When facing challenging financial circumstances, it can be overwhelming to meet your payment obligations to creditors, landlords, or lenders. In such situations, a well-crafted financial hardship letter can serve as a crucial tool to formally inform the relevant parties of your current predicament and request temporary relief.

Whether you are seeking a payment pause, reduced payments, or a loan modification, this letter provides a platform to explain the reasons behind your hardship and work towards a mutually beneficial solution.

Let’s delve deeper into the what, why, and how of composing a compelling financial hardship letter.

What is a Financial Hardship Letter?

A financial hardship letter is a formal communication sent to creditors, landlords, or lenders to convey your current financial struggles. It is a detailed account of your circumstances, explaining why you are unable to meet your payment obligations and requesting temporary assistance.

By providing a comprehensive overview of your situation, you demonstrate your commitment to addressing the issue responsibly and collaborating towards a resolution.

Why Write a Financial Hardship Letter?

There are several reasons why writing a financial hardship letter is beneficial for both parties involved. Firstly, it allows you to communicate openly and transparently about your financial struggles, fostering trust and understanding. Additionally, by outlining your challenges and proposing solutions, you demonstrate your willingness to address the situation responsibly and collaboratively.

Building Trust

Writing a financial hardship letter is an opportunity to build trust with your creditor, landlord, or lender. By openly sharing your financial difficulties and seeking assistance, you show that you are committed to finding a solution and fulfilling your obligations in the long run.

Explaining Circumstances

Often, financial hardships are caused by unforeseen circumstances such as job loss, medical emergencies, or natural disasters. A well-written hardship letter provides a platform to explain these circumstances to the relevant party, helping them understand the root cause of your financial struggles.

Seeking Empathy

By sharing your personal challenges and the impact of the financial hardship on your life, you appeal to the empathy of the recipient. Humanizing your situation can evoke understanding and compassion, potentially leading to a more sympathetic response.

Demonstrating Responsibility

Writing a financial hardship letter demonstrates your responsibility and commitment to addressing the issue head-on. It shows that you are proactive in seeking solutions and willing to work towards a mutually beneficial outcome, highlighting your integrity and reliability as a borrower.

Seeking Temporary Relief

One of the primary purposes of a financial hardship letter is to request temporary relief from your payment obligations. Whether it’s a short-term payment pause, reduced payments, or a loan modification, this letter serves as a formal request for assistance during a challenging financial period.

What to Include in a Financial Hardship Letter?

When composing a financial hardship letter, it’s essential to include specific details about your situation and clearly outline your request for temporary relief. Here are some key elements that should be incorporated into your letter:

Explanation of Hardship

Start by providing a detailed explanation of the circumstances that have led to your financial hardship. Whether it’s a job loss, medical expenses, or other unexpected events, be transparent about the factors contributing to your financial struggles.

Impact on Finances

Describe how your financial situation has been affected by the hardship and why you are unable to meet your payment obligations. Include specific examples of how the hardship has impacted your income, expenses, and overall financial stability.

Request for Relief

Clearly state the type of assistance you are seeking, whether it’s a temporary payment pause, reduced payments, or a loan modification. Be specific about the relief you require to alleviate the financial burden and explain why this assistance is necessary.

Proposed Solution

Offer potential solutions or compromises that you believe would help address the financial hardship. Whether it’s a revised payment plan, debt consolidation, or other arrangements, present your ideas for resolving the issue and demonstrate your commitment to finding a workable solution.

Contact Information

Provide your complete contact information in the letter to ensure that the recipient can easily reach out to discuss the situation further. Include your full name, address, phone number, email address, and any other relevant details that will facilitate communication regarding your financial hardship.

How to Write a Financial Hardship Letter

Writing a financial hardship letter can be a challenging task, but with careful planning and attention to detail, you can create a compelling document. Here are some tips to help you craft a powerful letter that effectively communicates your situation and requests for temporary relief:

Be Honest and Transparent

Honesty is key when explaining your financial situation in a hardship letter. Provide accurate information and avoid exaggerating or understating the facts to ensure clarity and transparency in your communication.

Be Concise and Clear

Avoid unnecessary details and focus on the most critical information in your letter. Keep your message concise and to the point, ensuring that the recipient can easily understand the reasons behind your financial hardship and your request for assistance.

Be Professional and Polite

Maintain a professional tone throughout the letter and express gratitude for any assistance or consideration provided by the recipient. Approach the communication with respect and politeness to foster a positive dialogue and encourage a favorable response.

Proofread Carefully

Before sending your financial hardship letter, review it carefully for any spelling or grammatical errors. A well-edited and error-free letter demonstrates attention to detail and professionalism, enhancing the credibility of your communication.

Follow Up

After sending your letter, follow up with the recipient to ensure that they have received it and discuss potential next steps. Open communication and proactive follow-up can help expedite the review process and increase the likelihood of a timely response to your request.

Tips for Successful Financial Hardship Letters

Here are some additional tips to help you increase the effectiveness of your financial hardship letter and maximize your chances of reaching a favorable resolution:

Provide Supporting Documentation

Incorporate relevant supporting documentation into your letter, such as pay stubs, medical bills, or unemployment paperwork. These documents can substantiate your claims and provide additional context to support your request for temporary relief.

Offer a Realistic Solution

Propose a solution that is realistic and feasible for both parties involved. Consider the financial constraints of the recipient and your own limitations, and present a solution that is reasonable and mutually beneficial for addressing the financial hardship.

Seek Guidance if Needed

If you are unsure about how to craft your financial hardship letter or what information to include, consider seeking guidance from a financial advisor, counselor, or legal professional. Their expertise can help you navigate the process and ensure that your letter is effective and impactful.

Be Persistent but Patient

Follow up with the recipient if you do not receive a response promptly, but also practice patience and understanding throughout the communication process. Recognize that reviewing and considering a financial hardship request may take time, and remain persistent while being respectful of the recipient’s timeline.

Maintain Open Communication

Keep the lines of communication open with the creditor, landlord, or lender throughout the process. Be responsive to any requests for additional information or clarification, and demonstrate your willingness to engage in a constructive dialogue to find a resolution that works for both parties.

By incorporating these tips and guidelines into your financial hardship letter, you can create a compelling and persuasive document that effectively communicates your situation and requests for temporary relief. Approach the writing process with honesty, transparency, and professionalism to maximize your chances of reaching a mutually beneficial solution with the relevant party.

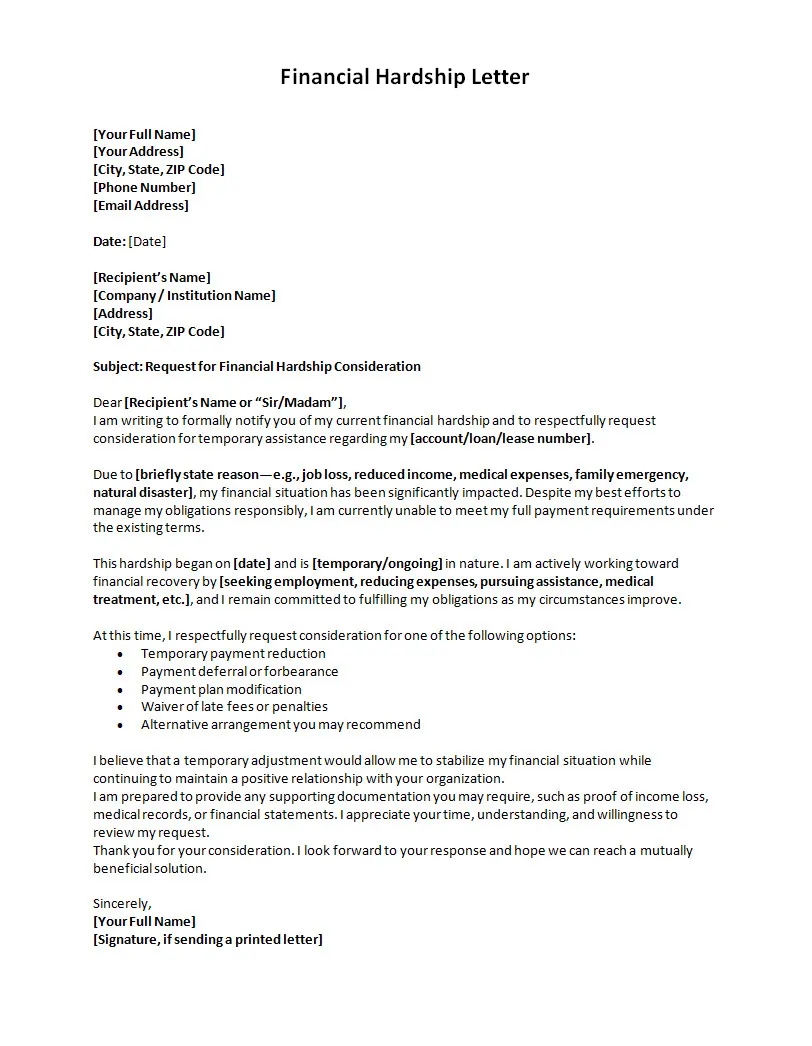

Financial Hardship Letter Template

A Financial Hardship Letter helps you clearly and respectfully explain your financial difficulties to creditors, lenders, or service providers. It provides a structured way to describe your situation, outline the reasons for hardship, and request assistance such as payment relief, extensions, or adjusted terms. With a well-prepared template, you can communicate your circumstances professionally and increase the likelihood of a positive response.

Download our Financial Hardship Letter Template today to present your situation clearly and request financial assistance with confidence.

Financial Hardship Letter Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026