When borrowing money, whether for personal or business purposes, having a solid agreement in place is crucial to protect both the lender and the borrower. A personal loan agreement is a legally binding contract that clearly outlines the terms and conditions of the loan, including the loan amount, interest rate, and repayment schedule.

By documenting all the details in writing, the agreement provides clarity, prevents misunderstandings, and offers a legal basis for action in case of a dispute or default.

What Is a Personal Loan Agreement?

A personal loan agreement is a formal document that outlines the terms and conditions of a loan between a lender and a borrower. It includes important details such as the loan amount, interest rate, repayment schedule, and any other specific terms agreed upon by both parties.

This document serves as a legal contract that protects the rights and obligations of both the lender and the borrower.

Why Is a Loan Agreement Needed?

Having a loan agreement in place is essential for several reasons.

Importance of Clear Communication in Loan Agreements

One of the primary reasons why a loan agreement is needed is to ensure clear communication between the lender and the borrower. By clearly outlining the terms of the loan in writing, both parties can avoid misinterpretations and misunderstandings. This can help to build trust and transparency in the borrowing process.

Risk Mitigation Through Loan Agreements

Loan agreements also play a crucial role in risk mitigation for both the lender and the borrower. By clearly defining the terms of the loan, including the repayment schedule and consequences of default, the agreement helps to minimize the risks associated with lending and borrowing money. This can protect both parties from potential financial losses.

Legal Protection Provided by Loan Agreements

Another key reason why loan agreements are needed is the legal protection they provide. In the event of a dispute or default, a well-drafted loan agreement serves as a legal document that can be used to enforce the terms of the loan. This can provide a clear framework for resolving conflicts and taking legal action if necessary.

Types of Charges in Personal Loan Agreement

In a personal loan agreement, there are several types of charges that may be included. These charges can vary depending on the lender and the specific terms of the loan, but some common charges to look out for include:

- Interest: The interest rate is the cost of borrowing money and is typically expressed as an annual percentage rate (APR).

- Origination fee: Some lenders charge an origination fee to process the loan application.

- Late payment fee: If the borrower fails to make a payment on time, they may incur a late payment fee.

- Prepayment penalty: Some loans come with a prepayment penalty if the borrower pays off the loan early.

- Other fees: There may be other fees associated with the loan, such as documentation fees or loan servicing fees.

Key Elements of a Personal Loan Agreement

A well-drafted personal loan agreement should include the following key elements:

Loan Amount and Disbursement Details

The loan amount is one of the most critical elements of a personal loan agreement. This amount represents the total sum of money that the borrower will receive from the lender. It is essential to specify the exact loan amount in the agreement to avoid any confusion or disputes later on. In addition to the loan amount, the agreement should also outline how and when the funds will be disbursed to the borrower.

Interest Rate and Repayment Schedule

The interest rate and repayment schedule are key components of a personal loan agreement that determine the cost of borrowing and the timeline for repayment. The interest rate is expressed as an annual percentage and represents the cost of borrowing money. The repayment schedule outlines when payments are due and how much is required to pay off the loan. Both the interest rate and repayment schedule should be clearly defined in the agreement to ensure that both parties are on the same page.

Late Payment and Default Provisions

Late payment and default provisions are important elements of a personal loan agreement that outline the consequences of missed payments and non-payment. These provisions typically include information about how late payments will be handled, any fees or penalties that may apply, and the steps that will be taken in case of default. By including clear provisions for late payments and default, the agreement helps to protect the lender’s interests and ensures that the borrower understands their obligations.

Prepayment Terms and Conditions

Prepayment terms and conditions refer to the rules surrounding early repayment of the loan. Some lenders may charge a prepayment penalty if the borrower pays off the loan before the agreed-upon term. It is important for borrowers to understand these terms and conditions before entering into a loan agreement to avoid any surprises down the line. Including clear prepayment provisions in the agreement can help to prevent misunderstandings and disputes related to early repayment.

Collateral Requirements (if applicable)

If the loan is secured by collateral, such as a car or property, the personal loan agreement should outline the specific collateral requirements. This may include details about the type of collateral accepted, how the collateral will be valued, and what will happen in case of default. Collateral provides additional security for the lender and may impact the terms of the loan, so it is important for borrowers to understand these requirements before signing the agreement.

Signatures of Both Parties and Date of Agreement

To make the personal loan agreement legally binding, it must be signed by both the lender and the borrower. The signatures indicate that both parties agree to the terms and conditions outlined in the agreement. Additionally, including the date of the agreement helps to establish when the contract was entered into force. Having both signatures and a clear date on the agreement is essential for ensuring its validity and enforceability.

How to Write a Personal Loan Agreement

Writing a personal loan agreement may seem daunting, but it doesn’t have to be complicated. Here are some steps to help you create a solid agreement:

- Start by outlining the basic terms of the loan, including the loan amount, interest rate, and repayment schedule.

- Include any specific terms or conditions that are important to both parties.

- Clearly define the consequences of late payments or default.

- Consider including provisions for prepayment or early payoff.

- Have both parties review the agreement carefully before signing.

- If you are unsure about any aspect of the loan agreement or if you want to ensure that it complies with all legal requirements, it is always a good idea to seek legal advice. A legal professional can review the agreement and provide guidance on any potential issues or areas for improvement.

- Clearly outline the repayment terms in the agreement, including the frequency of payments, the amount of each payment, and the total number of payments required to pay off the loan. This information ensures that both parties understand their obligations and can help prevent misunderstandings.

- It is important to include provisions in the agreement that outline the consequences of default, such as late fees, interest penalties, and possible legal action. By clearly defining the repercussions of non-payment, you can protect the lender’s interests and encourage timely repayment.

- Sometimes unexpected circumstances arise that may require changes to the loan agreement. Include provisions in the agreement that outline how modifications can be made, such as through a written amendment signed by both parties. This flexibility can help accommodate changes while maintaining the integrity of the agreement.

- While notarization is not always required for a personal loan agreement, having the document notarized can provide an extra layer of authenticity and legal validity. A notary public can certify the signatures on the agreement, making it more difficult for either party to dispute its authenticity in the future.

Other Personal Loan Documents

In addition to the personal loan agreement, there are other important documents that may be involved in the borrowing process. Some of these documents include:

– Promissory note: A promissory note is a written promise to repay a loan under specific terms and conditions. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default. The promissory note serves as a legal contract between the borrower and the lender and can be used as evidence in case of a dispute.

– Security agreement: If the loan is secured by collateral, such as a car or property, a security agreement may be required. This document outlines the specific collateral being used to secure the loan and the rights of the lender in case of default. It helps to protect the lender’s interests by providing a legal claim to the collateral in case the borrower fails to repay the loan.

– Guaranty agreement: In some cases, a guarantor may be required to co-sign the loan agreement. A guaranty agreement is a document in which a third party guarantees the repayment of the loan if the borrower defaults. This provides additional security for the lender and increases the likelihood of loan approval for the borrower.

– Disclosure statement: Lenders are required to provide borrowers with a disclosure statement that outlines the terms of the loan in a clear and transparent manner. This document includes important information such as the total cost of the loan, the annual percentage rate (APR), any fees or charges associated with the loan, and the borrower’s rights and responsibilities. The disclosure statement helps borrowers make informed decisions about borrowing money and ensures compliance with lending regulations.

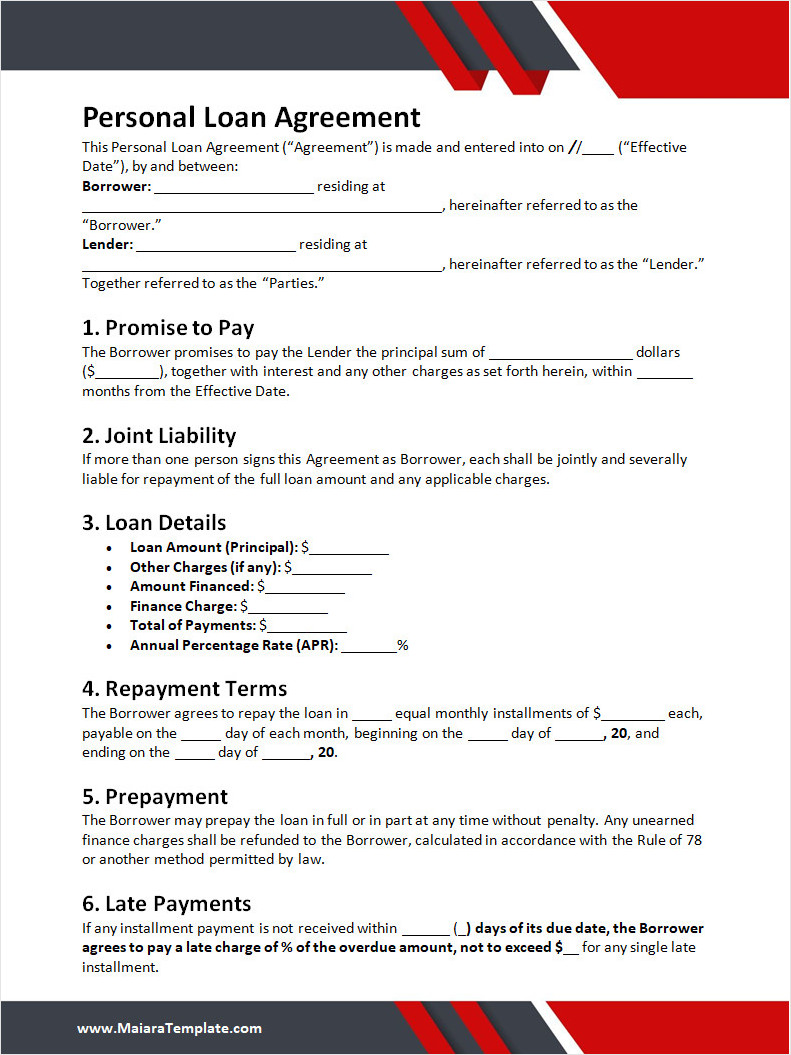

Personal Loan Agreement Template

A personal loan agreement is an important tool for documenting the terms of a loan between individuals, ensuring both parties are protected. It outlines repayment terms, interest rates, and responsibilities to avoid misunderstandings.

To make lending and borrowing clear and secure, use our free personal loan agreement template and set fair terms with confidence!

Personal Loan Agreement Template – Word

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026