Starting a new business can be an exciting venture, but it also comes with its fair share of challenges. One of the most important aspects of running a successful startup is managing your finances effectively. This is where a startup business budget can be a valuable tool. By providing a plan for managing your income and expenses, a startup business budget helps you stay organized and make informed financial decisions.

In this article, we will explore the importance of a startup business budget, how to create one, and provide some tips for successful budgeting.

What is a Startup Business Budget?

A startup business budget is a document that outlines the projected income and expenses for your business. It helps you keep track of your financial goals and provides a roadmap for managing your finances.

By creating a budget, you can plan for future expenses, identify areas where you can cut costs, and ensure that you have enough cash flow to cover your business operations.

Why is a Startup Business Budget Important?

A startup business budget is essential for several reasons.

- Firstly, it helps you gain a clear understanding of your financial situation. By tracking your income and expenses, you can identify any cash flow issues and make necessary adjustments.

- Additionally, a budget helps you set financial goals and measure your progress towards achieving them. It also enables you to make informed decisions about investments, hiring, and other financial decisions.

Overall, a startup business budget provides you with a solid foundation for managing your finances effectively.

How to Create a Startup Business Budget

Creating a startup business budget may seem daunting, but it doesn’t have to be. By following these steps, you can create a budget that works for your business:

- Identify your income sources: Start by listing all the potential sources of income for your business. This may include sales revenue, investments, loans, or grants.

- List your fixed expenses: Next, identify the fixed expenses that your business incurs regularly. These may include rent, utilities, salaries, and insurance.

- Track variable expenses: Variable expenses are costs that fluctuate monthly or are project-specific. Examples include marketing expenses, raw materials, and office supplies. Keep track of these expenses to get an accurate picture of your spending.

- Estimate future expenses: Anticipate any future expenses that your business may incur, such as equipment upgrades, hiring new employees, or expanding to a new location.

- Calculate your net income: Subtract your total expenses from your income to determine your net income. This will give you an idea of how much money you have left after covering all expenses.

- Review and adjust: Regularly review your budget and make necessary adjustments. As your business grows and evolves, your financial needs may change, so it’s important to stay flexible.

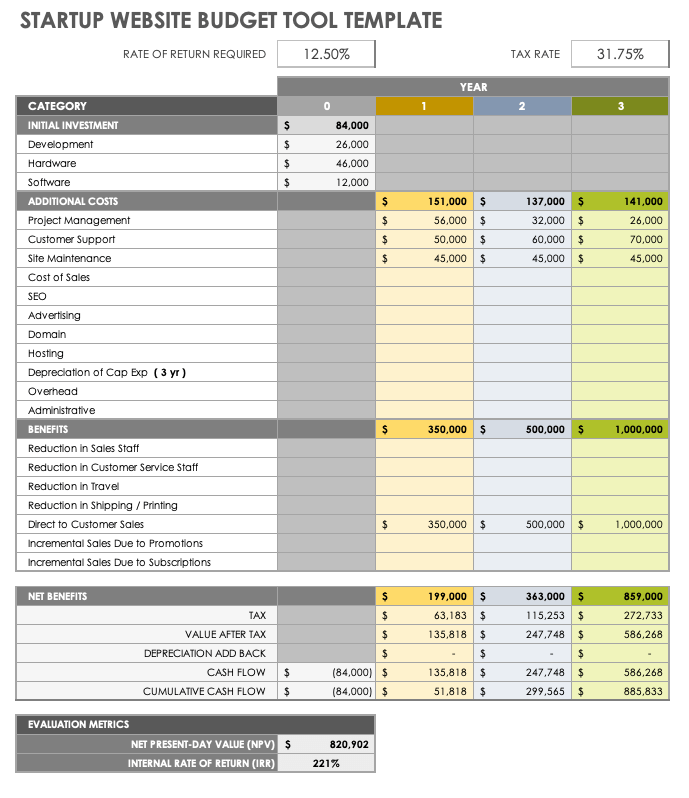

Examples of Startup Business Budget Templates

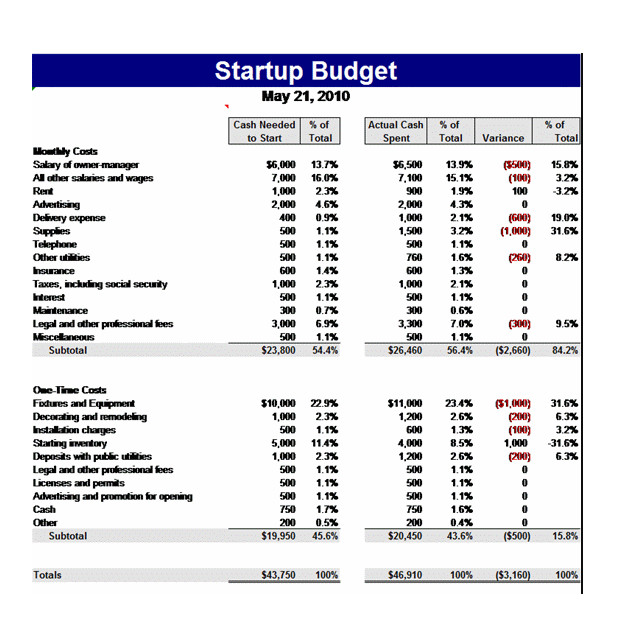

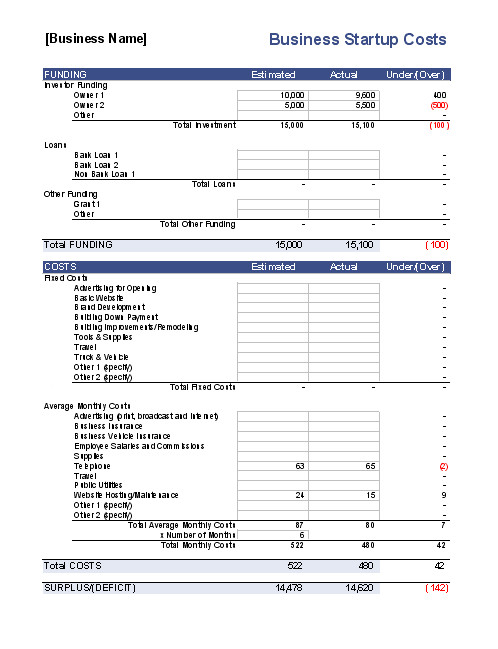

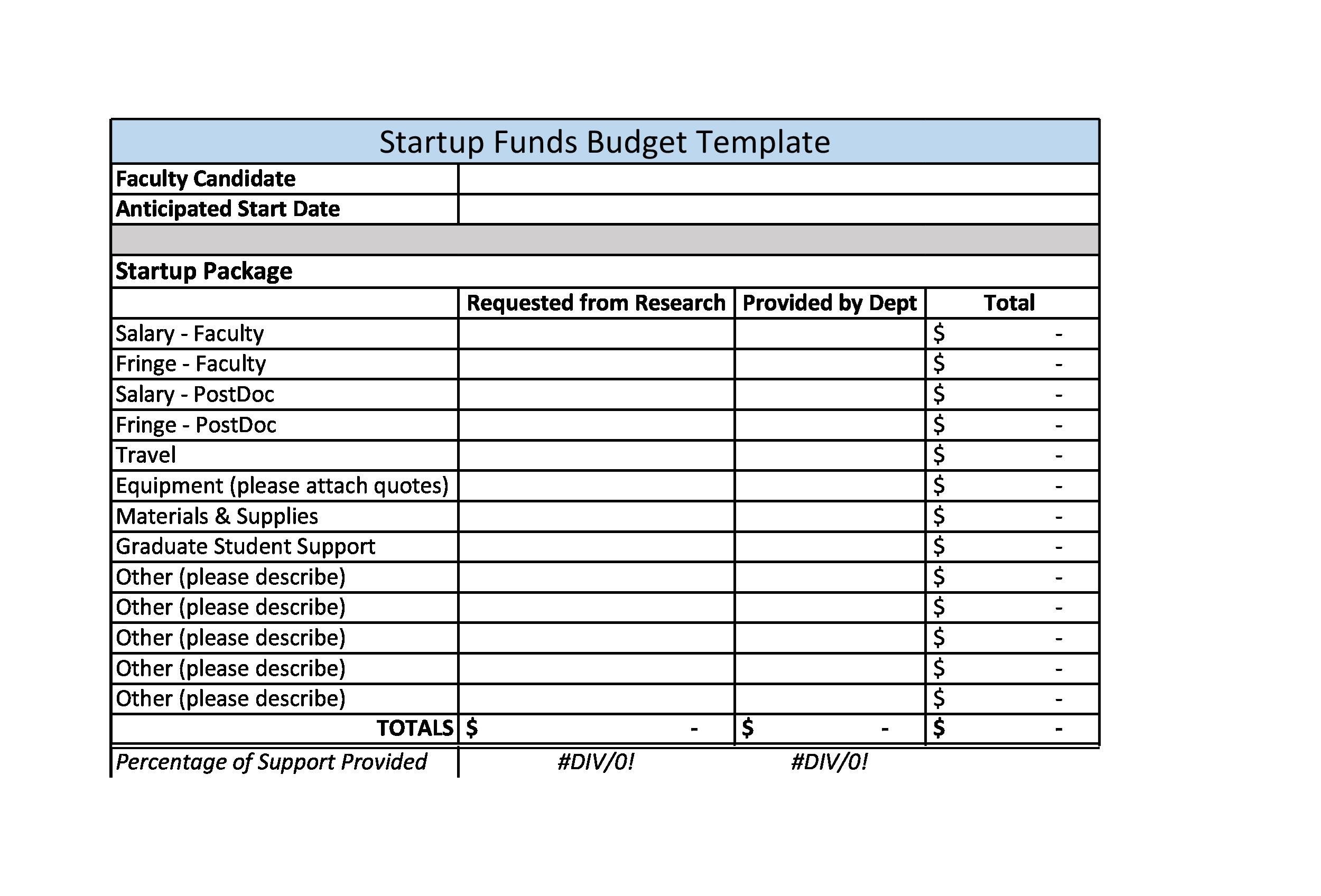

When creating a startup business budget, you can use pre-designed templates to simplify the process. Here are a few examples of startup business budget templates:

Tips for Successful Startup Business Budgeting

Creating a startup business budget is just the first step. To ensure its effectiveness, consider the following tips:

- Be realistic: When estimating your income and expenses, be realistic and conservative. It’s better to underestimate your income and overestimate your expenses to avoid any unexpected financial setbacks.

- Track your spending: Regularly monitor your actual spending against your budget. This will help you identify any discrepancies and make adjustments as needed.

- Set aside an emergency fund: Unexpected expenses can arise at any time, so it’s important to have an emergency fund to cover these costs without jeopardizing your budget.

- Review and update regularly: Your startup business budget should be a living document that evolves with your business. Review and update it regularly to reflect any changes in your financial situation.

- Seek professional advice: If you’re unsure about creating or managing your budget, consider consulting with a financial advisor or accountant. They can provide valuable insights and help you make informed financial decisions.

- Use budgeting software: There are various budgeting software and tools available that can automate the budgeting process and make it easier to track your finances.

- Stay disciplined: Stick to your budget and avoid unnecessary expenses. It may be tempting to overspend, especially during periods of growth, but maintaining discipline is crucial for long-term financial success.

Conclusion

A startup business budget is a valuable tool for managing your finances effectively. By creating a budget and following the tips outlined in this article, you can gain control over your income and expenses, make informed financial decisions, and set your business up for long-term success.

Remember, budgeting is an ongoing process, so regularly review and update your budget to ensure its accuracy and effectiveness.

Startup Business Budget Template – Download

- Free Student Reference Letter Template (Word) - February 22, 2026

- Free Printable Greeting Card Template - February 19, 2026

- Printable Homeschooling Schedule Template - February 18, 2026