Seller financing agreements have gained popularity in the real estate industry as an alternative to traditional bank financing. This arrangement allows the property seller to act as the lender, providing an opportunity for buyers who may not qualify for a conventional loan. Seller financing benefits both buyers and sellers by enabling transactions that may have otherwise been challenging to complete.

Let’s explore the various aspects of seller financing agreements in more detail.

What is Seller Financing?

Seller financing, also known as owner financing or seller carryback, is a creative financing option where the seller of a property or business acts as the lender for the buyer. In a seller financing agreement, the buyer makes payments directly to the seller over an agreed-upon period, typically with interest.

This arrangement allows buyers who may not meet the stringent requirements of traditional bank loans to secure financing and purchase the property.

Flexibility in Financing

One of the key advantages of seller financing is the flexibility it offers to both buyers and sellers. Unlike traditional bank loans that have strict eligibility criteria, seller financing allows for more personalized terms and conditions. Sellers can negotiate the down payment, interest rate, payment schedule, and other terms based on the specific needs and circumstances of the transaction.

Opportunity for Buyers

For buyers, seller financing presents an opportunity to achieve their dream of homeownership or business ownership, even if they have limited financial resources or less-than-perfect credit. By working directly with the seller, buyers can avoid the lengthy approval process and stringent requirements of traditional lenders, making the purchasing process smoother and more accessible.

Benefits for Sellers

Sellers can also benefit significantly from offering seller financing. By acting as the lender, sellers can attract a larger pool of potential buyers who may not qualify for conventional loans. This can help sellers sell their properties faster and potentially at a higher price. Additionally, sellers can earn a steady income stream from the monthly payments made by the buyer, providing financial security and a reliable source of passive income.

Building Trust and Relationships

Seller financing agreements can help foster trust and build strong relationships between buyers and sellers. By working directly with each other to negotiate the terms of the financing agreement, both parties have the opportunity to communicate openly and address any concerns or questions. This transparent and collaborative process can create a positive experience for all parties involved in the transaction.

Long-Term Investment

Seller financing can also be an attractive option for sellers looking to generate long-term investment income. By financing the sale of their property or business, sellers can spread out their capital gains over time and potentially reduce tax liabilities. This can be particularly beneficial for sellers looking to diversify their investment portfolio and maximize returns on their real estate assets.

Reducing Closing Costs

Another advantage of seller financing is the potential to reduce closing costs for both buyers and sellers. In traditional real estate transactions, closing costs can add up to a significant amount, including fees for loan origination, appraisal, and title insurance. With seller financing, the parties can negotiate who will be responsible for certain closing costs, potentially saving money and making the transaction more cost-effective.

Increased Marketability

Offering seller financing can increase the marketability of a property or business, making it more attractive to potential buyers. Properties listed with seller financing options may stand out in a competitive market, drawing in buyers who are unable to secure traditional financing or who prefer the flexibility and personalized terms offered through seller financing agreements. This can help sellers reach a broader audience and sell their properties more quickly.

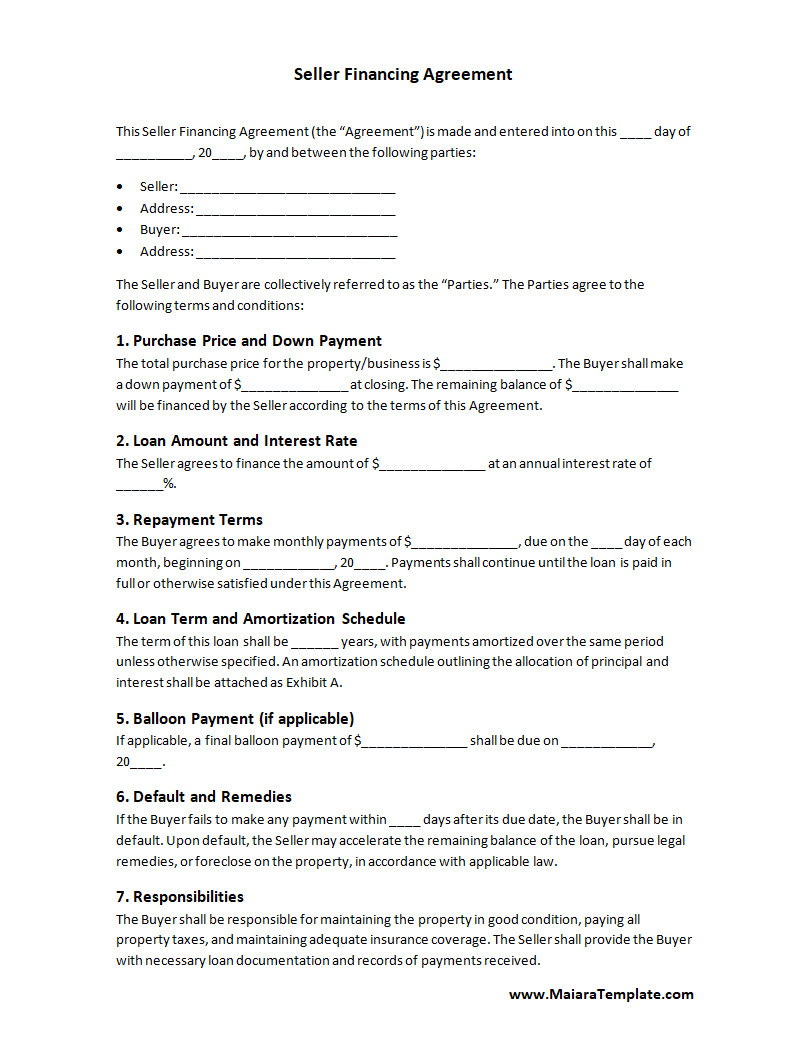

What to Include in a Seller Financing Agreement?

When structuring a seller financing agreement, it is crucial to include specific terms and conditions to protect the interests of both parties. A well-drafted seller financing agreement should cover various aspects of the transaction to ensure clarity and compliance with legal requirements. Here are some essential elements to include in a seller financing agreement:

Purchase Price and Terms

The seller financing agreement should clearly outline the purchase price of the property or business and the terms of the financing arrangement. This includes the total amount financed, the down payment required from the buyer, and the interest rate applied to the financed amount. The agreement should also specify whether the purchase price includes any personal property or assets associated with the sale.

Payment Schedule and Amount

Establishing a payment schedule is crucial to the seller financing agreement. The parties should agree on the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the duration of the financing term. Including a detailed payment schedule in the agreement helps ensure that both parties are aware of their obligations and can plan their finances accordingly.

Interest Rate and Terms

The interest rate is a critical component of the seller financing agreement, as it determines the cost of borrowing for the buyer and the return on investment for the seller. The parties should agree on a fair and competitive interest rate that reflects current market conditions and the risk associated with the transaction. The agreement should also specify whether the interest rate is fixed or adjustable and any penalties for late payments.

Default Provisions and Remedies

In the event of default by the buyer, the seller financing agreement should include provisions outlining the consequences and remedies available to the parties. This may include penalties for late payments, procedures for curing defaults, and the right of the seller to repossess the property in case of non-payment. It is essential to clearly define the default terms to protect both parties’ interests and prevent potential disputes.

Security Interest and Collateral

To secure the seller’s interest in the property, the seller financing agreement may include provisions for a security interest or collateral. This could involve placing a mortgage or deed of trust on the property, giving the seller a legal claim in case of default by the buyer. By securing the agreement with collateral, sellers can mitigate the risk of non-payment and protect their investment in the property or business.

Transferability and Assumption

The seller financing agreement should specify whether the agreement is transferable or assumable in the event of a sale of the property. Transferability allows the buyer to assign the financing agreement to another party, while assumption requires the new buyer to take over the existing financing terms. Clarifying the transferability and assumption options upfront can prevent confusion and ensure a smooth transition in case of a change in ownership.

Legal Review and Compliance

It is advisable to have the seller financing agreement reviewed by a legal professional to ensure compliance with local laws and regulations. Real estate laws vary by jurisdiction, and the terms of seller financing agreements must adhere to specific legal requirements to be enforceable. A real estate attorney can provide guidance on drafting the agreement, verifying the legality of the terms, and protecting the interests of both parties throughout the transaction.

How to Structure a Seller Financing Agreement

Structuring a seller financing agreement requires careful consideration of the terms and conditions to protect the interests of both buyers and sellers. Sellers should assess the financial stability and creditworthiness of the buyer before agreeing to provide financing. Buyers should conduct due diligence on the property or business being purchased and negotiate favorable terms with the seller. Here are some tips on how to structure a seller financing agreement effectively:

Assess Buyer’s Financial Situation

Before entering into a seller financing agreement, sellers should conduct a thorough assessment of the buyer’s financial situation and creditworthiness. This may involve reviewing the buyer’s credit history, income sources, and ability to make timely payments. Sellers may request financial documentation from the buyer, such as bank statements, tax returns, and employment verification, to verify their financial stability and ability to fulfill the terms of the agreement.

Negotiate Terms and Conditions

Once the buyer’s financial situation has been assessed, sellers and buyers should negotiate the terms and conditions of the seller financing agreement. This includes determining the purchase price, down payment amount, interest rate, payment schedule, and any other relevant terms. Both parties should be clear about their expectations and communicate openly to reach a mutually beneficial agreement that meets their needs and preferences.

Draft a Clear and Detailed Agreement

To avoid misunderstandings and disputes later on, it is essential to draft a clear and detailed seller financing agreement that outlines all the agreed-upon terms. The agreement should be written in plain language, avoiding jargon or complex legal terms that may be confusing to the parties involved. Including specific details about the property, financing terms, payment schedule, and default provisions can help ensure that both parties understand their rights and obligations under the agreement.

Consult with Professionals

Both buyers and sellers should consult with real estate professionals, such as attorneys, real estate agents, or financial advisors, when structuring a seller financing agreement. These professionals can provide valuable guidance and expertise to ensure that the agreement is legally binding, compliant with local laws, and effectively protects the interests of both parties. Seeking professional advice can help avoid common pitfalls and ensure a smooth and successful transaction.

Review and Revise as Needed

Before finalizing the seller financing agreement, both parties should carefully review the terms and conditions to ensure accuracy and completeness. Any discrepancies or ambiguities should be addressed and clarified before signing the agreement. If necessary, revisions may be made to the agreement to reflect the parties’ intentions accurately and comply with legal requirements. Taking the time to review and revise the agreement can prevent future disputes and promote a positive and productive relationship between buyers and sellers.

Tips for Successful Seller Financing

Seller financing agreements offer a flexible and mutually beneficial option for buyers and sellers to facilitate property sales and investments. By understanding the advantages, structuring the agreement effectively, and following best practices, both parties can achieve their goals and create a successful transaction

Communicate Openly and Honestly

Maintaining open and honest communication throughout the seller financing process is essential for a successful transaction. Buyers and sellers should feel comfortable discussing their needs, concerns, and expectations to ensure that the agreement meets both parties’ requirements. Transparency and clarity in communication can help build trust and foster a positive relationship between the parties involved.

Establish Realistic Expectations

Setting realistic expectations from the outset can help prevent misunderstandings and conflicts later on. Buyers should have a clear understanding of their financial responsibilities and the terms of the financing agreement, while sellers should be upfront about their expectations for payments, timelines, and any potential risks. Establishing mutual expectations can create a solid foundation for a successful seller financing arrangement.

Stay Committed to the Agreement

Both buyers and sellers should remain committed to the terms of the seller financing agreement throughout its duration. Buyers must make timely payments as outlined in the agreement, while sellers should uphold their obligations to provide financing and maintain the property or business in good condition. By honoring their commitments, both parties can ensure a smooth and positive experience with seller financing.

Monitor and Track Payments

Sellers must monitor and track payments made by the buyer to ensure compliance with the terms of the seller financing agreement. Keeping accurate records of payments received, including dates, amounts, and any late fees, can help sellers stay organized and proactive in managing the agreement. Buyers should also keep track of their payments to maintain a clear understanding of their financial obligations.

Address Issues Promptly

In the event of any issues or disputes arising during the term of the seller financing agreement, it is essential to address them promptly and proactively. Buyers and sellers should communicate openly to resolve conflicts, clarify misunderstandings, and find mutually agreeable solutions. Seeking legal or professional advice may be necessary to navigate complex issues and ensure that the agreement remains fair and enforceable.

Consider Refinancing Options

Buyers who have entered into a seller financing agreement may explore refinancing options as their financial situation improves. Refinancing the seller financing loan into a traditional mortgage can offer lower interest rates, extended repayment terms, and greater financial flexibility. Sellers should be open to discussing refinancing options with buyers to facilitate a smooth transition to conventional financing and potentially reduce their ongoing involvement in the agreement.

Stay Informed About Market Trends

Both buyers and sellers should stay informed about current market trends, interest rates, and real estate conditions that may impact the seller financing agreement. Economic factors, changes in property values, and shifts in lending practices can influence the terms and viability of seller financing arrangements. By staying up-to-date on market developments, parties can make informed decisions and adjust their strategies as needed to maximize the benefits of seller financing.

Review and Update the Agreement Periodically

Periodically reviewing and updating the seller financing agreement can help ensure that it remains relevant and effective for both parties. Changes in financial circumstances, market conditions, or personal preferences may warrant modifications to the agreement to better align with the parties’ current needs and goals. By revisiting and updating the agreement as necessary, buyers and sellers can adapt to changing circumstances and maintain a positive and productive relationship.

Seek Professional Assistance When Needed

When navigating the complexities of seller financing agreements, buyers and sellers may benefit from seeking professional assistance from real estate attorneys, financial advisors, or other experts. These professionals can offer guidance, legal advice, and strategic insights to help parties structure the agreement effectively, address potential issues, and protect their interests throughout the transaction. Seeking professional assistance can provide peace of mind and ensure a successful seller financing experience.

Seller Financing Agreement Template

In conclusion, a Seller Financing Agreement is an essential tool for outlining payment terms, interest rates, and conditions when the seller finances the buyer’s purchase. It ensures clarity, legal protection, and mutual trust between both parties.

Simplify your real estate transaction—download our Seller Financing Agreement Template and create a secure, transparent agreement today!

Seller Financing Agreement Template – WORD

- Home Purchase Agreement Template - January 28, 2026

- Home Improvement Contract Template - January 27, 2026

- Free Printable Home Budget Template - January 26, 2026