When entering into a relationship, the last thing on most couples’ minds is the possibility that it may come to an end. However, it is essential to consider the importance of having a financial agreement in place to protect both parties in case the relationship does not work out.

A financial agreement sets out how a couple’s assets, liabilities, and other financial resources will be divided if their relationship ends. It provides clarity, certainty, and control over financial matters, helping to avoid lengthy and expensive court proceedings by creating a legally binding contract that can be made before, during, or after a relationship.

What is a Financial Agreement?

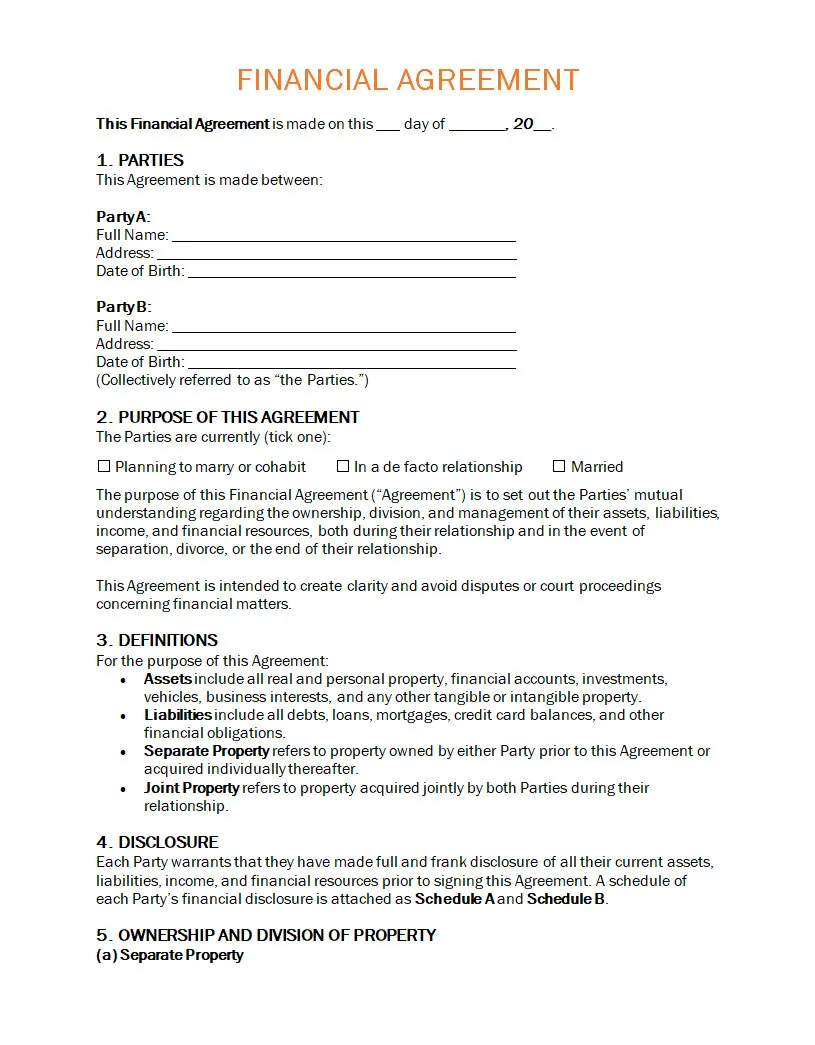

A financial agreement, also known as a prenuptial agreement or a cohabitation agreement, is a legal document that outlines how a couple’s finances will be managed in the event of a separation or divorce.

It can cover a wide range of financial matters, including the division of assets and debts, spousal support, and any other financial arrangements that the couple wishes to formalize.

Why Should You Consider a Financial Agreement?

Protecting Assets

One of the main reasons to consider a financial agreement is to protect your assets. Without a clear agreement in place, there is a risk that assets acquired during the relationship could be subject to division in the event of a breakup. A financial agreement allows you to specify how assets will be divided, ensuring that your individual assets are protected.

Financial Security

A financial agreement can also provide financial security for both parties in a relationship. By outlining provisions for spousal support or maintenance payments in the agreement, you can ensure that both parties are taken care of financially if the relationship ends. This can help reduce financial stress and uncertainty during a difficult time.

Avoiding Conflict

Another important reason to consider a financial agreement is to avoid potential conflicts and disputes in the event of a breakup. By setting out clear guidelines for how financial matters will be handled, you can minimize the risk of disagreements and legal battles over assets and finances. This can lead to a smoother and less contentious separation process.

What to Include in a Financial Agreement?

Comprehensive Asset List

When drafting a financial agreement, it is essential to include a comprehensive list of all assets, liabilities, and financial resources owned by each party. This includes properties, investments, bank accounts, retirement accounts, vehicles, and any other assets of value. By detailing all assets in the agreement, you can ensure that each party’s financial interests are properly accounted for.

Division of Assets

The agreement should clearly outline how assets will be divided in the event of a separation. This may include specifying who will retain ownership of specific assets, how joint assets will be divided, and any provisions for selling or transferring assets. By establishing a clear division of assets in the agreement, you can avoid disputes over asset ownership in the future.

Spousal Support Provisions

If applicable, the financial agreement should detail any provisions for spousal support or maintenance payments. This may include specifying the amount of support, the duration of payments, and any conditions that must be met for support to be provided. By including spousal support provisions in the agreement, you can ensure that both parties are taken care of financially after the relationship ends.

How to Create a Financial Agreement

Consult with a Lawyer

When creating a financial agreement, it is crucial to consult with a lawyer who specializes in family law. A lawyer can provide valuable legal advice and ensure that the agreement meets all legal requirements. They can also help you understand your rights and obligations under the agreement and ensure that your interests are protected.

Full Financial Disclosure

Both parties should fully disclose all assets, liabilities, and financial information when creating a financial agreement. This includes providing documentation such as bank statements, tax returns, property deeds, and investment accounts. By being transparent about your finances, you can ensure that the agreement accurately reflects your financial situation and is fair to both parties.

Negotiate Terms

The couple should negotiate the terms of the agreement and come to a mutual understanding of how their finances will be managed in the event of a separation. This may involve discussing and compromising on issues such as asset division, spousal support, and any other financial arrangements. By working together to create the agreement, you can ensure that both parties’ needs and interests are taken into account.

Tips for a Successful Financial Agreement

Start Early

It is best to create a financial agreement early in the relationship, rather than waiting until issues arise. By discussing and creating the agreement early on, you can prevent misunderstandings and conflicts in the future. Starting early also allows both parties to fully consider their financial situation and needs before making any commitments.

Be Honest and Transparent

Both parties should be open and honest about their finances when creating a financial agreement. This includes disclosing all assets, liabilities, and financial information, as well as discussing any concerns or preferences regarding financial matters. By being transparent, you can ensure that the agreement accurately reflects your financial situation and is fair to both parties.

Review and Update Regularly

It is important to review and update the financial agreement periodically to ensure that it remains relevant and reflects any changes in your financial circumstances. This may include reviewing the agreement after major life events such as marriage, the birth of children, or changes in employment. By regularly updating the agreement, you can ensure that it continues to meet your needs and protect your financial interests.

Financial Agreement Template – DOWNLOAD

- House Purchase Agreement Template - February 10, 2026

- Free House Lease Agreement Template - February 9, 2026

- Printable Hours Worked Invoice Template - February 6, 2026