. Avoid setting unrealistic saving targets or spending limits that may be difficult to sustain in the long run.

Track Your Spending

Keep a detailed record of your expenses to identify areas where you can cut back. Use budgeting apps or spreadsheets to track your spending habits and monitor your progress towards your financial goals.

Automate Your Savings

Set up automatic transfers to your savings account to make saving easier. By automating your savings, you can ensure that you consistently set aside money for your financial goals without having to think about it.

Review Your Budget Regularly

Make time to review your budget monthly to track your progress and make adjustments. Regularly reviewing your budget can help you stay on track with your financial goals and identify any areas where you may need to make changes.

Include a Buffer

Leave room in your budget for unexpected expenses or emergencies. Incorporating a buffer into your budget can help you cover unexpected costs without derailing your financial plan or dipping into your savings.

Involve Your Family

Make budgeting a family affair and involve your loved ones in the process. Discuss financial goals and priorities with your family members, and encourage open communication about money matters to ensure everyone is on the same page.

Celebrate Milestones

Celebrate your financial milestones to stay motivated and on track with your goals. Whether it’s reaching a savings target, paying off a debt, or sticking to your budget for a consecutive month, acknowledging your achievements can boost your confidence and commitment to financial success.

Seek Support

Don’t be afraid to ask for help or seek guidance from financial professionals if needed. A financial advisor can provide expert advice on budgeting, saving, and investing, helping you make informed decisions about your financial future.

Tracking Your Family’s Monthly Budget Progress

Tracking your family’s monthly budget progress is essential to ensure that you are staying on track with your financial goals. By monitoring your income, expenses, savings, and debt payments regularly, you can identify any areas where you may need to make adjustments and stay accountable to your budgeting plan.

Utilize Budgeting Tools

Take advantage of budgeting tools and resources to help you track your family’s monthly budget progress effectively. Budgeting apps, spreadsheets, and online calculators can simplify the process of monitoring your finances and provide valuable insights into your spending habits.

Review Your Budget Regularly

Set aside time each month to review your budget and assess your progress towards your financial goals. Compare your actual income and expenses to your budgeted amounts, and identify any discrepancies or areas where you may need to make adjustments.

Analyze Your Spending Patterns

Analyze your spending patterns to identify areas where you may be overspending or underspending. Look for trends in your expenses, such as recurring bills, discretionary purchases, or seasonal expenses, and adjust your budget accordingly to align with your financial objectives.

Monitor Your Savings Goals

Track your progress towards your savings goals to ensure that you are on target to meet your objectives. Regularly review your savings contributions, interest earnings, and investment performance to stay motivated and committed to building a secure financial future.

Assess Your Debt Repayment

Monitor your debt repayment progress to track how much you are paying off each month and how close you are to becoming debt-free. Prioritize high-interest debts and consider debt consolidation or refinancing options to accelerate your debt repayment journey.

Adjust Your Budget as Needed

Be flexible with your budget and make adjustments as needed based on changing financial circumstances. Life events, unexpected expenses, or income fluctuations may require you to revise your budget to ensure that it remains realistic and sustainable.

Celebrate Financial Milestones

Celebrate your financial milestones, whether it’s reaching a specific savings goal, paying off a significant debt, or sticking to your budget consistently. Recognizing your achievements can boost your confidence, motivation, and commitment to maintaining healthy financial habits.

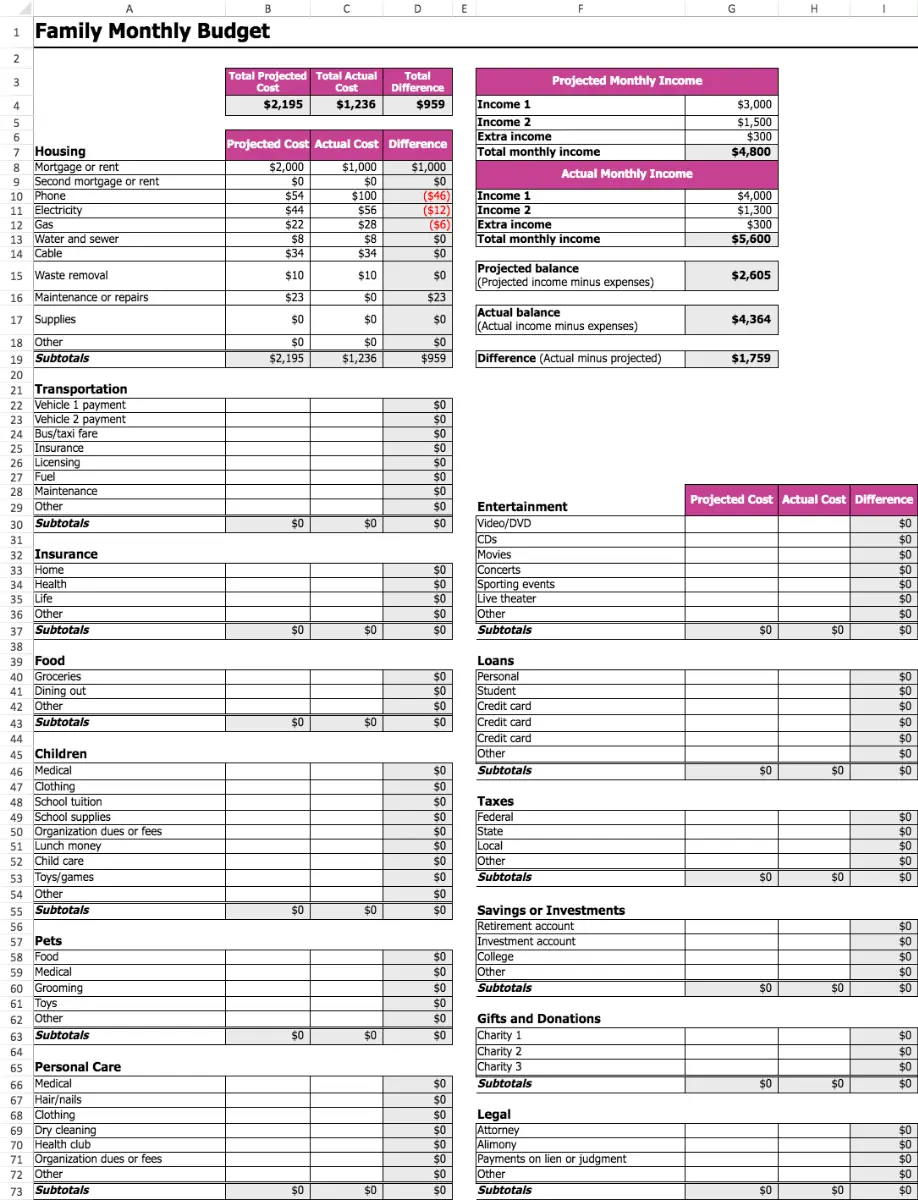

Family Monthly Budget Template

In conclusion, a Family Monthly Budget helps households manage income, expenses, and savings effectively, promoting financial stability and smarter spending.

Keep your family’s finances on track—download our Family Monthly Budget Template today to start planning your budget with confidence!

Family Monthly Budget Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026