Retirement is a significant milestone in one’s life, marking the end of a career and the beginning of a new chapter. Whether you are approaching retirement age or planning for the future, having a comprehensive checklist can help you stay organized and ensure a smooth transition into this next phase of life.

In this article, we will explore the importance of a retirement checklist, why you need one, and how to create one that suits your needs.

What is a retirement checklist?

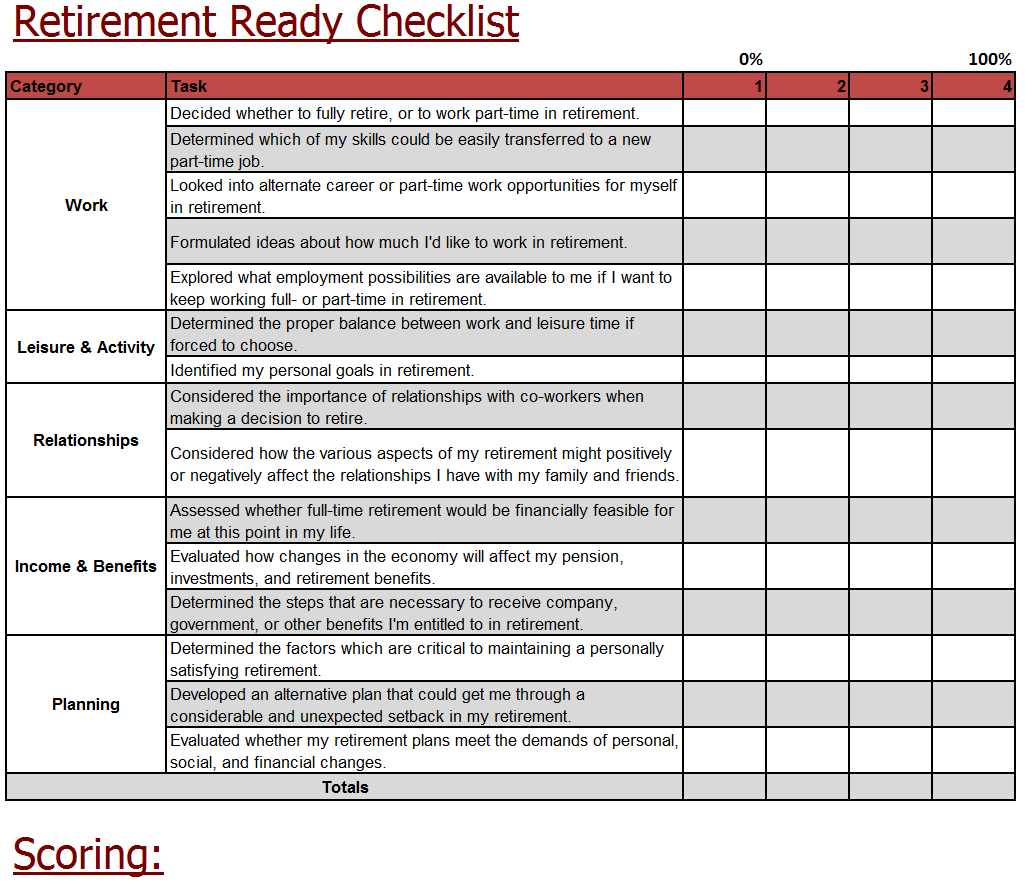

A retirement checklist is a tool that outlines the essential tasks and considerations for individuals preparing to retire. It serves as a guide to help you navigate the various aspects of retirement planning, from financial preparations to lifestyle adjustments.

By having a checklist in hand, you can ensure that you address all the necessary steps leading up to your retirement date.

Why do you need a retirement checklist?

Planning for retirement can be overwhelming, with numerous details to consider and decisions to make.

A retirement checklist provides a structured approach to retirement planning, helping you prioritize tasks and stay on track. It can also serve as a reminder of important deadlines and milestones, ensuring that nothing falls through the cracks during this crucial period.

Retirement Checklist: How to Create One

Creating a retirement checklist is a straightforward process that involves identifying key areas of retirement planning and breaking them down into actionable steps. Here are some tips to help you create a personalized retirement checklist:

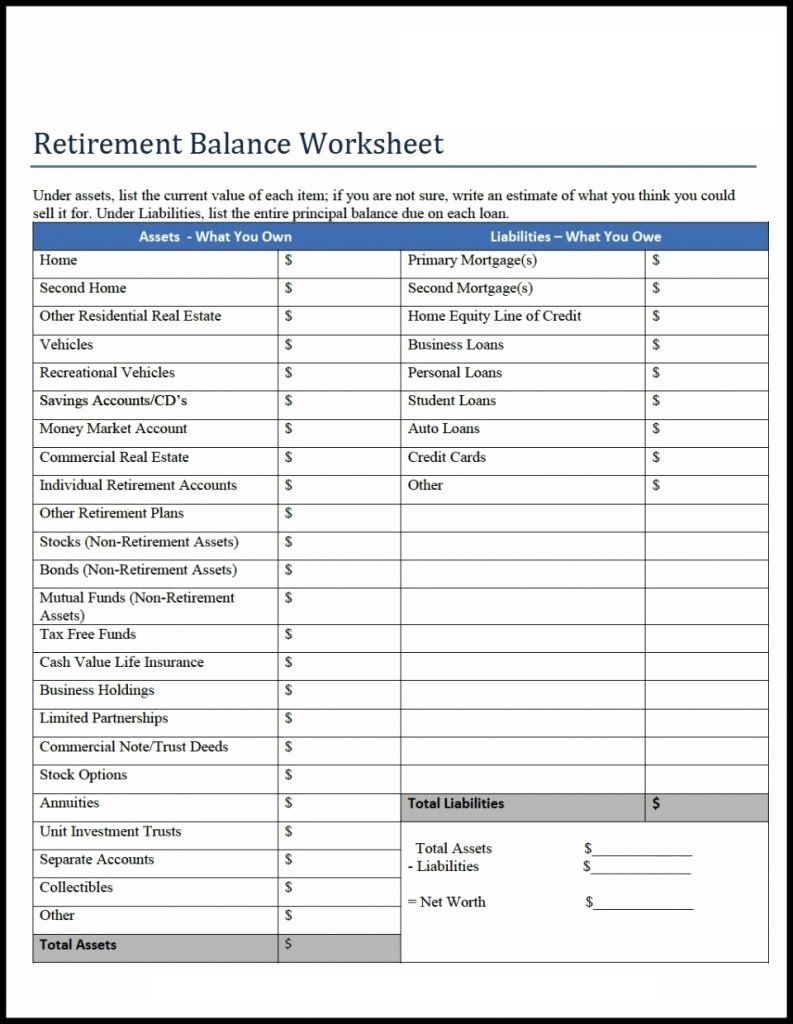

1. Assess your financial situation

Before you retire, it’s essential to evaluate your financial status and determine if you have enough savings to support your desired lifestyle. Consider factors such as retirement accounts, Social Security benefits, pension plans, and other sources of income.

2. Determine your retirement date

Choose a specific date for your retirement that aligns with your financial goals and personal preferences. This will give you a clear timeline for completing tasks on your retirement checklist.

3. Plan for healthcare and insurance

Review your healthcare coverage options and consider purchasing supplemental insurance if needed. Make sure you understand the transition from employer-provided health benefits to Medicare or other insurance plans.

4. Consider your living arrangements

Decide where you want to live during retirement and explore housing options that suit your needs. Whether you plan to downsize, relocate, or stay in your current home, factor in housing costs and lifestyle preferences.

5. Prepare for Social Security and benefits

Evaluate your eligibility for Social Security benefits and determine the best time to start claiming them. Research other benefits you may be entitled to, such as veterans’ benefits or retirement incentives from your employer.

6. Organize important documents

Gather essential documents such as birth certificates, Social Security cards, wills, and estate plans. Keep these documents in a secure location and share copies with trusted family members or advisors.

7. Develop a retirement budget

Create a budget that outlines your expected expenses and income during retirement. Consider factors such as healthcare costs, travel expenses, and leisure activities to ensure your finances are well-managed.

8. Plan for leisure and activities

Think about how you want to spend your time during retirement and make a list of hobbies, travel plans, or volunteer opportunities you would like to pursue. Having a plan for leisure activities can help you stay engaged and fulfilled in retirement.

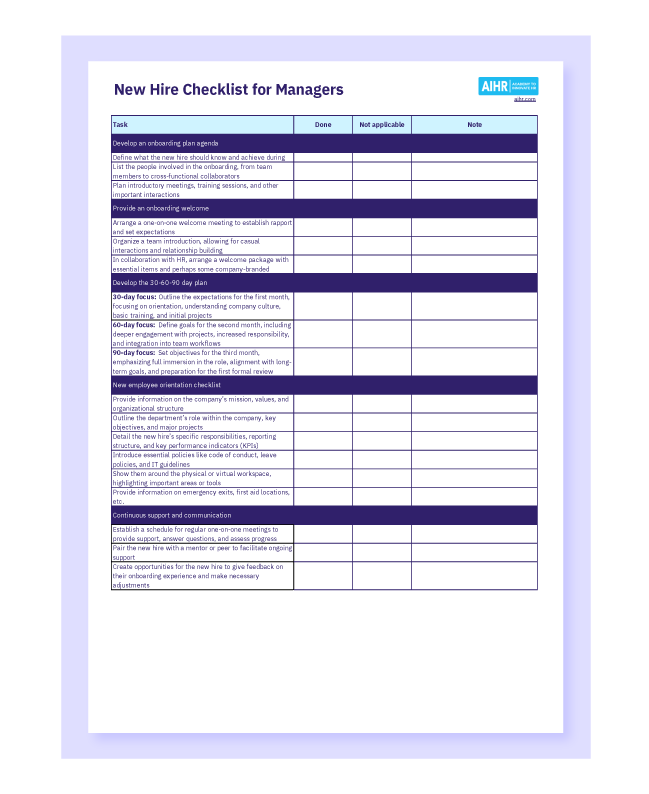

Examples of Retirement Checklists

Tips for Successful Retirement Planning

- Start early: Begin planning for retirement as soon as possible to maximize your savings and investment growth.

- Consult a financial advisor: Seek professional advice to ensure your retirement plan aligns with your goals and risk tolerance.

- Review and update your checklist regularly: Stay on top of changes in your financial situation and adjust your retirement checklist as needed.

- Stay flexible: Be prepared for unexpected events or changes in your retirement plans and adapt accordingly.

- Enjoy the journey: Retirement is a time to relax, explore new interests, and spend time with loved ones. Embrace this new chapter in your life with positivity and enthusiasm.

In Conclusion

A retirement checklist is a valuable tool for anyone preparing to retire, offering a roadmap to help you navigate the complexities of retirement planning. By following the steps outlined in this article and customizing a checklist that meets your unique needs, you can approach retirement with confidence and peace of mind.

Remember, retirement is not just a destination but a journey, so make the most of this new chapter in your life and enjoy the fruits of your labor.

Retirement Checklist Template – Download

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026